- China

- /

- Oil and Gas

- /

- SHSE:601001

Here's Why We Think Jinneng Holding Shanxi Coal Industryltd (SHSE:601001) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jinneng Holding Shanxi Coal Industryltd (SHSE:601001). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Jinneng Holding Shanxi Coal Industryltd

How Quickly Is Jinneng Holding Shanxi Coal Industryltd Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Jinneng Holding Shanxi Coal Industryltd's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 46%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Jinneng Holding Shanxi Coal Industryltd's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While Jinneng Holding Shanxi Coal Industryltd may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

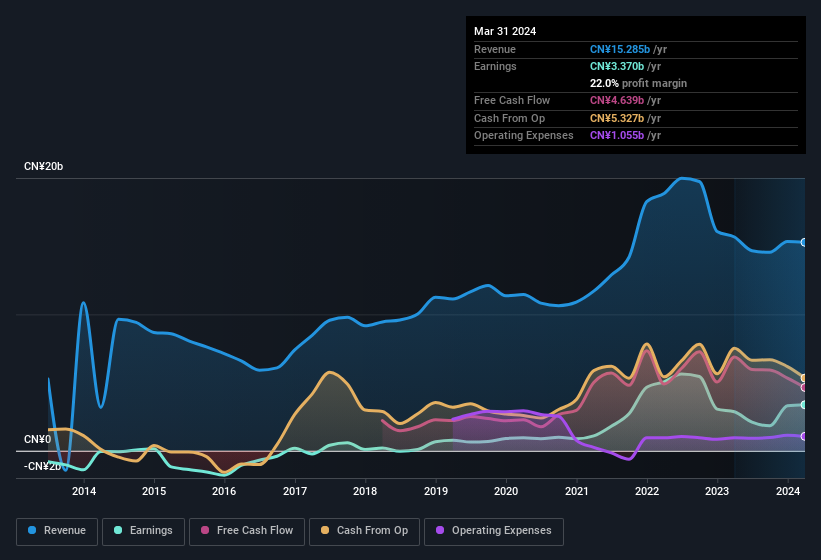

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Jinneng Holding Shanxi Coal Industryltd?

Are Jinneng Holding Shanxi Coal Industryltd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥15b and CN¥46b, like Jinneng Holding Shanxi Coal Industryltd, the median CEO pay is around CN¥1.6m.

The CEO of Jinneng Holding Shanxi Coal Industryltd only received CN¥626k in total compensation for the year ending December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Jinneng Holding Shanxi Coal Industryltd Deserve A Spot On Your Watchlist?

Jinneng Holding Shanxi Coal Industryltd's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Jinneng Holding Shanxi Coal Industryltd , and understanding it should be part of your investment process.

Although Jinneng Holding Shanxi Coal Industryltd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601001

Jinneng Holding Shanxi Coal Industryltd

Engages in the production and sales of coal and related chemical products in China.

Flawless balance sheet, undervalued and pays a dividend.