- China

- /

- Diversified Financial

- /

- SZSE:300773

Asian Growth Companies With Up To 38 Percent Insider Ownership

Reviewed by Simply Wall St

As global markets experience a mix of positive developments and ongoing economic challenges, Asian economies are navigating their own set of circumstances with varying degrees of growth and investor sentiment. In this context, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's explore several standout options from the results in the screener.

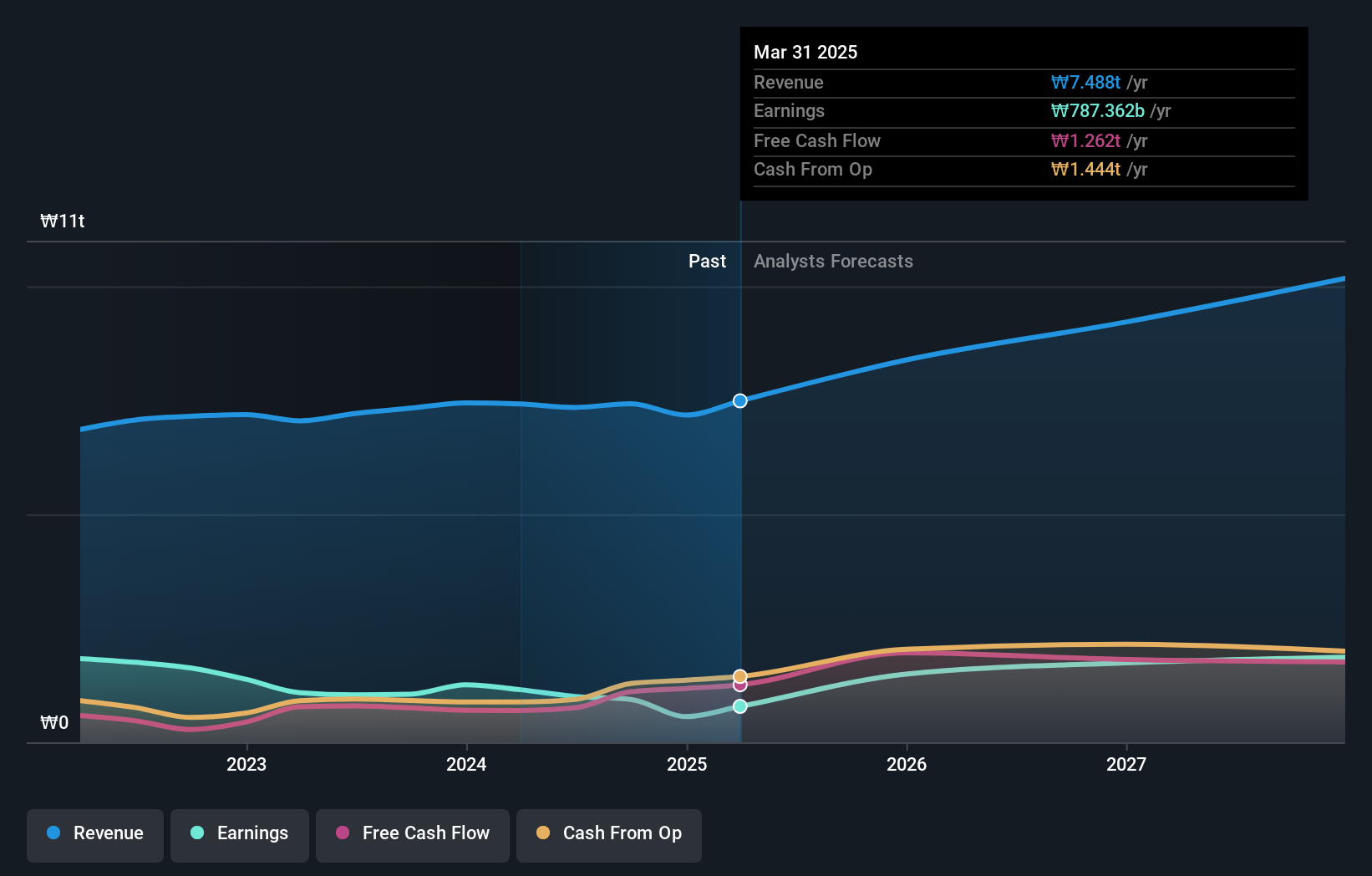

LG (KOSE:A003550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LG Corp. operates through its subsidiaries in the electronics, chemicals, and communication and services industries with a market cap of ₩12.24 billion.

Operations: The company's revenue segments include LG Corp. with ₩854.36 million and LG CNS Co., LTD generating ₩6.90 billion.

Insider Ownership: 38.5%

LG Corp. is positioned for significant growth with earnings forecasted to rise 26.74% annually, outpacing the Korean market's 21.1%. Despite a lower-than-ideal return on equity and declining profit margins, LG trades at a substantial discount to its estimated fair value. Recent Q1 results showed a notable increase in net income to KRW 580 billion from KRW 344 billion year-on-year, indicating robust financial performance amidst slower revenue growth projections of 11.6% annually.

- Click here to discover the nuances of LG with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, LG's share price might be too pessimistic.

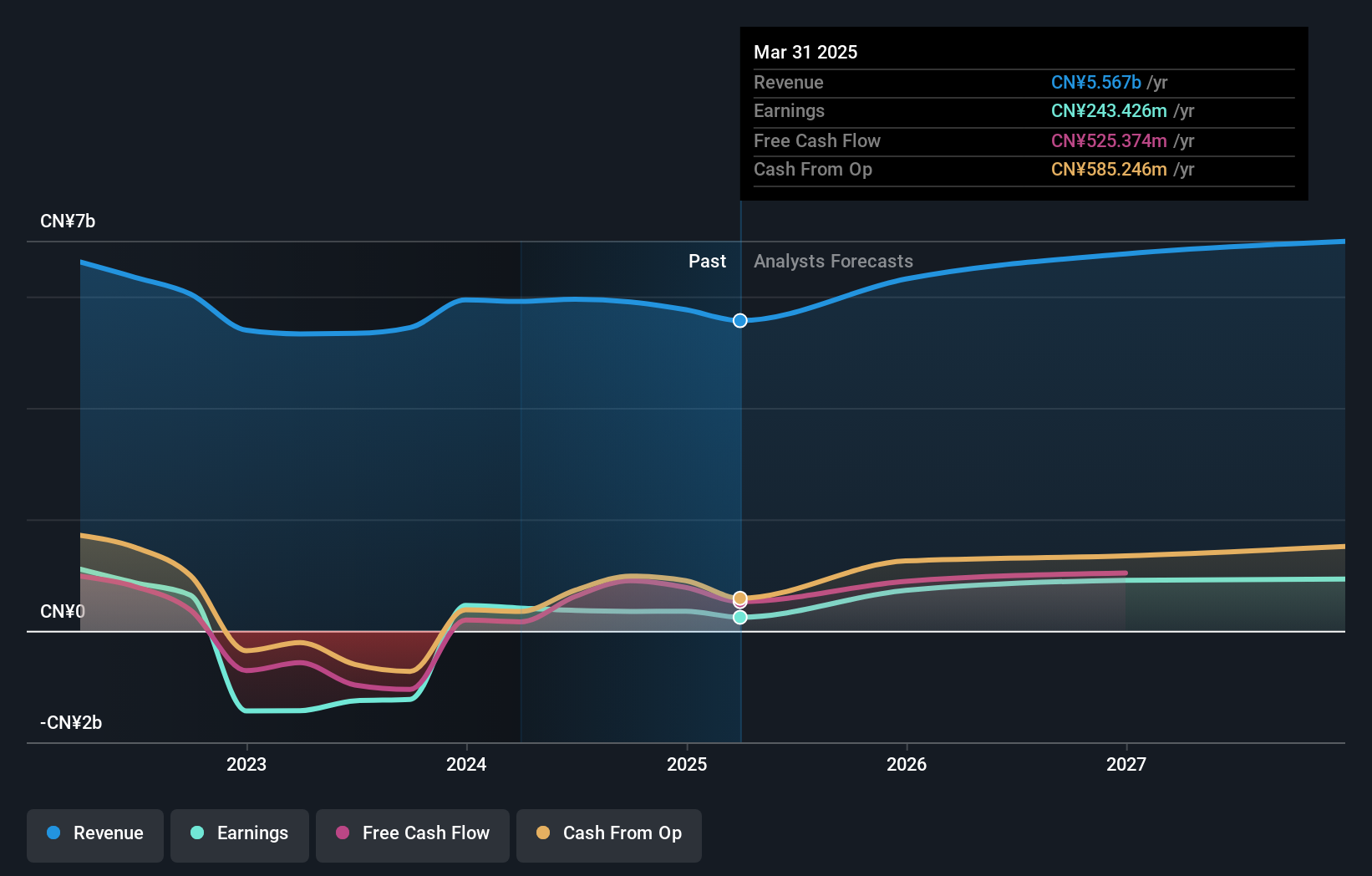

Lakala Payment (SZSE:300773)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lakala Payment Co., Ltd. operates in the digital payment and technology service sector in China with a market cap of CN¥25.53 billion.

Operations: Lakala Payment Co., Ltd. generates revenue through its digital payment and technology services in China.

Insider Ownership: 11.9%

Lakala Payment is poised for substantial earnings growth, with forecasts indicating a 30.4% annual increase over the next three years, surpassing the Chinese market's 23.4%. However, revenue growth is expected to be slower at 7.1% annually, below the market average of 12.4%. Despite recent volatility in share price and declining profit margins from last year, insider ownership remains stable with no significant trading activity reported in recent months.

- Delve into the full analysis future growth report here for a deeper understanding of Lakala Payment.

- Our expertly prepared valuation report Lakala Payment implies its share price may be too high.

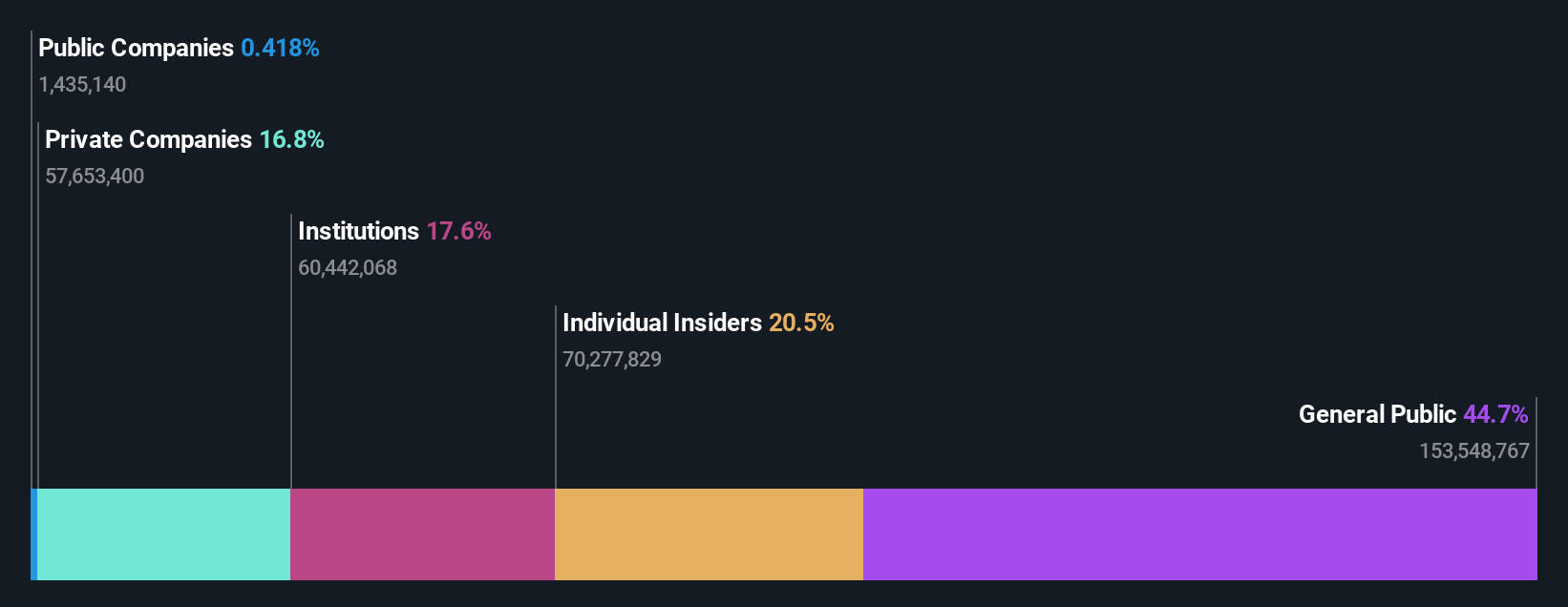

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating in China and internationally, with a market cap of CN¥29.66 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates its revenue primarily through the provision of wireless IoT products both domestically and internationally.

Insider Ownership: 20.5%

Sharetronic Data Technology is positioned for robust growth, with earnings projected to rise 34.3% annually, outpacing the Chinese market's 23.4%. Revenue is also expected to grow at a strong 26.2% per year. Despite high volatility in share price and debt concerns relative to operating cash flow, its price-to-earnings ratio of 42.4x remains below the tech industry average. Recent meetings focused on asset acquisition and credit line expansion may influence future performance positively.

- Navigate through the intricacies of Sharetronic Data Technology with our comprehensive analyst estimates report here.

- The analysis detailed in our Sharetronic Data Technology valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 611 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Ready For A Different Approach? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300773

Lakala Payment

Engages in digital payment and technology service business in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives