- China

- /

- Consumer Services

- /

- SZSE:002607

Insider Favorites: Three High-Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the challenges of tariff uncertainties and mixed economic data, investors are keenly observing companies that demonstrate resilience and growth potential. In such a landscape, stocks with high insider ownership often attract attention, as they can indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Here we highlight a subset of our preferred stocks from the screener.

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★☆

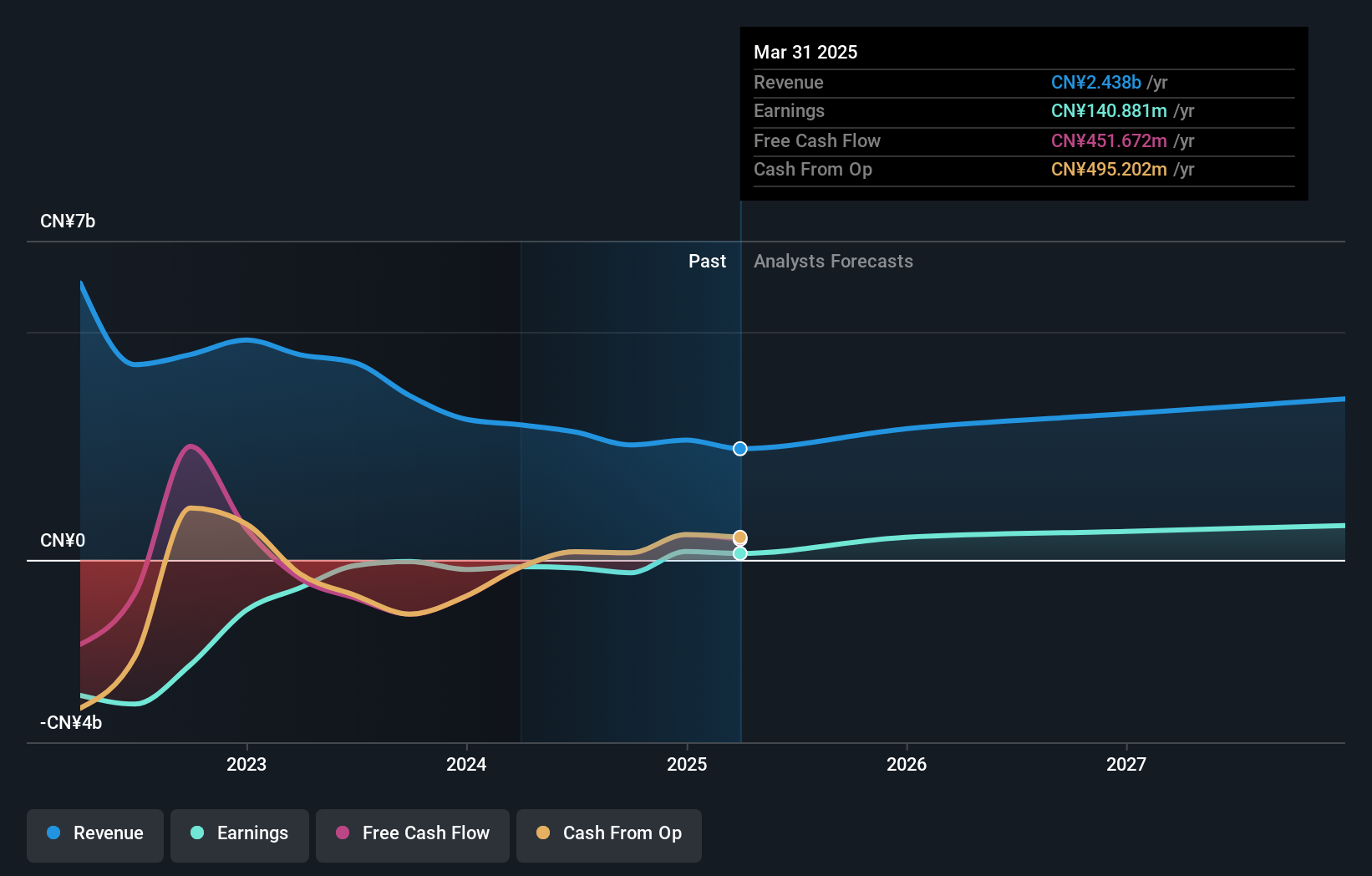

Overview: Smartsens Technology (Shanghai) Co., Ltd. operates in the semiconductor industry, focusing on the design and development of CMOS image sensors, with a market cap of CN¥34.30 billion.

Operations: The company's revenue primarily comes from its Semiconductor Integrated Circuit Chips segment, which generated CN¥5.29 billion.

Insider Ownership: 24.3%

Smartsens Technology (Shanghai) shows promising growth potential, with its revenue expected to grow 27.1% annually, outpacing the Chinese market's 13.5%. Earnings are forecasted to increase significantly at 48.4% per year, surpassing the market's 25.4%. The company recently completed a share buyback worth CNY 20.04 million, indicating confidence in its future prospects despite low return on equity projections and insufficient operating cash flow coverage for debt obligations.

- Click to explore a detailed breakdown of our findings in Smartsens Technology (Shanghai)'s earnings growth report.

- The valuation report we've compiled suggests that Smartsens Technology (Shanghai)'s current price could be inflated.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★★

Overview: Offcn Education Technology Co., Ltd. is a vocational education institution in China offering various educational services, with a market cap of CN¥23.19 billion.

Operations: Offcn Education Technology Co., Ltd. generates revenue through its diverse vocational education services in China.

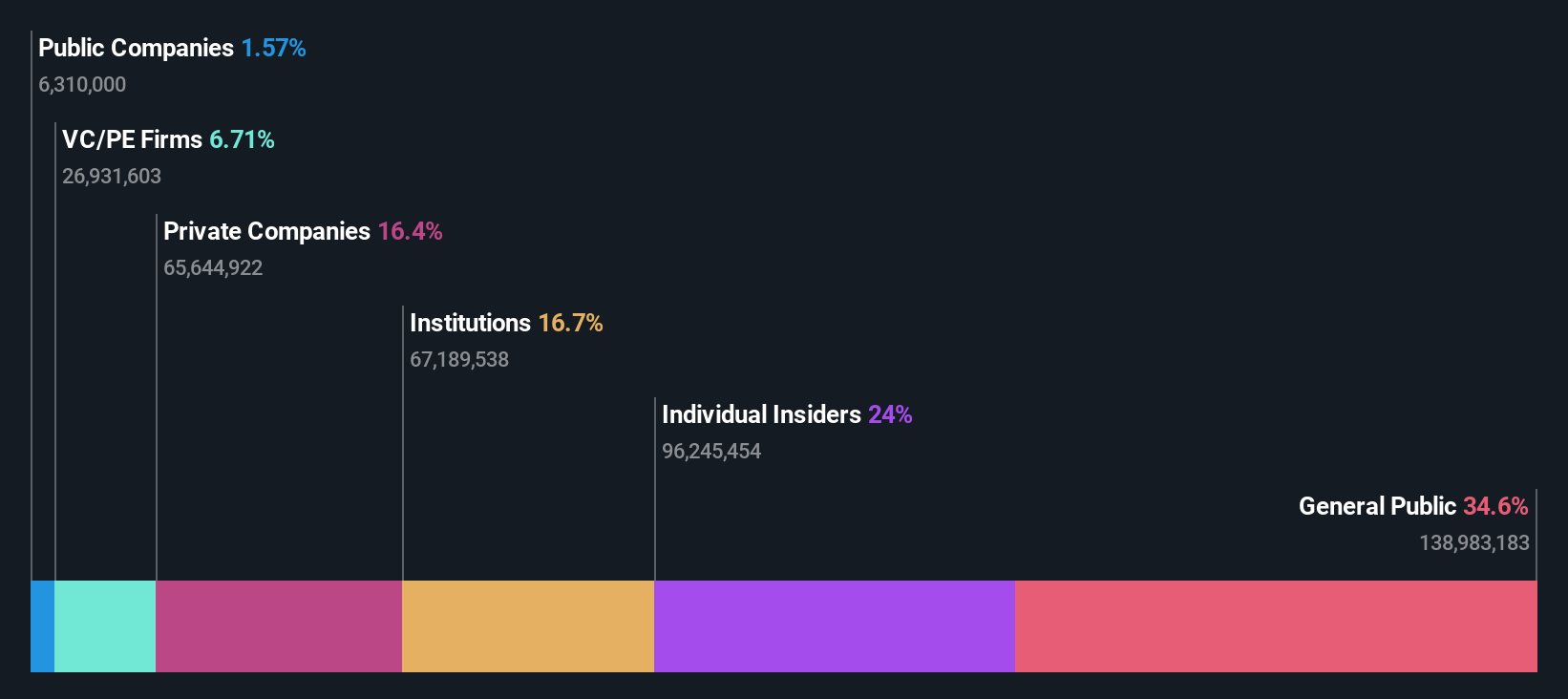

Insider Ownership: 26.1%

Offcn Education Technology is poised for substantial growth, with revenue expected to rise 23.9% annually, surpassing the Chinese market's 13.5% forecast. Earnings are projected to soar by 93.34% per year, and the company is anticipated to achieve profitability within three years, outpacing average market growth rates. Despite high return on equity forecasts of 41.5%, interest payments remain inadequately covered by earnings, highlighting potential financial vulnerabilities amidst its growth trajectory.

- Dive into the specifics of Offcn Education Technology here with our thorough growth forecast report.

- Our valuation report unveils the possibility Offcn Education Technology's shares may be trading at a premium.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

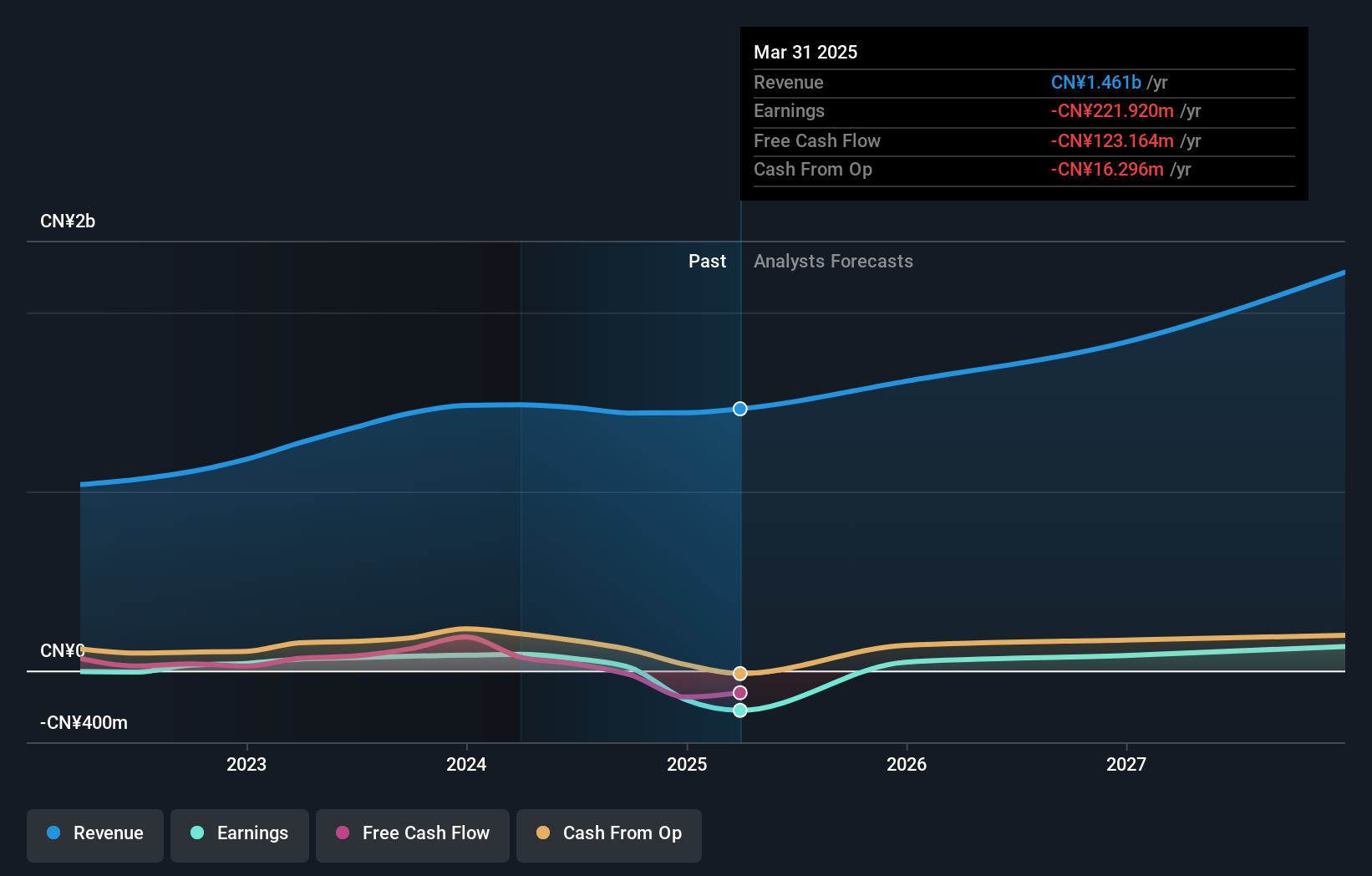

Overview: Wondershare Technology Group Co., Ltd. develops application software products both in China and internationally, with a market cap of CN¥15.69 billion.

Operations: Wondershare Technology Group Co., Ltd. generates its revenue primarily from the development and sale of application software products across both domestic and international markets.

Insider Ownership: 15.2%

Wondershare Technology Group shows promising growth potential, with earnings projected to rise significantly at 74.53% annually, outpacing the Chinese market's average. However, its profit margins have declined from 5.6% to 1.1% over the past year, indicating challenges in profitability. Recent product innovations like Recoverit 13.5 and HiPDF upgrades highlight strategic moves to enhance user experience and expand market reach, though share price volatility remains a concern for investors seeking stability.

- Navigate through the intricacies of Wondershare Technology Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Wondershare Technology Group's share price might be too optimistic.

Summing It All Up

- Navigate through the entire inventory of 1439 Fast Growing Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002607

Offcn Education Technology

Operates as a multi-category vocational education institution in China.

Exceptional growth potential very low.

Market Insights

Community Narratives