- China

- /

- Oil and Gas

- /

- SZSE:002221

Investors Aren't Buying Oriental Energy Co., Ltd.'s (SZSE:002221) Revenues

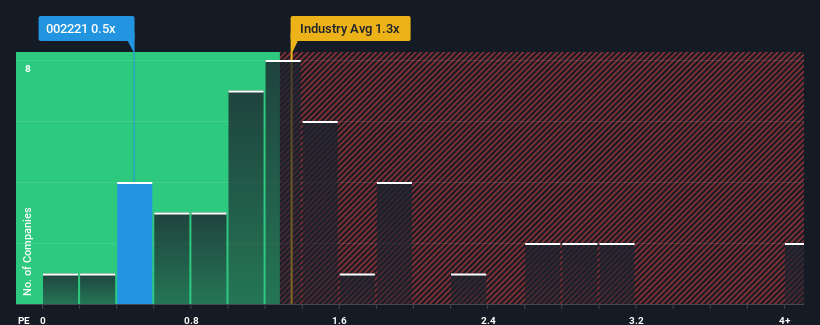

Oriental Energy Co., Ltd.'s (SZSE:002221) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in China have P/S ratios greater than 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Oriental Energy

How Oriental Energy Has Been Performing

Recent times have been pleasing for Oriental Energy as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Oriental Energy will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Oriental Energy's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Oriental Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 14% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 8.1% as estimated by the four analysts watching the company. With the industry predicted to deliver 6.3% growth, that's a disappointing outcome.

With this information, we are not surprised that Oriental Energy is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Oriental Energy's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Oriental Energy's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Oriental Energy's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Oriental Energy (including 1 which is potentially serious).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002221

Oriental Energy

Engages in the production and sale of liquified petroleum gas China.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives