- China

- /

- Capital Markets

- /

- SHSE:600958

Earnings Not Telling The Story For Orient Securities Company Limited (SHSE:600958) After Shares Rise 32%

Orient Securities Company Limited (SHSE:600958) shares have continued their recent momentum with a 32% gain in the last month alone. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

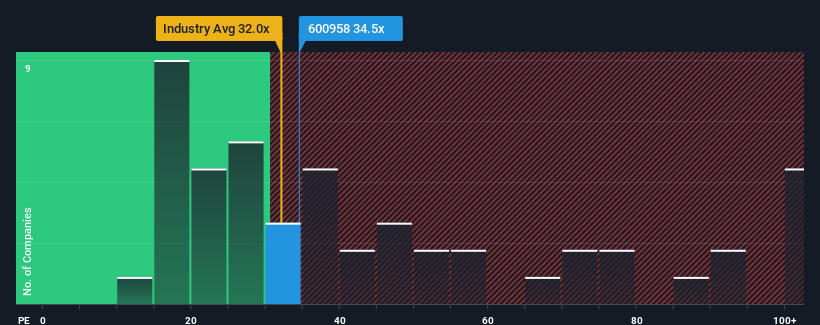

Following the firm bounce in price, Orient Securities may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 34.5x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for Orient Securities as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Orient Securities

How Is Orient Securities' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Orient Securities' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 39% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 9.6% per year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 19% each year growth forecast for the broader market.

With this information, we find it concerning that Orient Securities is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Orient Securities shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Orient Securities currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Orient Securities, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600958

Orient Securities

Operates as an integrated securities company in the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives