- China

- /

- Consumer Services

- /

- SZSE:002607

Offcn Education Technology Co., Ltd. (SZSE:002607) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Those holding Offcn Education Technology Co., Ltd. (SZSE:002607) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

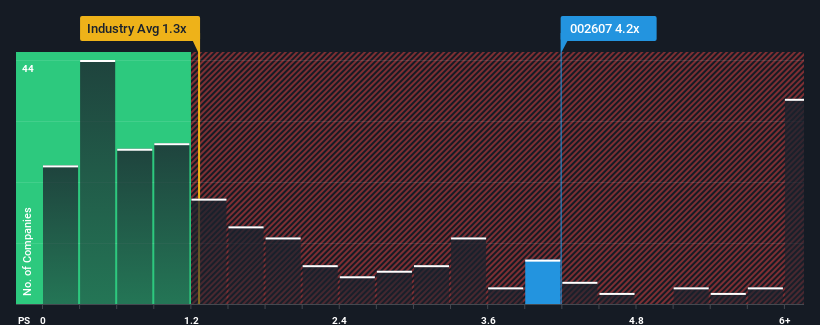

After such a large jump in price, given close to half the companies operating in China's Consumer Services industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Offcn Education Technology as a stock to potentially avoid with its 4.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Offcn Education Technology

What Does Offcn Education Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Offcn Education Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Offcn Education Technology.Do Revenue Forecasts Match The High P/S Ratio?

Offcn Education Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's top line. As a result, revenue from three years ago have also fallen 75% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 33% over the next year. Meanwhile, the rest of the industry is forecast to expand by 33%, which is not materially different.

With this information, we find it interesting that Offcn Education Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Offcn Education Technology's P/S Mean For Investors?

Offcn Education Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Offcn Education Technology currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 2 warning signs for Offcn Education Technology that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002607

Offcn Education Technology

Operates as a multi-category vocational education institution in China.

Exceptional growth potential very low.

Market Insights

Community Narratives