- China

- /

- Oil and Gas

- /

- SHSE:605090

Jiangxi Jovo Energy Co., Ltd's (SHSE:605090) Recent Stock Performance Looks Decent- Can Strong Fundamentals Be the Reason?

Most readers would already know that Jiangxi Jovo Energy's (SHSE:605090) stock increased by 2.5% over the past week. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Jiangxi Jovo Energy's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Jiangxi Jovo Energy

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Jiangxi Jovo Energy is:

19% = CN¥1.7b ÷ CN¥9.3b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.19 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Jiangxi Jovo Energy's Earnings Growth And 19% ROE

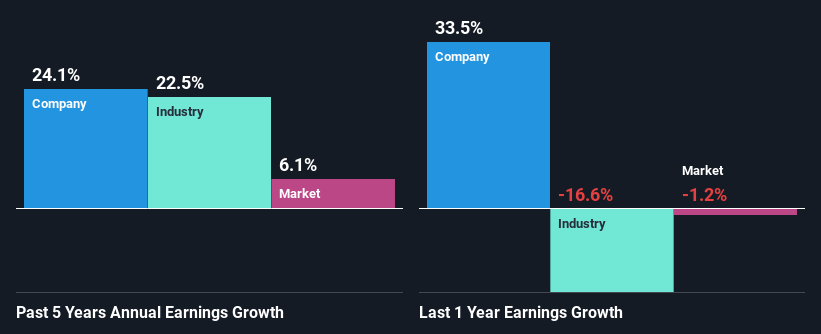

To start with, Jiangxi Jovo Energy's ROE looks acceptable. On comparing with the average industry ROE of 9.3% the company's ROE looks pretty remarkable. Probably as a result of this, Jiangxi Jovo Energy was able to see an impressive net income growth of 24% over the last five years. We reckon that there could also be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Jiangxi Jovo Energy's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 22% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Jiangxi Jovo Energy's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Jiangxi Jovo Energy Efficiently Re-investing Its Profits?

The three-year median payout ratio for Jiangxi Jovo Energy is 28%, which is moderately low. The company is retaining the remaining 72%. By the looks of it, the dividend is well covered and Jiangxi Jovo Energy is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Moreover, Jiangxi Jovo Energy is determined to keep sharing its profits with shareholders which we infer from its long history of three years of paying a dividend. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 49% over the next three years. Regardless, the ROE is not expected to change much for the company despite the higher expected payout ratio.

Conclusion

Overall, we are quite pleased with Jiangxi Jovo Energy's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605090

Jiangxi Jovo Energy

Provides clean energy integrated service for gas industries in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives