- China

- /

- Electrical

- /

- SZSE:200771

Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As we approach January 2025, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence dipping and manufacturing orders declining, while major stock indexes like the Nasdaq Composite and S&P 500 showed moderate gains despite some volatility. In this environment, identifying small-cap stocks with strong potential can be particularly rewarding for investors seeking opportunities that may not yet be on the radar; these undiscovered gems often exhibit solid fundamentals and growth prospects even amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| AuMas Resources Berhad | NA | 14.09% | 57.21% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vietnam Container Shipping | 47.45% | 7.52% | -7.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu Shemar ElectricLtd (SHSE:603530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Shemar Electric Co., Ltd focuses on the research, development, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China with a market capitalization of approximately CN¥10.46 billion.

Operations: Shemar Electric generates revenue primarily through the sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals. The company has a market capitalization of approximately CN¥10.46 billion.

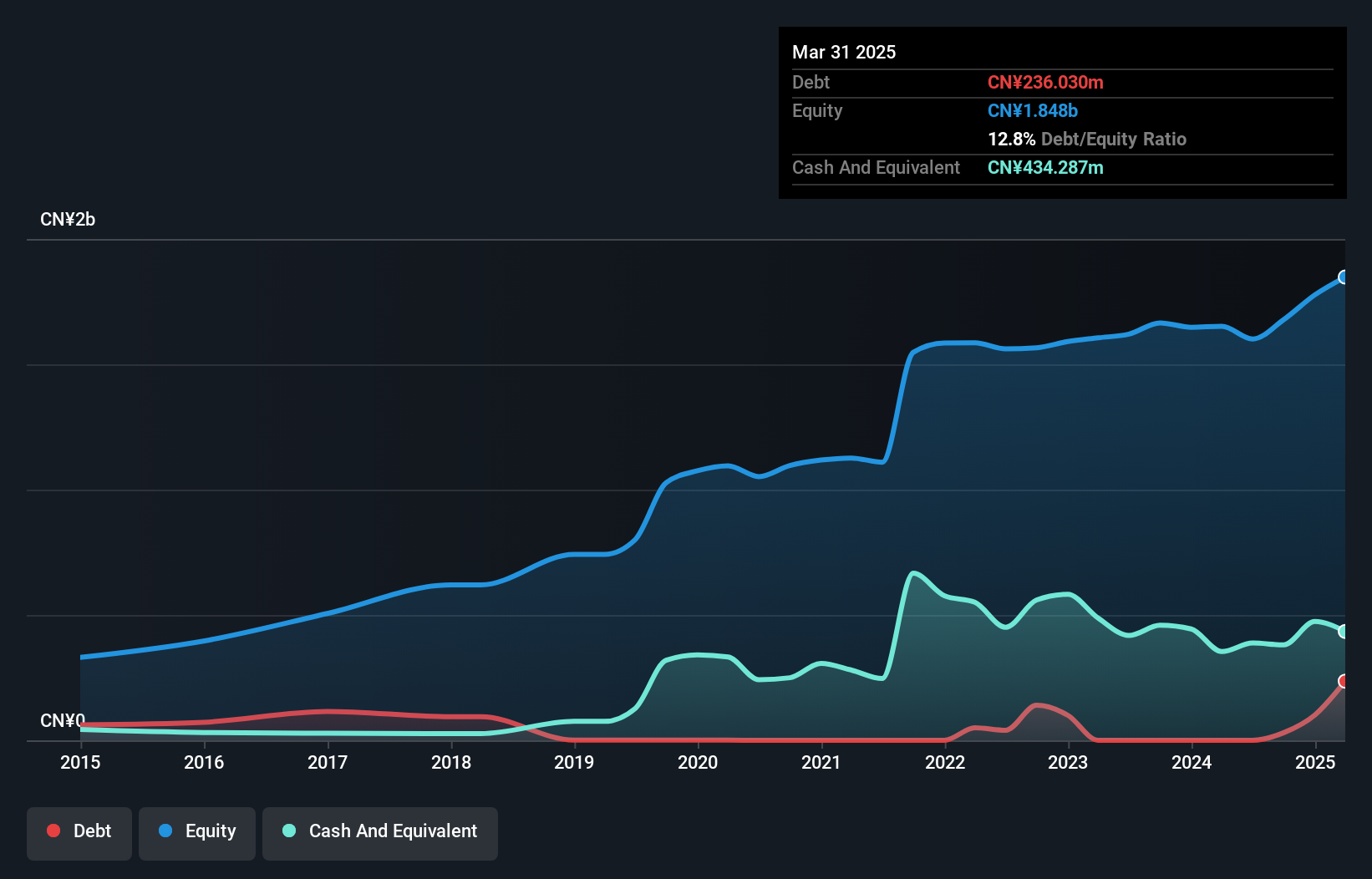

Jiangsu Shemar Electric, a nimble player in the electrical sector, has shown impressive growth with earnings surging by 131% over the past year, outpacing the industry average of 1%. The company reported sales of CNY 895.41 million for the first nine months of 2024, up from CNY 672.72 million a year earlier. Net income also jumped to CNY 215.6 million from CNY 95.81 million last year, reflecting robust performance. Trading at about 13% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space while maintaining more cash than total debt offers financial flexibility.

- Dive into the specifics of Jiangsu Shemar ElectricLtd here with our thorough health report.

Gain insights into Jiangsu Shemar ElectricLtd's past trends and performance with our Past report.

Hangzhou Turbine Power Group (SZSE:200771)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hangzhou Turbine Power Group Co., Ltd. is engaged in the design, manufacture, and sale of industrial steam turbines, gas turbines, and related components and spare parts in China, with a market cap of HK$12.07 billion.

Operations: Revenue for Hangzhou Turbine Power Group primarily stems from the sale of industrial steam turbines, gas turbines, and related components. The company's net profit margin has shown variability over recent periods.

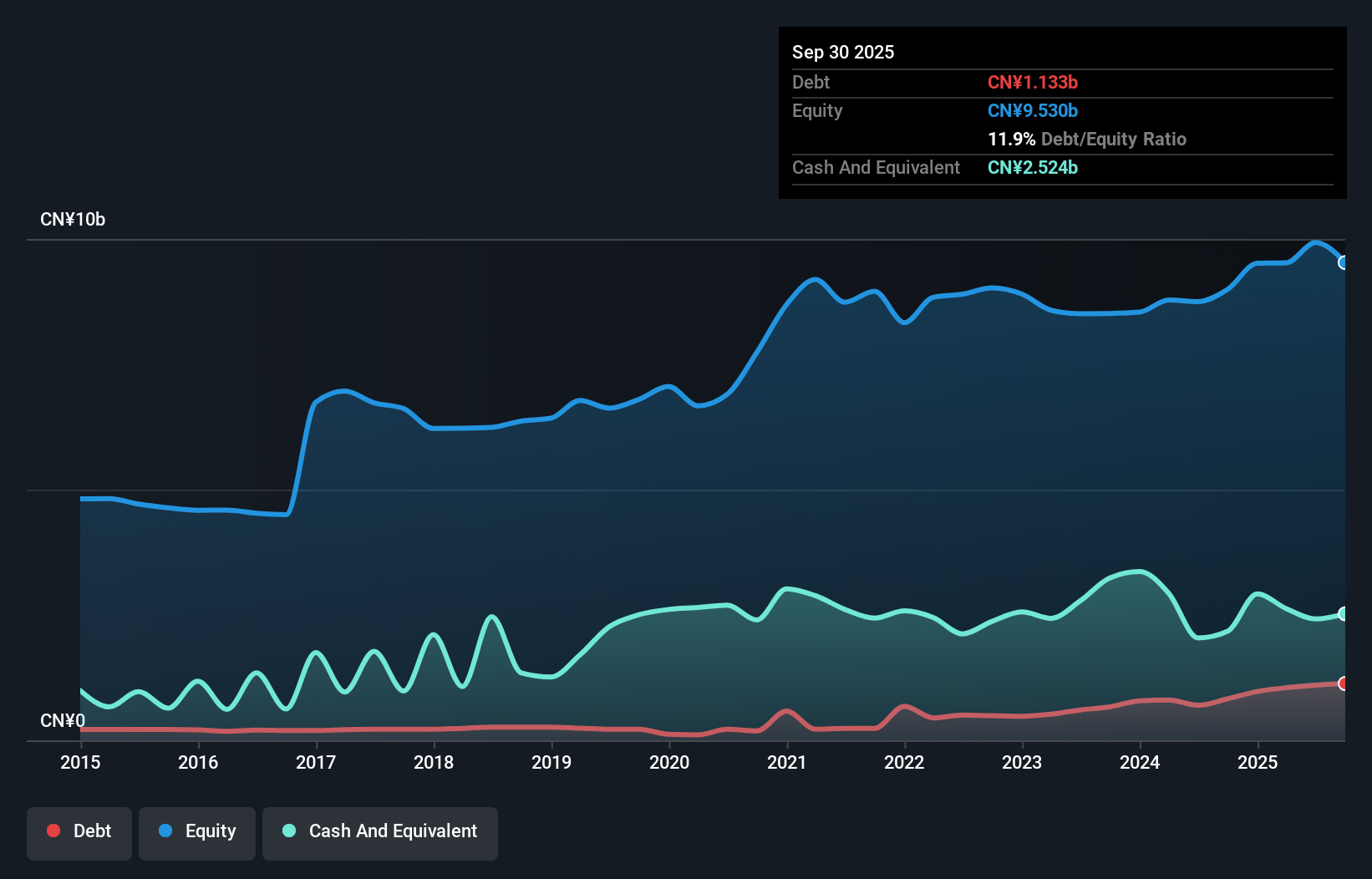

Hangzhou Turbine Power Group, a promising player in the electrical industry, recently reported a 17.6% earnings growth over the past year, outpacing the industry's 1.1%. Despite its solid performance, net income for the first nine months of 2024 was CNY 189.62 million, down from CNY 274.16 million last year. With a price-to-earnings ratio of 26.2x below China's market average of 34.8x, it presents an attractive valuation proposition. The company's debt to equity ratio rose from 3.2% to 9.2% over five years but remains supported by more cash than total debt, ensuring financial stability amidst changes like repurchase and cancellation of restricted stocks discussed in recent meetings.

Jiangsu Newamstar Packaging MachineryLtd (SZSE:300509)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Newamstar Packaging Machinery Co., Ltd specializes in the research, development, manufacturing, and sale of beverage packaging machinery both in China and internationally, with a market capitalization of CN¥2.05 billion.

Operations: Newamstar generates revenue primarily from the sale of beverage packaging machinery. The company's cost structure includes expenses related to research and development, manufacturing, and sales operations. Its financial performance is influenced by its ability to manage these costs effectively while maintaining competitive pricing in both domestic and international markets.

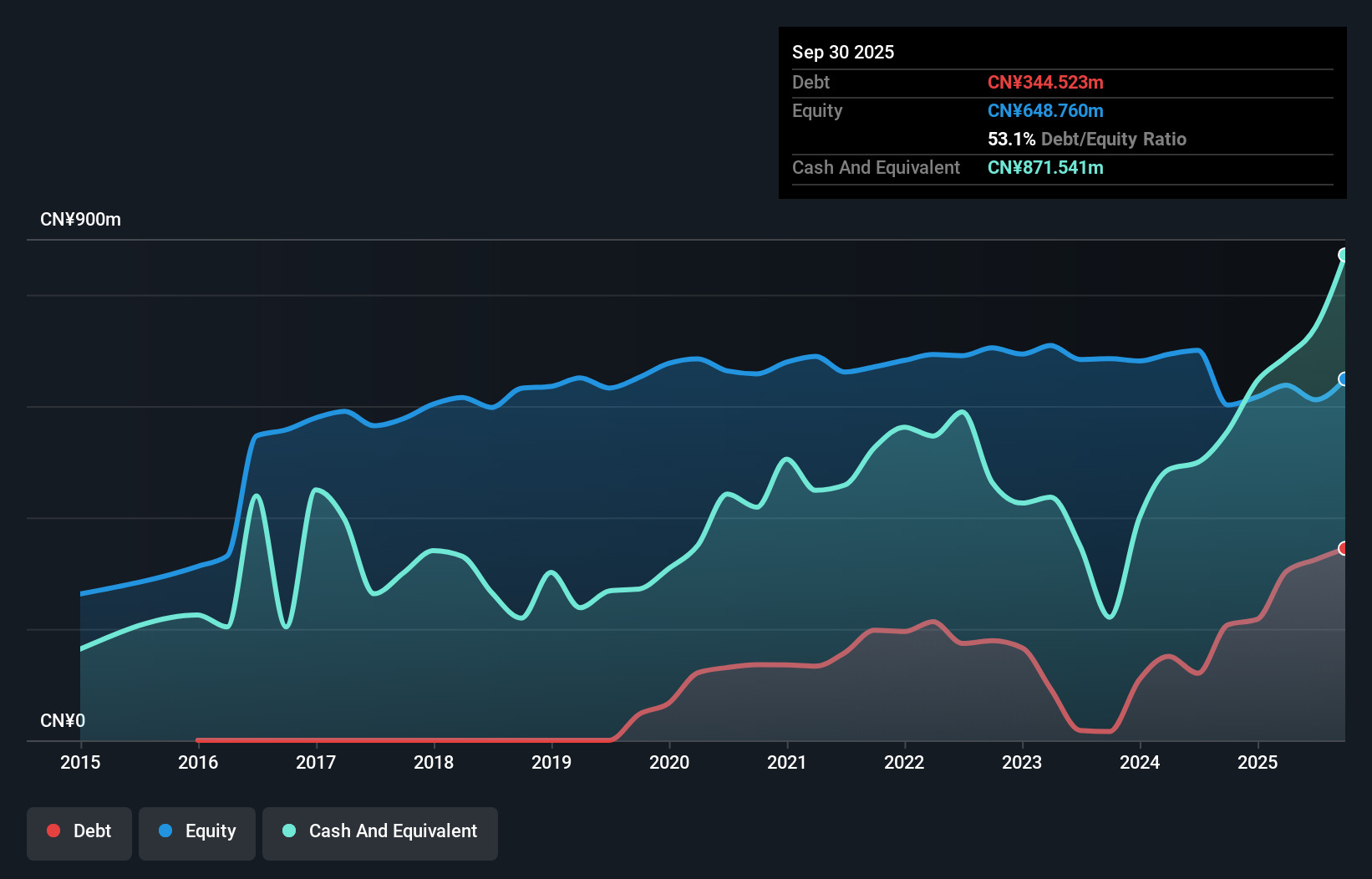

Jiangsu Newamstar, a nimble player in the machinery sector, has shown impressive earnings growth of 44.2% over the past year, outpacing its industry peers. Despite a volatile share price recently, it remains profitable with free cash flow turning positive. The company reported sales of CN¥750M for the first nine months of 2024, up from CN¥678M last year, while net income increased to CN¥27M from CN¥22M. A significant one-off gain of CN¥9.4M impacted recent results but hasn't hindered its strong performance relative to fair value estimates and industry benchmarks.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4635 more companies for you to explore.Click here to unveil our expertly curated list of 4638 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Turbine Power Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:200771

Hangzhou Turbine Power Group

Designs, manufactures, and sells industrial steam turbines, gas turbines and complement, and spare parts in China.

Adequate balance sheet second-rate dividend payer.