- China

- /

- Hospitality

- /

- SHSE:600706

Little Excitement Around Xi'an Qujiang Cultural Tourism Co., Ltd.'s (SHSE:600706) Revenues

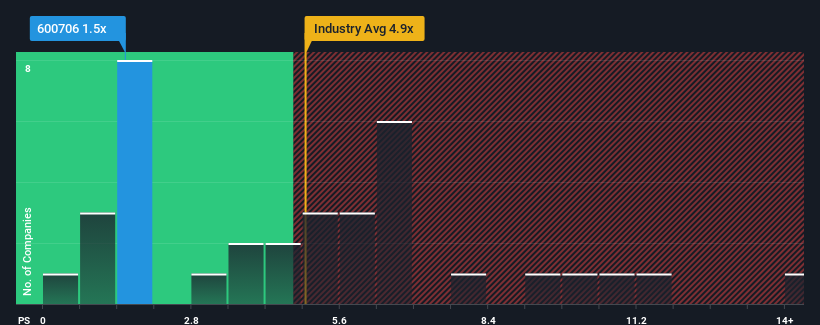

When close to half the companies in the Hospitality industry in China have price-to-sales ratios (or "P/S") above 4.9x, you may consider Xi'an Qujiang Cultural Tourism Co., Ltd. (SHSE:600706) as a highly attractive investment with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Xi'an Qujiang Cultural Tourism

How Xi'an Qujiang Cultural Tourism Has Been Performing

Xi'an Qujiang Cultural Tourism certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xi'an Qujiang Cultural Tourism will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Xi'an Qujiang Cultural Tourism?

Xi'an Qujiang Cultural Tourism's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this information, we can see why Xi'an Qujiang Cultural Tourism is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Xi'an Qujiang Cultural Tourism's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Xi'an Qujiang Cultural Tourism maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Xi'an Qujiang Cultural Tourism that we have uncovered.

If you're unsure about the strength of Xi'an Qujiang Cultural Tourism's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600706

Good value with mediocre balance sheet.

Market Insights

Community Narratives