- China

- /

- Energy Services

- /

- SZSE:002207

Revenues Not Telling The Story For Xinjiang Zhundong Petroleum Technology Co., Ltd. (SZSE:002207) After Shares Rise 26%

Xinjiang Zhundong Petroleum Technology Co., Ltd. (SZSE:002207) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

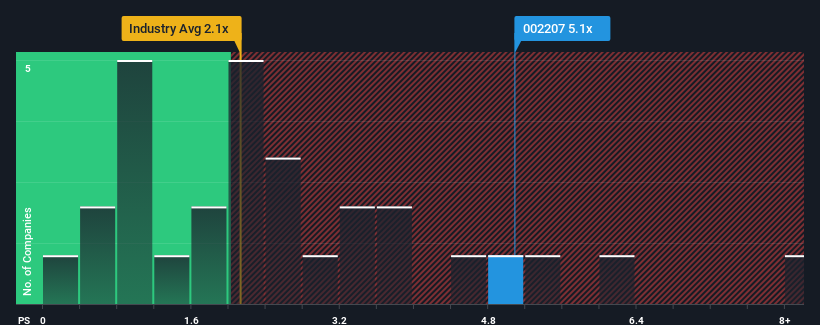

Following the firm bounce in price, when almost half of the companies in China's Energy Services industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Xinjiang Zhundong Petroleum Technology as a stock not worth researching with its 5.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xinjiang Zhundong Petroleum Technology

How Has Xinjiang Zhundong Petroleum Technology Performed Recently?

Xinjiang Zhundong Petroleum Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinjiang Zhundong Petroleum Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xinjiang Zhundong Petroleum Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. The strong recent performance means it was also able to grow revenue by 50% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Xinjiang Zhundong Petroleum Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Xinjiang Zhundong Petroleum Technology's P/S?

The strong share price surge has lead to Xinjiang Zhundong Petroleum Technology's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Xinjiang Zhundong Petroleum Technology revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for Xinjiang Zhundong Petroleum Technology that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Xinjiang Zhundong Petroleum Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002207

Xinjiang Zhundong Petroleum Technology

Xinjiang Zhundong Petroleum Technology Co., Ltd.

Mediocre balance sheet minimal.

Market Insights

Community Narratives