- China

- /

- Oil and Gas

- /

- SHSE:600123

Shanxi Lanhua Sci-Tech Venture Co.,Ltd's (SHSE:600123) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Shanxi Lanhua Sci-Tech Venture Co.,Ltd (SHSE:600123) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 4.0% isn't as attractive.

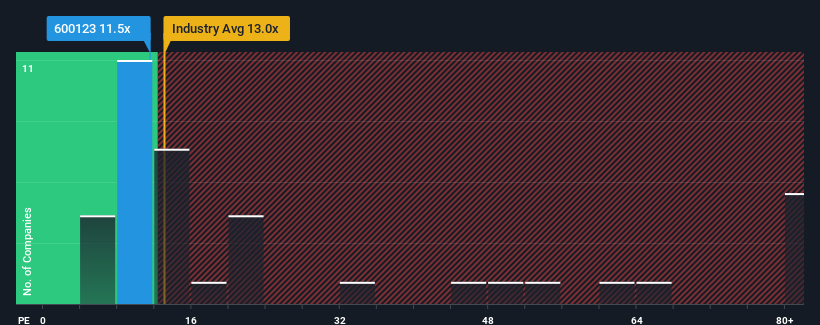

Even after such a large jump in price, Shanxi Lanhua Sci-Tech VentureLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.5x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Shanxi Lanhua Sci-Tech VentureLtd has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Shanxi Lanhua Sci-Tech VentureLtd

How Is Shanxi Lanhua Sci-Tech VentureLtd's Growth Trending?

In order to justify its P/E ratio, Shanxi Lanhua Sci-Tech VentureLtd would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 50%. Even so, admirably EPS has lifted 39% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 19% per year growth forecast for the broader market.

With this information, we can see why Shanxi Lanhua Sci-Tech VentureLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Shanxi Lanhua Sci-Tech VentureLtd's P/E

Shanxi Lanhua Sci-Tech VentureLtd's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanxi Lanhua Sci-Tech VentureLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Shanxi Lanhua Sci-Tech VentureLtd.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600123

Excellent balance sheet and fair value.