As global markets grapple with heightened trade tensions and economic uncertainty, investors are witnessing significant volatility across major indices. Amidst this turbulence, identifying undervalued stocks becomes crucial as they may offer potential opportunities for those seeking to navigate the current market landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mips (OM:MIPS) | SEK343.60 | SEK684.22 | 49.8% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥74.19 | CN¥148.31 | 50% |

| América Móvil. de (BMV:AMX B) | MX$14.35 | MX$28.68 | 50% |

| Etteplan Oyj (HLSE:ETTE) | €10.90 | €21.62 | 49.6% |

| Stille (OM:STIL) | SEK203.00 | SEK403.54 | 49.7% |

| 3U Holding (XTRA:UUU) | €1.41 | €2.78 | 49.3% |

| Dino Polska (WSE:DNP) | PLN439.70 | PLN875.60 | 49.8% |

| PSI Software (XTRA:PSAN) | €22.50 | €44.68 | 49.6% |

| Siemens Energy (XTRA:ENR) | €48.56 | €96.39 | 49.6% |

| SFA Semicon (KOSDAQ:A036540) | ₩2645.00 | ₩5243.07 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

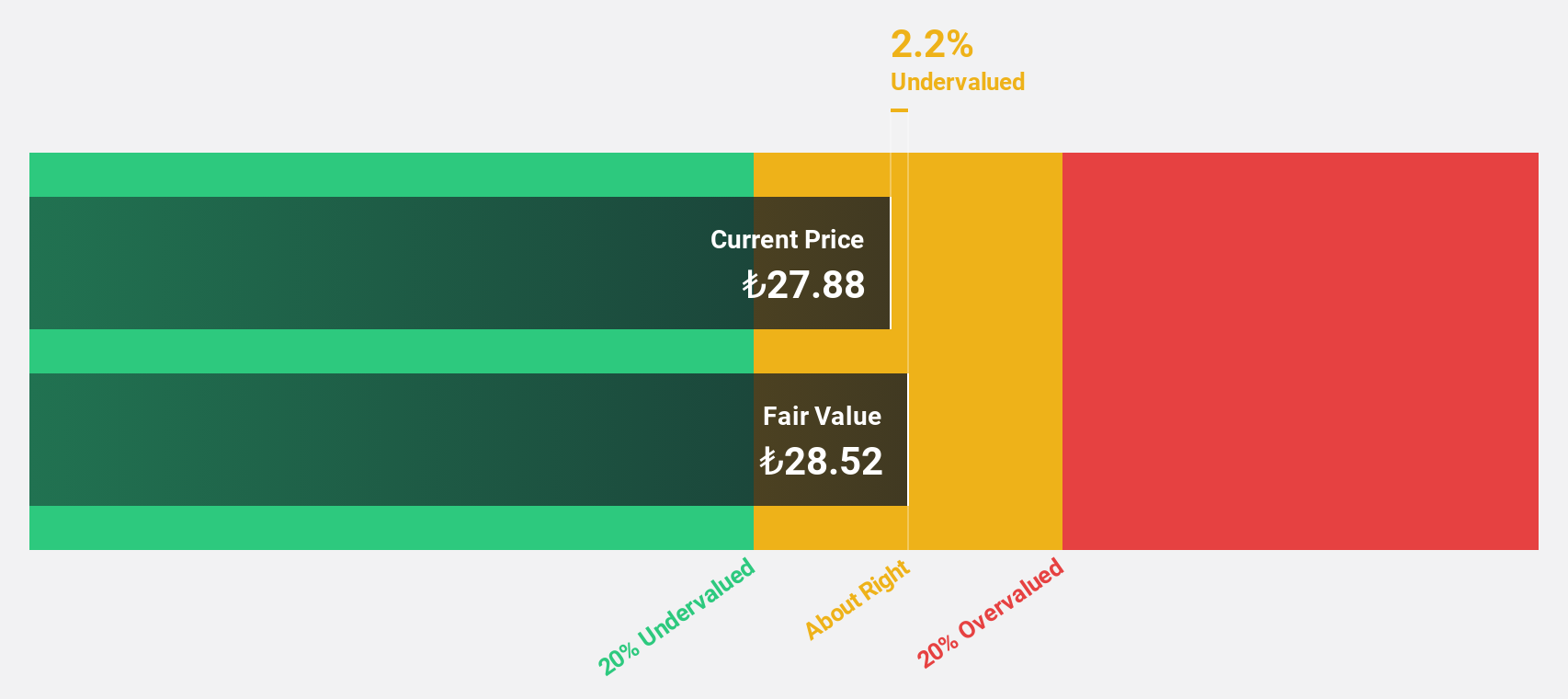

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers commercial banking and financial products and services both in Turkey and internationally, with a market cap of TRY206.95 billion.

Operations: The bank's revenue segments are comprised of Retail Banking (including Private Banking and Wealth Management) at TRY80.81 billion, Treasury, Asset Liability Management and Other at TRY55.16 billion, Commercial and SME Banking at TRY53.65 billion, Corporate Banking at TRY18.51 billion, Other Domestic Operations at TRY13.83 billion, and Other Foreign Operations at TRY5.21 billion.

Estimated Discount To Fair Value: 23.9%

Yapi ve Kredi Bankasi is trading at TRY24.5, which is 23.9% below its estimated fair value of TRY32.18, indicating it may be undervalued based on cash flows. Despite a high level of non-performing loans (3%), the bank's revenue and earnings are forecast to grow significantly over the next three years, with revenue expected to rise by 36.8% annually. However, profit margins have declined from last year’s levels, and net income has decreased compared to the previous year.

- The analysis detailed in our Yapi ve Kredi Bankasi growth report hints at robust future financial performance.

- Get an in-depth perspective on Yapi ve Kredi Bankasi's balance sheet by reading our health report here.

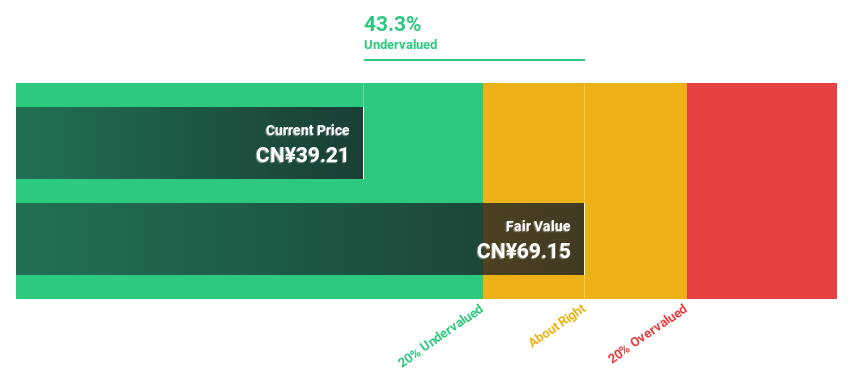

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market capitalization of CN¥6.54 billion.

Operations: The company's revenue from the E-Commerce Service Industry segment is CN¥1.69 billion.

Estimated Discount To Fair Value: 34.1%

Guangzhou Ruoyuchen Technology Ltd. is trading at CN¥44.64, 34.1% below its estimated fair value of CN¥67.75, highlighting potential undervaluation based on cash flows. The company has engaged in a share buyback program, repurchasing shares for CN¥10.95 million recently, which could enhance shareholder value if approved for capital reduction. Despite high share price volatility and a forecasted low return on equity (13%), earnings are expected to grow significantly by 37.5% annually over the next three years, outpacing the Chinese market growth rate.

- Our growth report here indicates Guangzhou Ruoyuchen TechnologyLtd may be poised for an improving outlook.

- Dive into the specifics of Guangzhou Ruoyuchen TechnologyLtd here with our thorough financial health report.

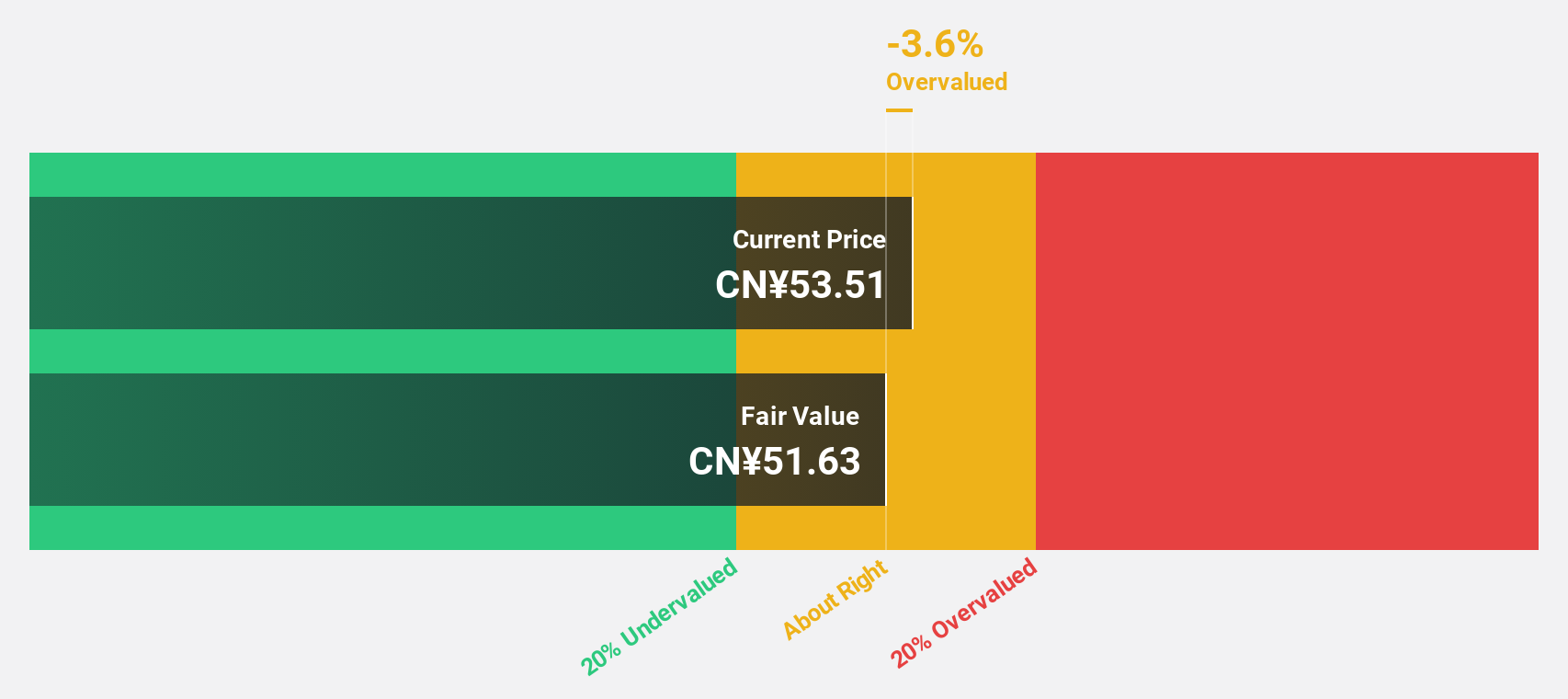

Ligao FoodsLtd (SZSE:300973)

Overview: Ligao Foods Co., Ltd. operates in China, focusing on the research and development, production, and sale of baked food raw materials and frozen baked foods, with a market cap of CN¥6.77 billion.

Operations: The company generates revenue primarily through its activities in the research, development, production, and sale of baked food raw materials and frozen baked foods within China.

Estimated Discount To Fair Value: 38.5%

Ligao Foods Ltd. is trading at CN¥43.24, significantly below its estimated fair value of CN¥70.26, suggesting undervaluation based on cash flows. The company recently completed a share buyback, repurchasing 2,702,077 shares for CNY 93.84 million, potentially enhancing shareholder value. Despite lower profit margins and a modest dividend yield of 0.93% not well covered by earnings or free cash flows, earnings are forecast to grow significantly at 36.2% annually over the next three years.

- Our earnings growth report unveils the potential for significant increases in Ligao FoodsLtd's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Ligao FoodsLtd.

Turning Ideas Into Actions

- Access the full spectrum of 487 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YKBNK

Yapi ve Kredi Bankasi

Provides commercial banking and financial products and services in Turkey and internationally.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives