- China

- /

- Oil and Gas

- /

- SHSE:600617

If EPS Growth Is Important To You, Shanxi Guoxin Energy (SHSE:600617) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Shanxi Guoxin Energy (SHSE:600617). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shanxi Guoxin Energy with the means to add long-term value to shareholders.

View our latest analysis for Shanxi Guoxin Energy

How Fast Is Shanxi Guoxin Energy Growing Its Earnings Per Share?

Shanxi Guoxin Energy has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Shanxi Guoxin Energy's EPS shot up from CN¥0.035 to CN¥0.055; a result that's bound to keep shareholders happy. That's a commendable gain of 60%.

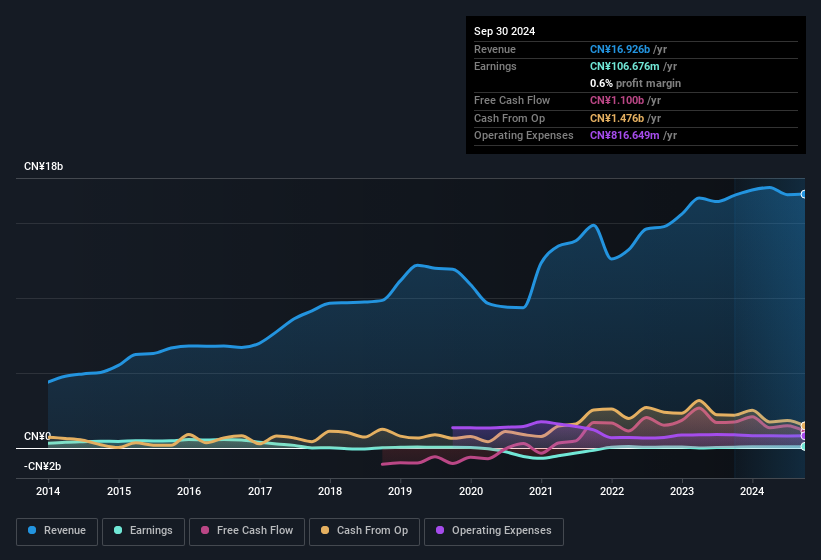

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Shanxi Guoxin Energy reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Shanxi Guoxin Energy's balance sheet strength, before getting too excited.

Are Shanxi Guoxin Energy Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Shanxi Guoxin Energy, with market caps between CN¥2.9b and CN¥12b, is around CN¥960k.

Shanxi Guoxin Energy's CEO took home a total compensation package worth CN¥581k in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Shanxi Guoxin Energy Worth Keeping An Eye On?

For growth investors, Shanxi Guoxin Energy's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. We think that based on its merits alone, this stock is worth watching into the future. Even so, be aware that Shanxi Guoxin Energy is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600617

Shanxi Guoxin Energy

Engages natural gas development and utilization, and consulting services.

Good value with worrying balance sheet.

Market Insights

Community Narratives