- China

- /

- Hospitality

- /

- SZSE:300859

Western Regions Tourism Development Co.,Ltd (SZSE:300859) Investors Are Less Pessimistic Than Expected

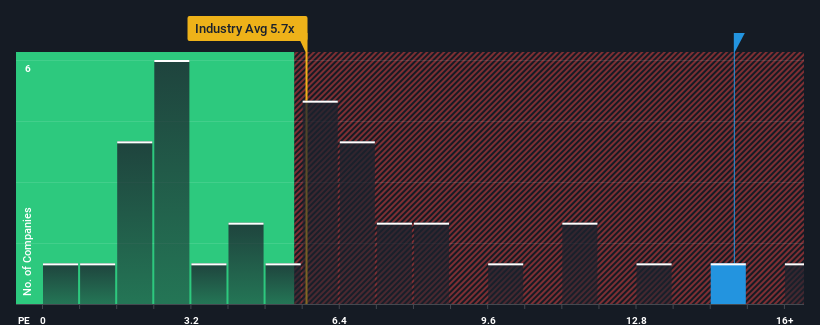

With a price-to-sales (or "P/S") ratio of 14.9x Western Regions Tourism Development Co.,Ltd (SZSE:300859) may be sending very bearish signals at the moment, given that almost half of all the Hospitality companies in China have P/S ratios under 5.7x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Western Regions Tourism DevelopmentLtd

What Does Western Regions Tourism DevelopmentLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Western Regions Tourism DevelopmentLtd has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Western Regions Tourism DevelopmentLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Western Regions Tourism DevelopmentLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 162% last year. The strong recent performance means it was also able to grow revenue by 123% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 38% shows it's noticeably less attractive.

In light of this, it's alarming that Western Regions Tourism DevelopmentLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Western Regions Tourism DevelopmentLtd's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Western Regions Tourism DevelopmentLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Western Regions Tourism DevelopmentLtd that you should be aware of.

If these risks are making you reconsider your opinion on Western Regions Tourism DevelopmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Western Regions Tourism DevelopmentLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Western Regions Tourism DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300859

Western Regions Tourism DevelopmentLtd

Provides tourism and travel services in China.

Exceptional growth potential with excellent balance sheet.