- China

- /

- Capital Markets

- /

- SHSE:600053

Risks To Shareholder Returns Are Elevated At These Prices For Kunwu Jiuding Investment Holdings Co., Ltd. (SHSE:600053)

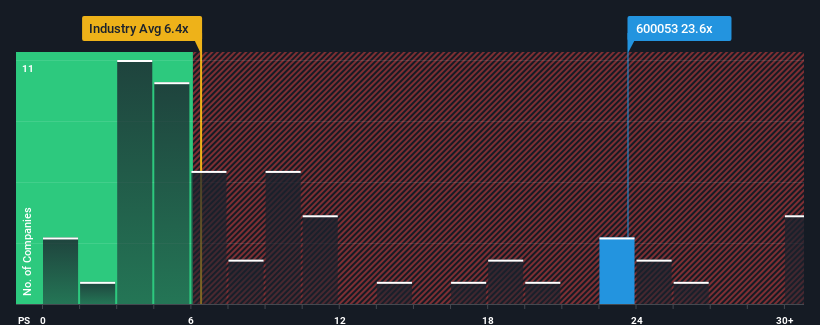

Kunwu Jiuding Investment Holdings Co., Ltd.'s (SHSE:600053) price-to-sales (or "P/S") ratio of 23.6x may look like a poor investment opportunity when you consider close to half the companies in the Capital Markets industry in China have P/S ratios below 6.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Kunwu Jiuding Investment Holdings

What Does Kunwu Jiuding Investment Holdings' Recent Performance Look Like?

For example, consider that Kunwu Jiuding Investment Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kunwu Jiuding Investment Holdings' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Kunwu Jiuding Investment Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Kunwu Jiuding Investment Holdings' is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. Still, the latest three year period has seen an excellent 33% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.5% shows it's about the same on an annualised basis.

In light of this, it's curious that Kunwu Jiuding Investment Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Kunwu Jiuding Investment Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Kunwu Jiuding Investment Holdings has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 4 warning signs for Kunwu Jiuding Investment Holdings (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Kunwu Jiuding Investment Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kunwu Jiuding Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600053

Kunwu Jiuding Investment Holdings

Kunwu Jiuding Investment Holding Co., Ltd.

Adequate balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026