- China

- /

- Food and Staples Retail

- /

- SZSE:300937

Sichuan Hezong Medicine Easy-to-buy Pharmaceutical Co., Ltd.'s (SZSE:300937) P/S Is Still On The Mark Following 48% Share Price Bounce

Despite an already strong run, Sichuan Hezong Medicine Easy-to-buy Pharmaceutical Co., Ltd. (SZSE:300937) shares have been powering on, with a gain of 48% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.2% in the last twelve months.

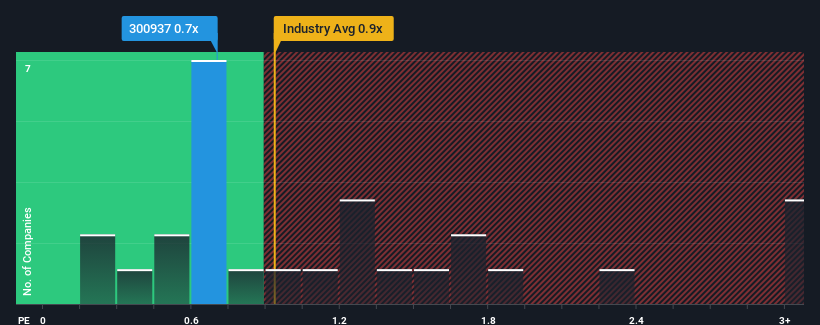

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in China is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Sichuan Hezong Medicine Easy-to-buy Pharmaceutical

How Sichuan Hezong Medicine Easy-to-buy Pharmaceutical Has Been Performing

As an illustration, revenue has deteriorated at Sichuan Hezong Medicine Easy-to-buy Pharmaceutical over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Sichuan Hezong Medicine Easy-to-buy Pharmaceutical?

The only time you'd be comfortable seeing a P/S like Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.0%. Still, the latest three year period has seen an excellent 40% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 12% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 5 warning signs for Sichuan Hezong Medicine Easy-to-buy Pharmaceutical (1 is a bit unpleasant!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300937

Sichuan Hezong Medicine Easy-to-buy Pharmaceutical

Sichuan Hezong Medicine Easy-to-buy Pharmaceutical Co., Ltd.

Moderate with adequate balance sheet.