Global Dividend Stocks Spotlight Featuring Three Key Players

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and recession fears, investors are increasingly focused on the stability and income potential that dividend stocks can offer. In such uncertain times, a good dividend stock is characterized by a strong history of consistent payouts and the financial resilience to maintain those dividends even amid economic fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.76% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.74% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

Click here to see the full list of 1437 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

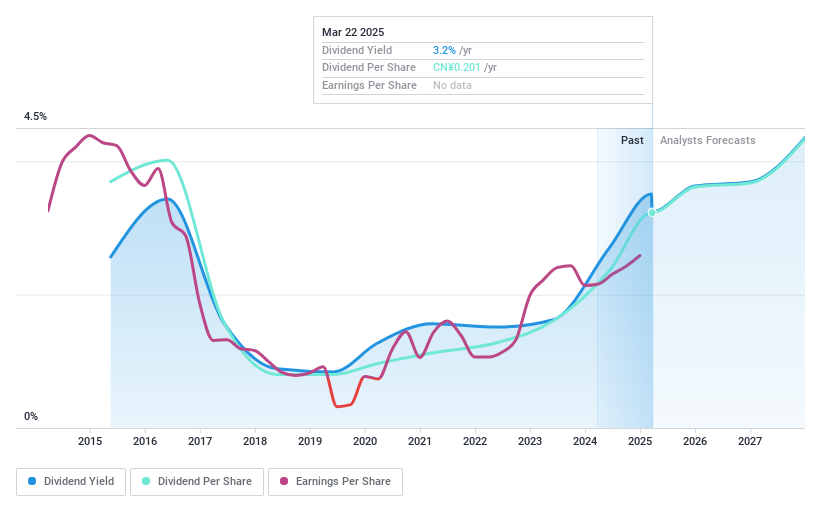

Offshore Oil EngineeringLtd (SHSE:600583)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Offshore Oil Engineering Co., Ltd is involved in the design, procurement, construction, offshore installation, commissioning and maintenance of offshore oil and gas development projects both in China and internationally, with a market cap of CN¥25.56 billion.

Operations: Offshore Oil Engineering Co., Ltd generates its revenue through activities including design, procurement, construction, offshore installation, commissioning and maintenance of offshore oil and gas development projects.

Dividend Yield: 3.2%

Offshore Oil Engineering Ltd. offers a dividend yield of 3.24%, placing it in the top 25% of dividend payers in the Chinese market. Despite a history of volatile and unreliable dividends over the past decade, current payouts are well covered by both earnings (41% payout ratio) and cash flows (30.6% cash payout ratio). The company trades at a favorable price-to-earnings ratio of 12.7x, below the market average, with recent earnings growth enhancing its value proposition for investors seeking dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Offshore Oil EngineeringLtd.

- Our valuation report here indicates Offshore Oil EngineeringLtd may be undervalued.

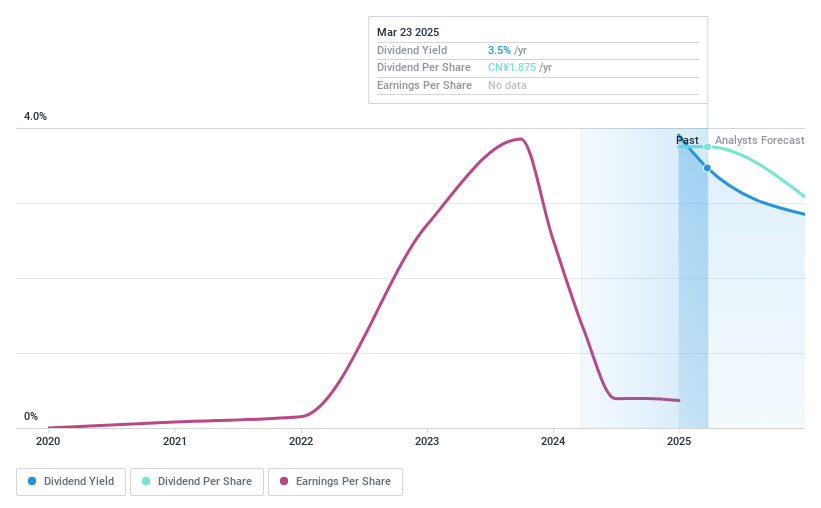

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) specializes in the development and manufacturing of solar energy products, with a market cap of CN¥8.65 billion.

Operations: SolaX Power Network Technology (Zhejiang) Co., Ltd. generates its revenue primarily from Electronic Components & Parts, totaling CN¥3.07 billion.

Dividend Yield: 3.5%

SolaX Power Network Technology's dividend yield of 3.47% ranks it among the top 25% in China, though its dividends are newly initiated and lack a track record. The payout is covered by earnings (68.2%) and cash flows (81.8%), suggesting sustainability despite recent profit margin declines from 23.8% to 6.7%. Trading at a discount to estimated fair value, SolaX offers potential upside but faces challenges with decreased sales and net income year-over-year.

- Navigate through the intricacies of SolaX Power Network Technology (Zhejiang) with our comprehensive dividend report here.

- Our valuation report unveils the possibility SolaX Power Network Technology (Zhejiang)'s shares may be trading at a discount.

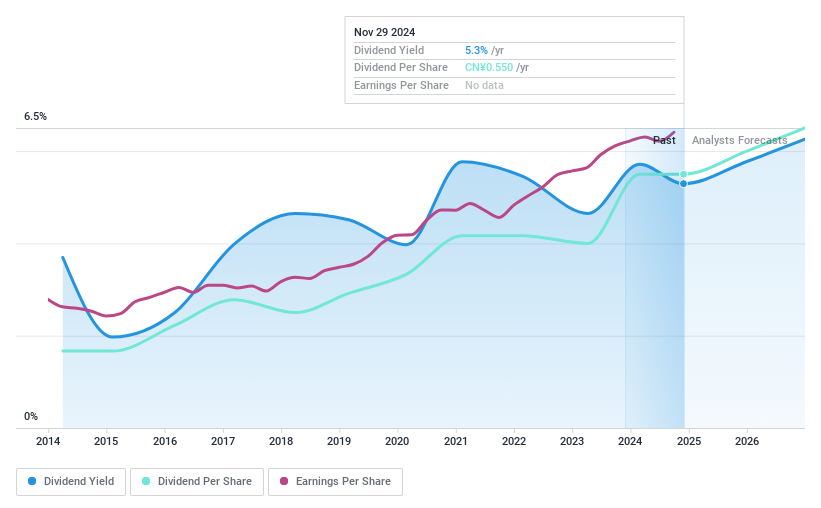

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huangshan Novel Co., Ltd manufactures and sells packaging materials both in China and internationally, with a market cap of CN¥6.77 billion.

Operations: Huangshan Novel Co., Ltd generates revenue through the manufacturing and sale of packaging materials within China and to international markets.

Dividend Yield: 4.6%

Huangshan Novel Ltd. offers a dividend yield of 4.6%, placing it in the top 25% of Chinese dividend payers, with stable and growing dividends over the past decade. However, its high cash payout ratio (108.9%) indicates dividends are not well covered by cash flows, raising sustainability concerns despite being covered by earnings at a 79.7% payout ratio. The company's price-to-earnings ratio (15.6x) is attractive relative to the market average of 39.4x.

- Click here to discover the nuances of Huangshan NovelLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Huangshan NovelLtd is trading beyond its estimated value.

Next Steps

- Dive into all 1437 of the Top Global Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Huangshan NovelLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huangshan NovelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002014

Huangshan NovelLtd

Manufactures and sells packaging materials in China and internationally.

Excellent balance sheet established dividend payer.