- China

- /

- Metals and Mining

- /

- SHSE:688190

Unearthing Undiscovered Gems In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are reflecting a mixed economic landscape with U.S. consumer confidence dipping and manufacturing orders declining, yet major stock indexes like the Nasdaq Composite and S&P 500 have shown moderate gains amidst these challenges. In this environment, identifying undiscovered gems in the small-cap sector can be particularly rewarding; these stocks often offer unique growth opportunities that are not immediately apparent in larger indices dominated by high-profile companies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| AuMas Resources Berhad | NA | 14.09% | 57.21% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vietnam Container Shipping | 47.45% | 7.52% | -7.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Sunny Loan TopLtd (SHSE:600830)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sunny Loan Top Co., Ltd. offers investment and financing services both within China and internationally, with a market cap of CN¥5.31 billion.

Operations: Sunny Loan Top Co., Ltd. generates revenue primarily through its investment and financing services, both domestically and internationally. The company's financial performance is influenced by its cost structure, which impacts profitability metrics such as the net profit margin.

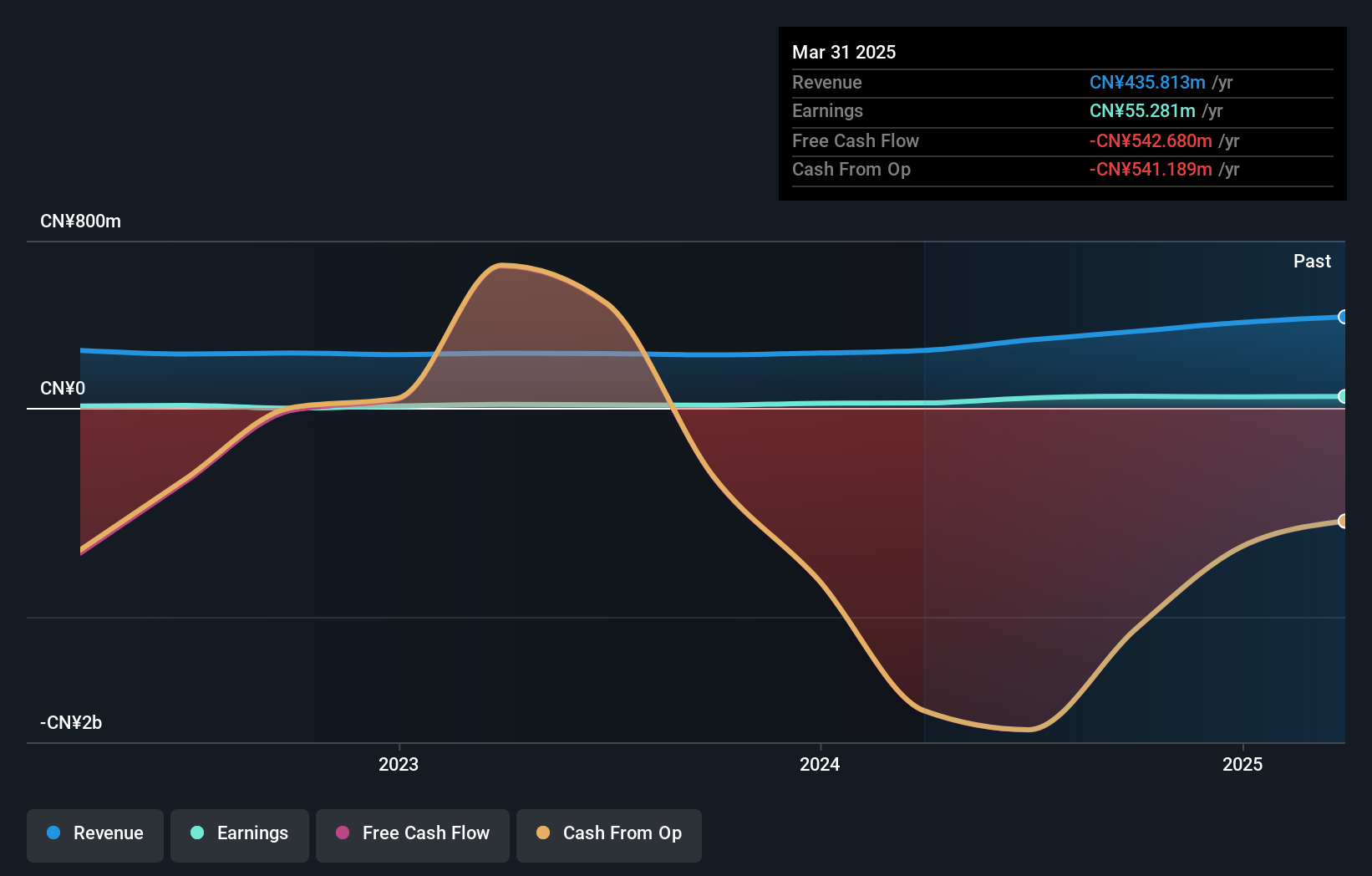

Sunny Loan Top Ltd., a smaller player in the financial sector, has shown remarkable earnings growth of 335% over the past year, outpacing the Consumer Finance industry's 12%. The company reported nine-month sales of CNY 240.3 million and net income of CNY 57.28 million, reflecting significant improvement from previous figures. Despite a rise in its debt-to-equity ratio to 68% over five years, its net debt to equity at 38% remains satisfactory. While free cash flow isn't positive, interest coverage is not an issue due to high non-cash earnings levels.

- Click here and access our complete health analysis report to understand the dynamics of Sunny Loan TopLtd.

Understand Sunny Loan TopLtd's track record by examining our Past report.

Qingdao Yunlu Advanced Materials Technology (SHSE:688190)

Simply Wall St Value Rating: ★★★★★★

Overview: Qingdao Yunlu Advanced Materials Technology Co., Ltd. specializes in the development and production of advanced magnetic materials, with a market cap of CN¥11.04 billion.

Operations: Yunlu Advanced Materials generates revenue primarily from the magnetic material industry, amounting to CN¥1.86 billion.

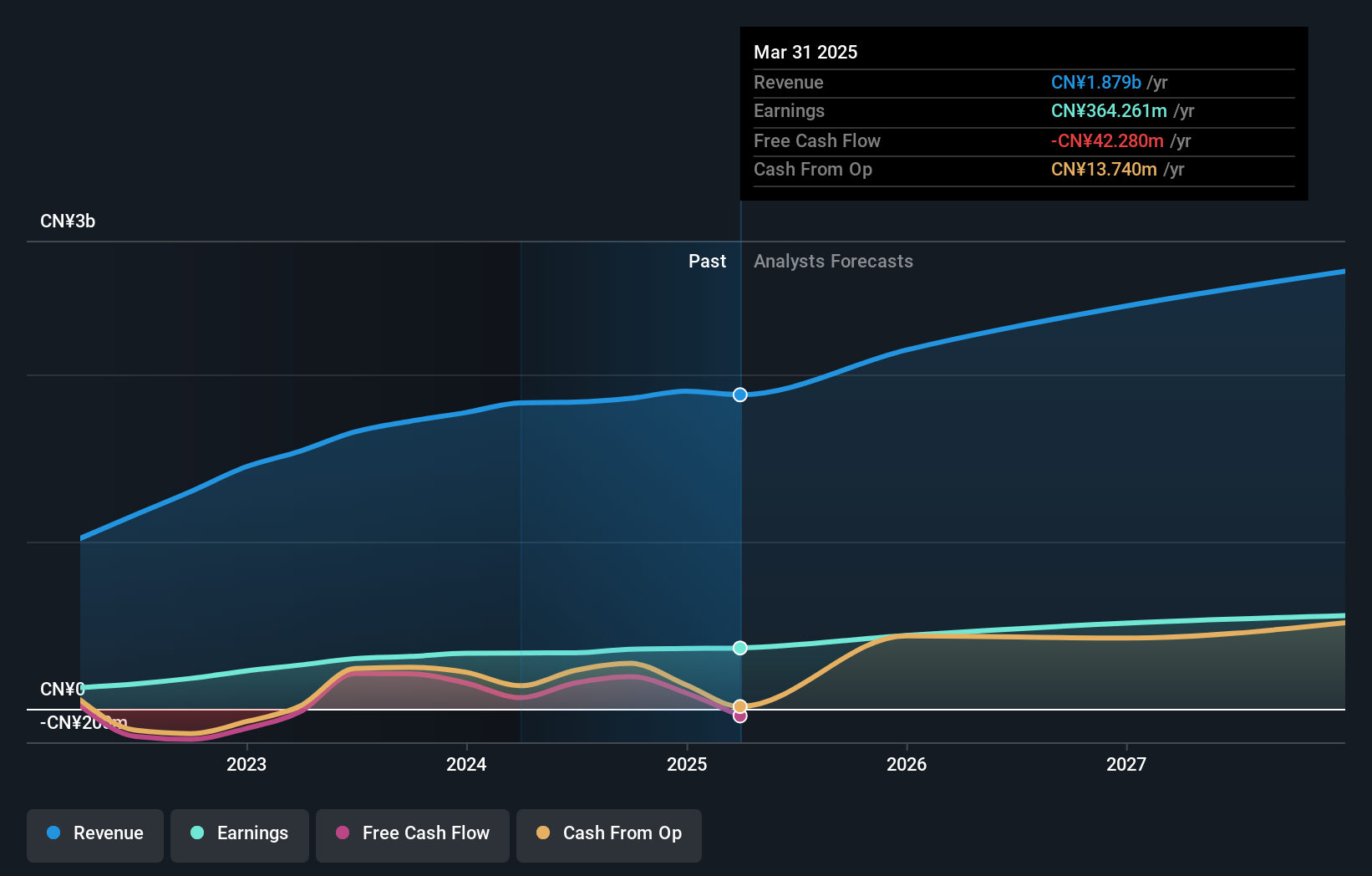

Qingdao Yunlu Advanced Materials Technology, a smaller player in the market, showcases robust performance with earnings growth of 13.8% over the past year, outpacing the broader Metals and Mining industry. The company is debt-free and boasts a price-to-earnings ratio of 31x, which is attractively below the CN market average of 34.8x. Recent financial results for nine months ending September 2024 reveal sales at CNY 1.39 billion and net income reaching CNY 262.86 million, both showing improvement from last year’s figures. With high-quality earnings and positive free cash flow (CNY193M), Qingdao Yunlu seems well-positioned for future growth prospects.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★★

Overview: Bic Camera Inc., along with its subsidiaries, operates in the manufacture and sale of audiovisual products in Japan, with a market capitalization of approximately ¥293.06 billion.

Operations: Bic Camera Inc. generates revenue primarily from its Goods Sale Business, contributing approximately ¥909.75 billion, while the BS Digital Broadcasting Business adds around ¥11.36 billion.

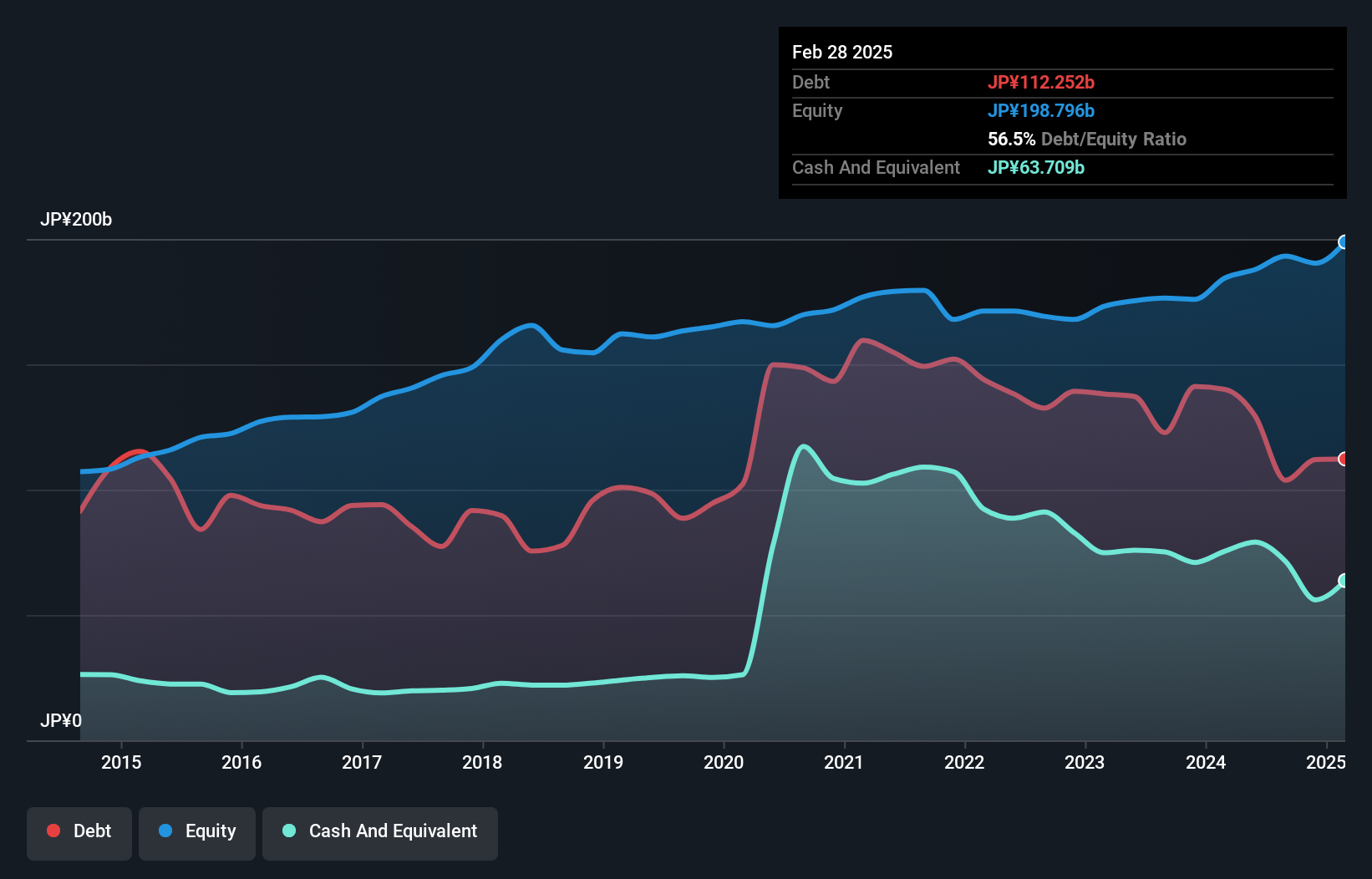

Bic Camera's remarkable earnings growth of 373% over the past year outpaced the Specialty Retail industry, which grew by just 5.8%. This small company seems to be trading at a bargain, with its stock valued at about 37% below estimated fair value. The debt to equity ratio has seen a slight improvement from 54.2% to 53.7% over five years, suggesting prudent financial management. Furthermore, Bic Camera enjoys high-quality earnings and positive free cash flow, indicating solid operational efficiency and profitability in its niche market segment within Japan’s retail landscape.

- Delve into the full analysis health report here for a deeper understanding of Bic Camera.

Assess Bic Camera's past performance with our detailed historical performance reports.

Next Steps

- Explore the 4638 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Yunlu Advanced Materials Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688190

Qingdao Yunlu Advanced Materials Technology

Qingdao Yunlu Advanced Materials Technology Co., Ltd.

Flawless balance sheet with proven track record.