- China

- /

- Consumer Services

- /

- SZSE:002659

Risks Still Elevated At These Prices As Beijing Kaiwen Education Technology Co., Ltd (SZSE:002659) Shares Dive 26%

Beijing Kaiwen Education Technology Co., Ltd (SZSE:002659) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 7.6% in the last year.

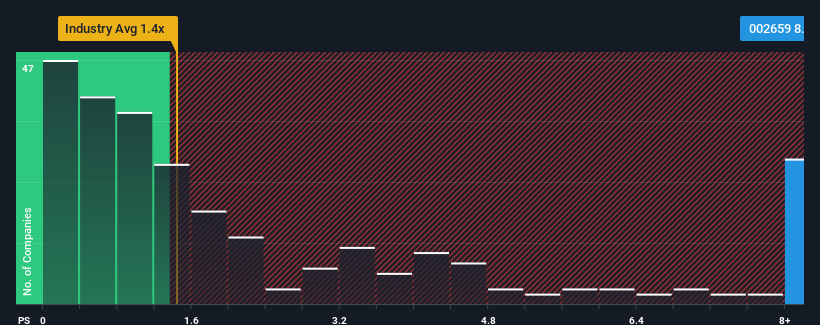

Although its price has dipped substantially, Beijing Kaiwen Education Technology's price-to-sales (or "P/S") ratio of 8.6x might still make it look like a strong sell right now compared to other companies in the Consumer Services industry in China, where around half of the companies have P/S ratios below 4.2x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Beijing Kaiwen Education Technology

How Beijing Kaiwen Education Technology Has Been Performing

Recent times have been pleasing for Beijing Kaiwen Education Technology as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Kaiwen Education Technology.Do Revenue Forecasts Match The High P/S Ratio?

Beijing Kaiwen Education Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 21% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 33% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Beijing Kaiwen Education Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Even after such a strong price drop, Beijing Kaiwen Education Technology's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Beijing Kaiwen Education Technology's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Beijing Kaiwen Education Technology with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Beijing Kaiwen Education Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Kaiwen Education Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002659

High growth potential with excellent balance sheet.