- China

- /

- Consumer Services

- /

- SZSE:002659

Beijing Kaiwen Education Technology Co., Ltd's (SZSE:002659) Share Price Is Still Matching Investor Opinion Despite 26% Slump

The Beijing Kaiwen Education Technology Co., Ltd (SZSE:002659) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

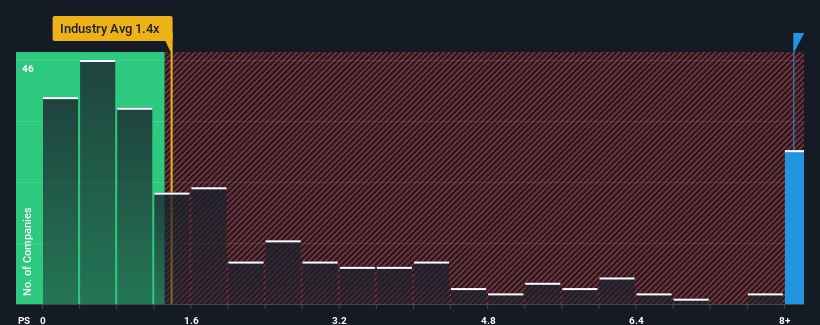

Although its price has dipped substantially, given around half the companies in China's Consumer Services industry have price-to-sales ratios (or "P/S") below 3.5x, you may still consider Beijing Kaiwen Education Technology as a stock to avoid entirely with its 8.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Kaiwen Education Technology

What Does Beijing Kaiwen Education Technology's P/S Mean For Shareholders?

Beijing Kaiwen Education Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Kaiwen Education Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Beijing Kaiwen Education Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 85% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 68% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 42% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we can see why Beijing Kaiwen Education Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Beijing Kaiwen Education Technology's P/S

Even after such a strong price drop, Beijing Kaiwen Education Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Beijing Kaiwen Education Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Beijing Kaiwen Education Technology with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Beijing Kaiwen Education Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Kaiwen Education Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002659

High growth potential with excellent balance sheet.

Market Insights

Community Narratives