- China

- /

- Oil and Gas

- /

- SHSE:601101

3 Reliable Dividend Stocks To Consider With Up To 3.9% Yield

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have seen fluctuations with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Amidst these market dynamics, investors are increasingly turning their attention to dividend stocks as a potential source of steady income, particularly in an environment where manufacturing activity is subdued and inflationary pressures linger. A reliable dividend stock typically offers consistent payouts and financial stability, making it an attractive option for those looking to navigate the current economic landscape while seeking income opportunities.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.63% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

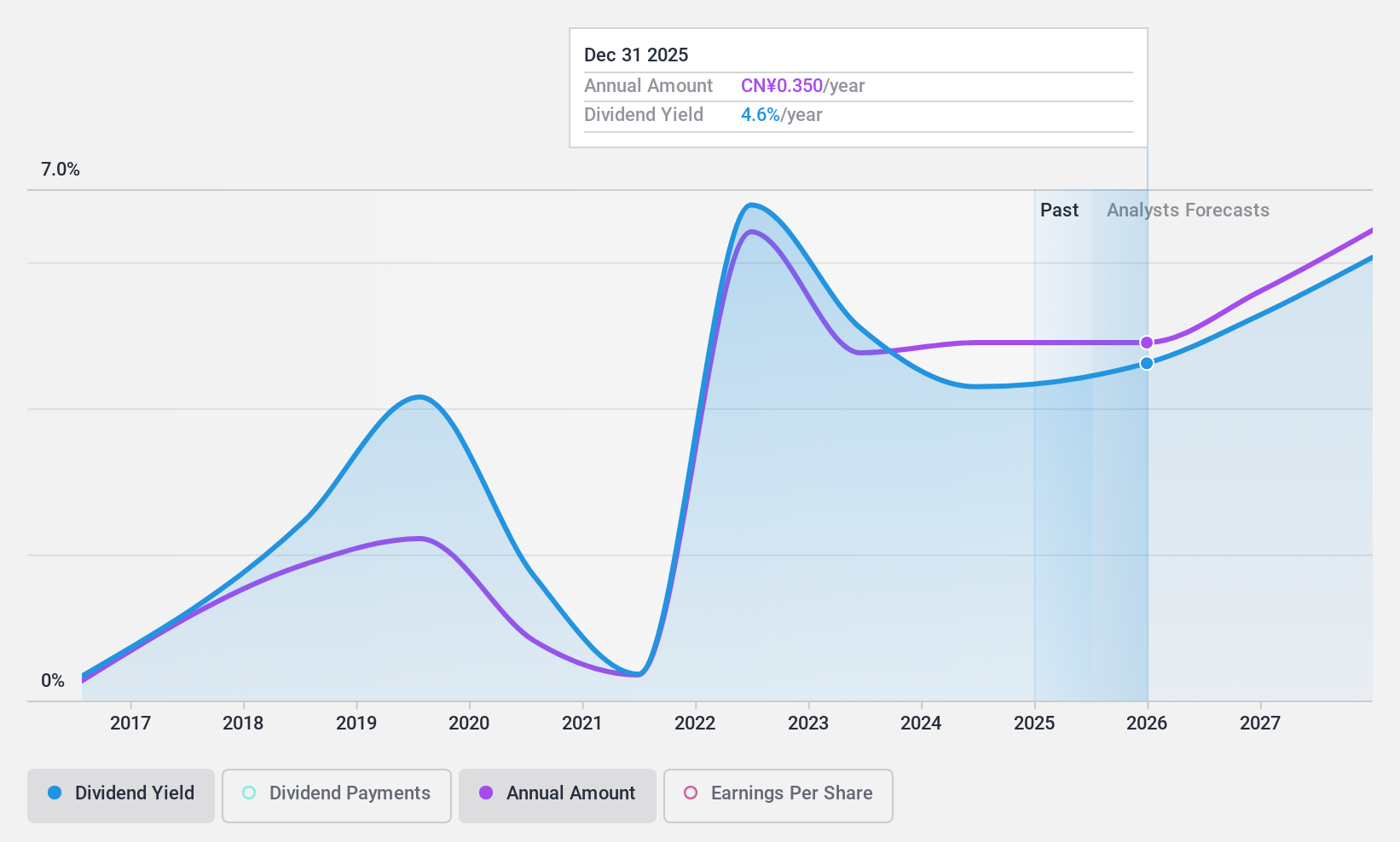

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, processing, export, and sale of coal in China with a market cap of CN¥12.99 billion.

Operations: Beijing Haohua Energy Resource Co., Ltd. generates revenue primarily through its activities in coal mining, washing, processing, and sales within China.

Dividend Yield: 3.9%

Beijing Haohua Energy Resource reported strong earnings growth, with net income rising to CNY 1.12 billion for the first nine months of 2024. The company trades at a good value and its dividend yield is in the top tier of the CN market. While dividends are well covered by earnings and cash flows, past payments have been volatile and unreliable over a decade. However, recent increases suggest potential improvement in dividend stability.

- Take a closer look at Beijing Haohua Energy Resource's potential here in our dividend report.

- Our expertly prepared valuation report Beijing Haohua Energy Resource implies its share price may be lower than expected.

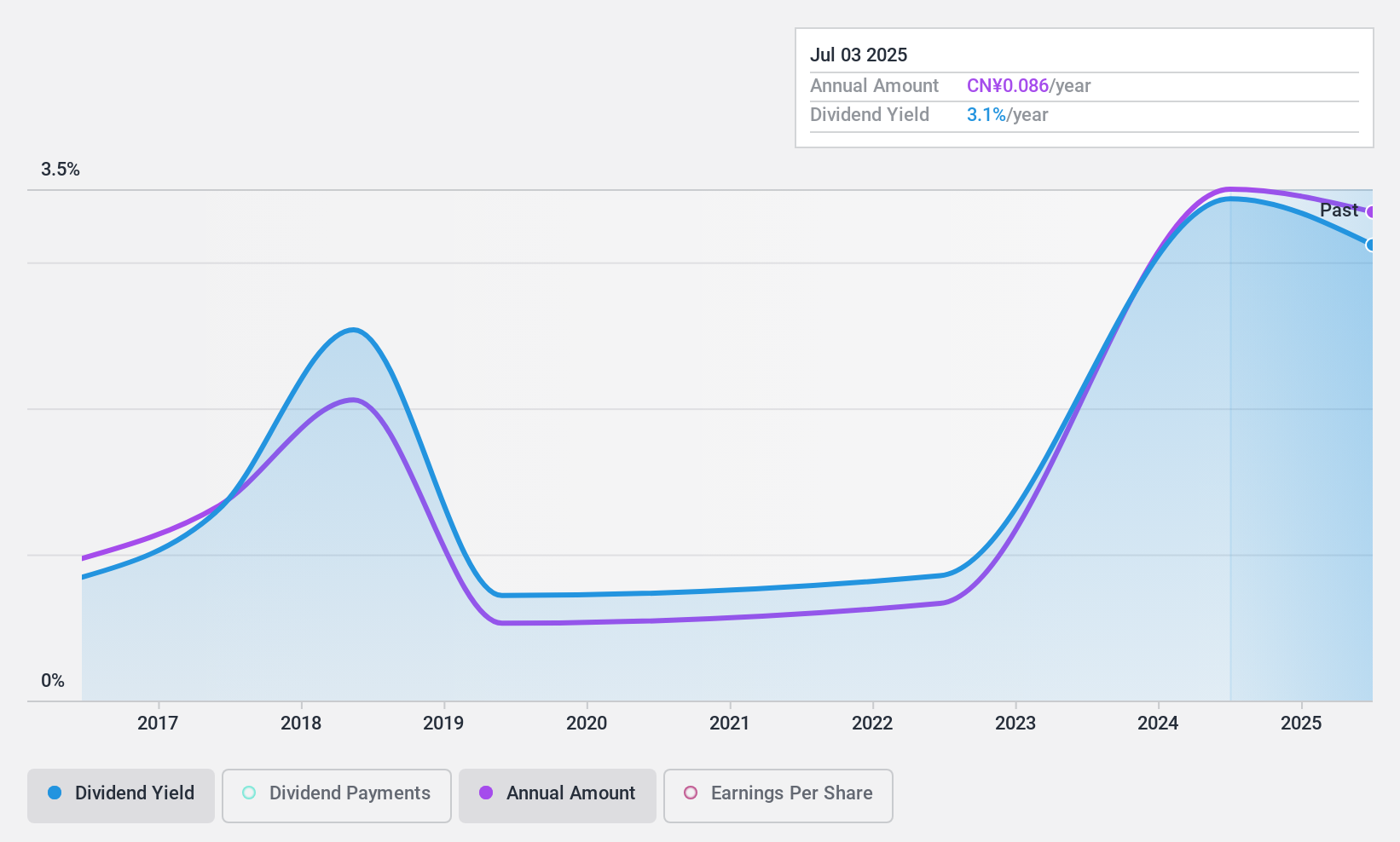

Jilin Expressway (SHSE:601518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jilin Expressway Co., Ltd. operates in the investment, development, construction, operation, management, and maintenance of toll roads in Jilin Province and has a market cap of CN¥5.41 billion.

Operations: Jilin Expressway Co., Ltd. generates revenue primarily from its subsidiaries' activities in toll road investment, development, construction, operation, management, and maintenance within Jilin Province.

Dividend Yield: 3.1%

Jilin Expressway's recent earnings report shows stable net income of CNY 389.74 million for the first nine months of 2024, despite a decline in sales to CNY 869.02 million. The company trades below its estimated fair value and offers a dividend yield in the top 25% of the CN market, supported by low payout ratios from both earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of Jilin Expressway.

- Our valuation report here indicates Jilin Expressway may be undervalued.

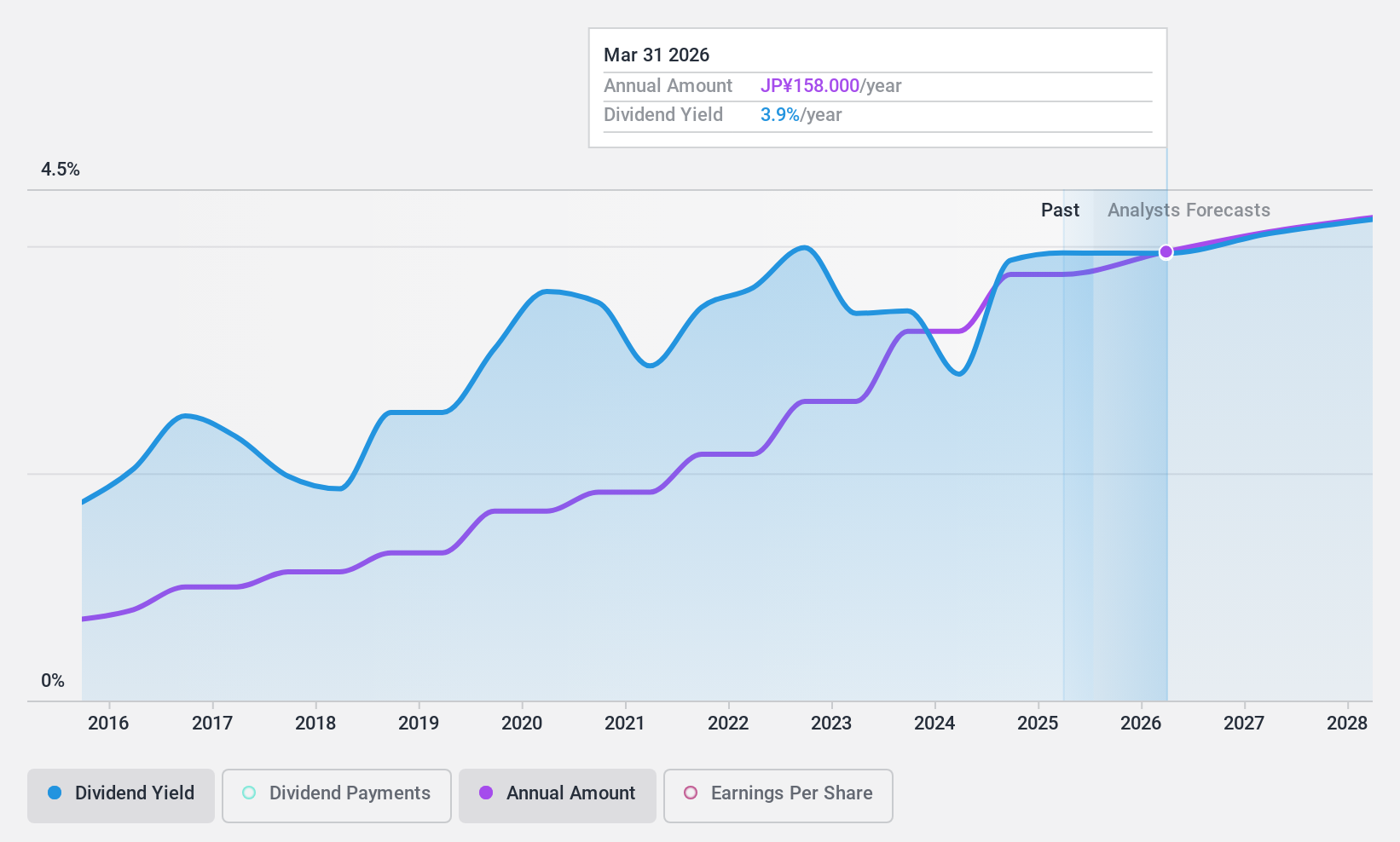

Fuyo General Lease (TSE:8424)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fuyo General Lease Co., Ltd. operates in the leasing and installment sales sector both in Japan and internationally, with a market cap of ¥345.74 billion.

Operations: Fuyo General Lease Co., Ltd. generates revenue primarily through its Lease and Installment segment, which accounts for ¥622.97 billion, alongside a Financing segment contributing ¥40.82 billion.

Dividend Yield: 3.9%

Fuyo General Lease's dividend yield of 3.92% ranks in the top 25% of JP market dividend payers, supported by a low payout ratio of 27.7%, indicating earnings cover dividends well. However, despite stable and growing dividends over the past decade, free cash flow does not cover these payments, raising sustainability concerns. The company trades at a significant discount to its estimated fair value but faces challenges with debt coverage from operating cash flow.

- Get an in-depth perspective on Fuyo General Lease's performance by reading our dividend report here.

- The analysis detailed in our Fuyo General Lease valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Click this link to deep-dive into the 1937 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Haohua Energy Resource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601101

Beijing Haohua Energy Resource

Engages in the mining, washing, manufacturing, processing, export, and sale of coal in China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives