- China

- /

- Capital Markets

- /

- SHSE:601377

Investors Appear Satisfied With Industrial Securities Co.,Ltd.'s (SHSE:601377) Prospects As Shares Rocket 32%

Industrial Securities Co.,Ltd. (SHSE:601377) shareholders have had their patience rewarded with a 32% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 6.2% isn't as attractive.

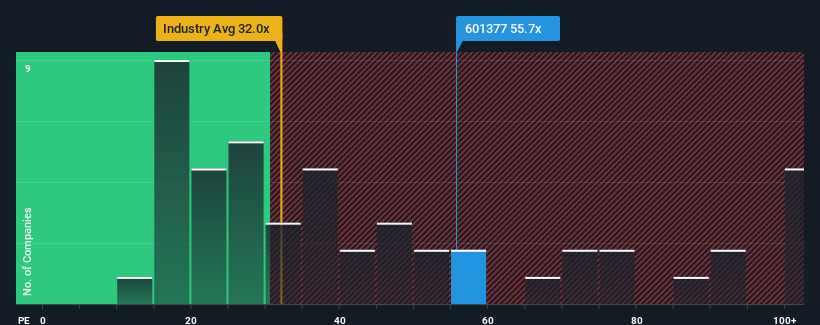

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Industrial SecuritiesLtd as a stock to avoid entirely with its 55.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Industrial SecuritiesLtd as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Industrial SecuritiesLtd

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Industrial SecuritiesLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 66%. This means it has also seen a slide in earnings over the longer-term as EPS is down 83% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 32% per annum during the coming three years according to the six analysts following the company. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Industrial SecuritiesLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Industrial SecuritiesLtd's P/E?

Shares in Industrial SecuritiesLtd have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Industrial SecuritiesLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Industrial SecuritiesLtd (2 are concerning) you should be aware of.

Of course, you might also be able to find a better stock than Industrial SecuritiesLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Industrial SecuritiesLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601377

Industrial SecuritiesLtd

Operates as a securities company in China and internationally.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives