- China

- /

- Energy Services

- /

- SHSE:601798

Lanpec Technologies Limited's (SHSE:601798) Shares Climb 52% But Its Business Is Yet to Catch Up

The Lanpec Technologies Limited (SHSE:601798) share price has done very well over the last month, posting an excellent gain of 52%. The last 30 days bring the annual gain to a very sharp 41%.

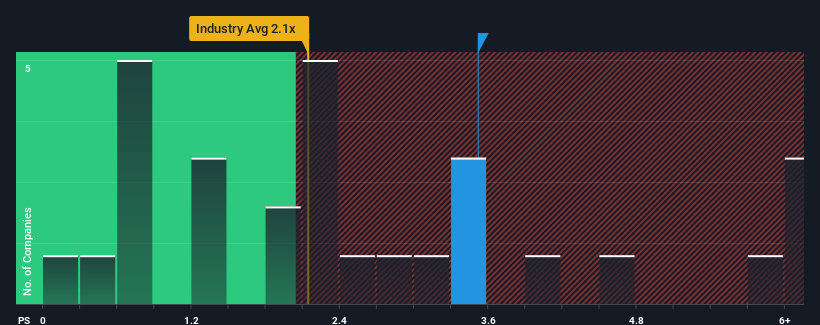

Following the firm bounce in price, you could be forgiven for thinking Lanpec Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in China's Energy Services industry have P/S ratios below 2.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lanpec Technologies

What Does Lanpec Technologies' Recent Performance Look Like?

The revenue growth achieved at Lanpec Technologies over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lanpec Technologies will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Lanpec Technologies?

Lanpec Technologies' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Still, revenue has fallen 4.2% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this in mind, we find it worrying that Lanpec Technologies' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Lanpec Technologies' P/S

Lanpec Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Lanpec Technologies revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 2 warning signs for Lanpec Technologies that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601798

Lanpec Technologies

Engages in the manufacture and sale of petroleum and petrochemical equipment in the People’s Republic of China and internationally.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives