- China

- /

- Oil and Gas

- /

- SHSE:600123

Shanxi Lanhua Sci-Tech Venture Co.,Ltd's (SHSE:600123) Price Is Right But Growth Is Lacking

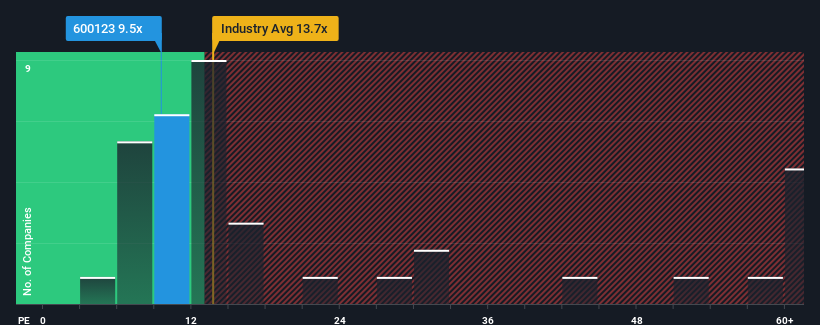

Shanxi Lanhua Sci-Tech Venture Co.,Ltd's (SHSE:600123) price-to-earnings (or "P/E") ratio of 9.5x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 57x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Shanxi Lanhua Sci-Tech VentureLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shanxi Lanhua Sci-Tech VentureLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shanxi Lanhua Sci-Tech VentureLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 53%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 166% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.0% each year as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 25% per annum growth forecast for the broader market.

In light of this, it's understandable that Shanxi Lanhua Sci-Tech VentureLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanxi Lanhua Sci-Tech VentureLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Shanxi Lanhua Sci-Tech VentureLtd that we have uncovered.

Of course, you might also be able to find a better stock than Shanxi Lanhua Sci-Tech VentureLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600123

Excellent balance sheet and fair value.