- China

- /

- Energy Services

- /

- SHSE:600339

What You Can Learn From China Petroleum Engineering Corporation's (SHSE:600339) P/E

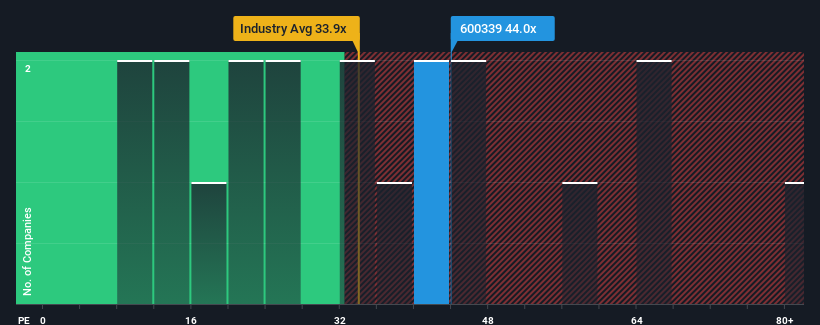

With a price-to-earnings (or "P/E") ratio of 44x China Petroleum Engineering Corporation (SHSE:600339) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 36x and even P/E's lower than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

China Petroleum Engineering has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for China Petroleum Engineering

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like China Petroleum Engineering's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. This means it has also seen a slide in earnings over the longer-term as EPS is down 54% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 94% during the coming year according to the three analysts following the company. With the market only predicted to deliver 39%, the company is positioned for a stronger earnings result.

With this information, we can see why China Petroleum Engineering is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On China Petroleum Engineering's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Petroleum Engineering's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for China Petroleum Engineering that you should be aware of.

If you're unsure about the strength of China Petroleum Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600339

Adequate balance sheet low.

Market Insights

Community Narratives