- China

- /

- Energy Services

- /

- SZSE:002108

Earnings Troubles May Signal Larger Issues for Cangzhou Mingzhu PlasticLtd (SZSE:002108) Shareholders

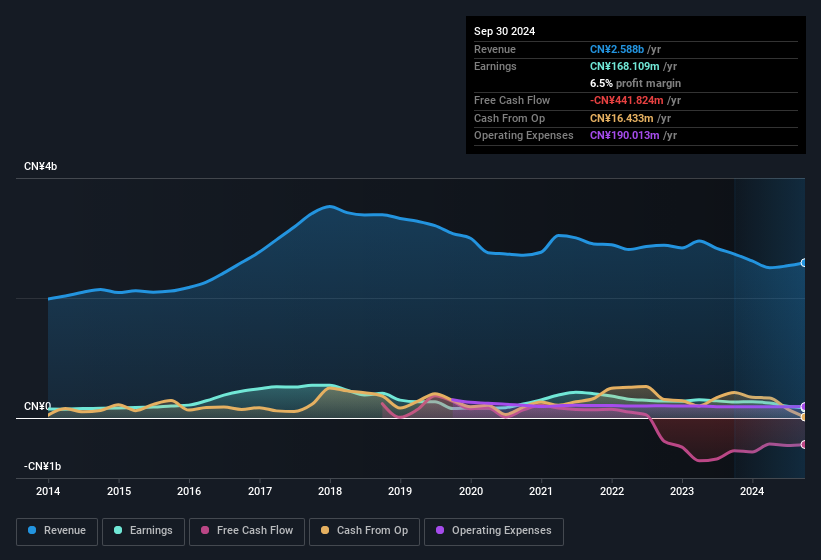

Cangzhou Mingzhu Plastic Co.,Ltd.'s (SZSE:002108) recent weak earnings report didn't cause a big stock movement. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for Cangzhou Mingzhu PlasticLtd

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Cangzhou Mingzhu PlasticLtd's profit received a boost of CN¥91m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Cangzhou Mingzhu PlasticLtd had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Cangzhou Mingzhu PlasticLtd.

Our Take On Cangzhou Mingzhu PlasticLtd's Profit Performance

As we discussed above, we think the significant positive unusual item makes Cangzhou Mingzhu PlasticLtd's earnings a poor guide to its underlying profitability. For this reason, we think that Cangzhou Mingzhu PlasticLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For instance, we've identified 3 warning signs for Cangzhou Mingzhu PlasticLtd (1 can't be ignored) you should be familiar with.

Today we've zoomed in on a single data point to better understand the nature of Cangzhou Mingzhu PlasticLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002108

Cangzhou Mingzhu PlasticLtd

Manufactures and sells PE pipe systems, BOPA films, Li-ion battery separators, and composite piping systems in China.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives