- China

- /

- Capital Markets

- /

- SHSE:601059

Getting In Cheap On Cinda Securities Co., Ltd. (SHSE:601059) Is Unlikely

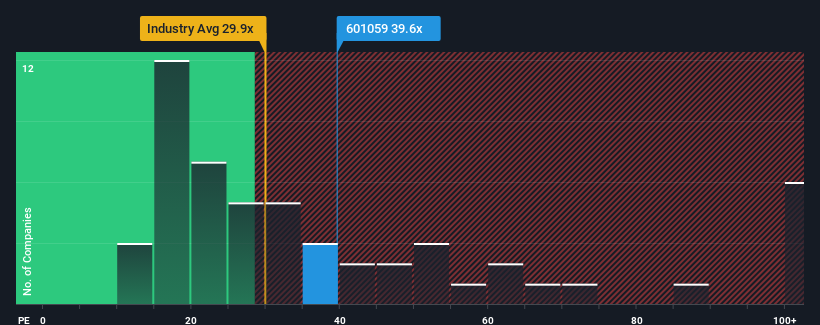

There wouldn't be many who think Cinda Securities Co., Ltd.'s (SHSE:601059) price-to-earnings (or "P/E") ratio of 39.6x is worth a mention when the median P/E in China is similar at about 38x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Cinda Securities could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Cinda Securities

Does Growth Match The P/E?

In order to justify its P/E ratio, Cinda Securities would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. Regardless, EPS has managed to lift by a handy 5.2% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 6.1% each year as estimated by the only analyst watching the company. With the market predicted to deliver 21% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Cinda Securities' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Cinda Securities' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cinda Securities' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Cinda Securities with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Cinda Securities. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601059

Cinda Securities

Through its subsidiaries, provides securities and futures brokerage, securities proprietary trading, asset management, investment banking, and related financial services in China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives