- China

- /

- Construction

- /

- SZSE:002941

New Huadu Technology And 2 Other Undiscovered Gems With Solid Potential

Reviewed by Simply Wall St

In the current global market landscape, U.S. stock indexes are nearing record highs with growth stocks leading the charge, while small-cap stocks have been trailing larger indices like the S&P 500. Amidst this environment of heightened inflation and cautious monetary policy, investors may find opportunities in smaller companies that possess strong fundamentals and potential for growth. Identifying such "undiscovered gems" involves looking for firms with solid business models and resilience to navigate economic uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

New Huadu Technology (SZSE:002264)

Simply Wall St Value Rating: ★★★★★★

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of CN¥4.90 billion.

Operations: New Huadu Technology's primary revenue stream is derived from its Internet marketing operations in China. The company has a market capitalization of CN¥4.90 billion.

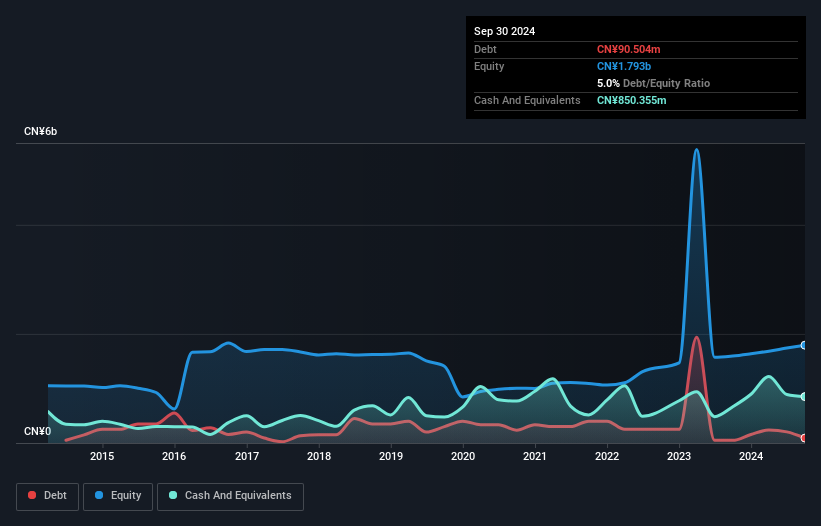

New Huadu Technology, a promising player in the market, has shown impressive growth with earnings surging by 116% over the past year, outpacing the Consumer Retailing industry. The company's price-to-earnings ratio stands at 21.1x, which is favorable compared to the broader CN market's 36.6x. Over five years, it reduced its debt to equity from 21% to just 5%, suggesting prudent financial management. Additionally, New Huadu is free cash flow positive and holds more cash than total debt. A recent shareholders meeting discussed optimizing project funding and supplementing working capital with surplus funds for strategic flexibility moving forward.

Xinjiang Communications Construction Group (SZSE:002941)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xinjiang Communications Construction Group Co., Ltd. operates in the construction industry, focusing on infrastructure projects, with a market cap of CN¥76.50 billion.

Operations: The company generates revenue primarily from infrastructure construction projects. With a market cap of CN¥76.50 billion, the financial performance is influenced by its project execution and cost management strategies.

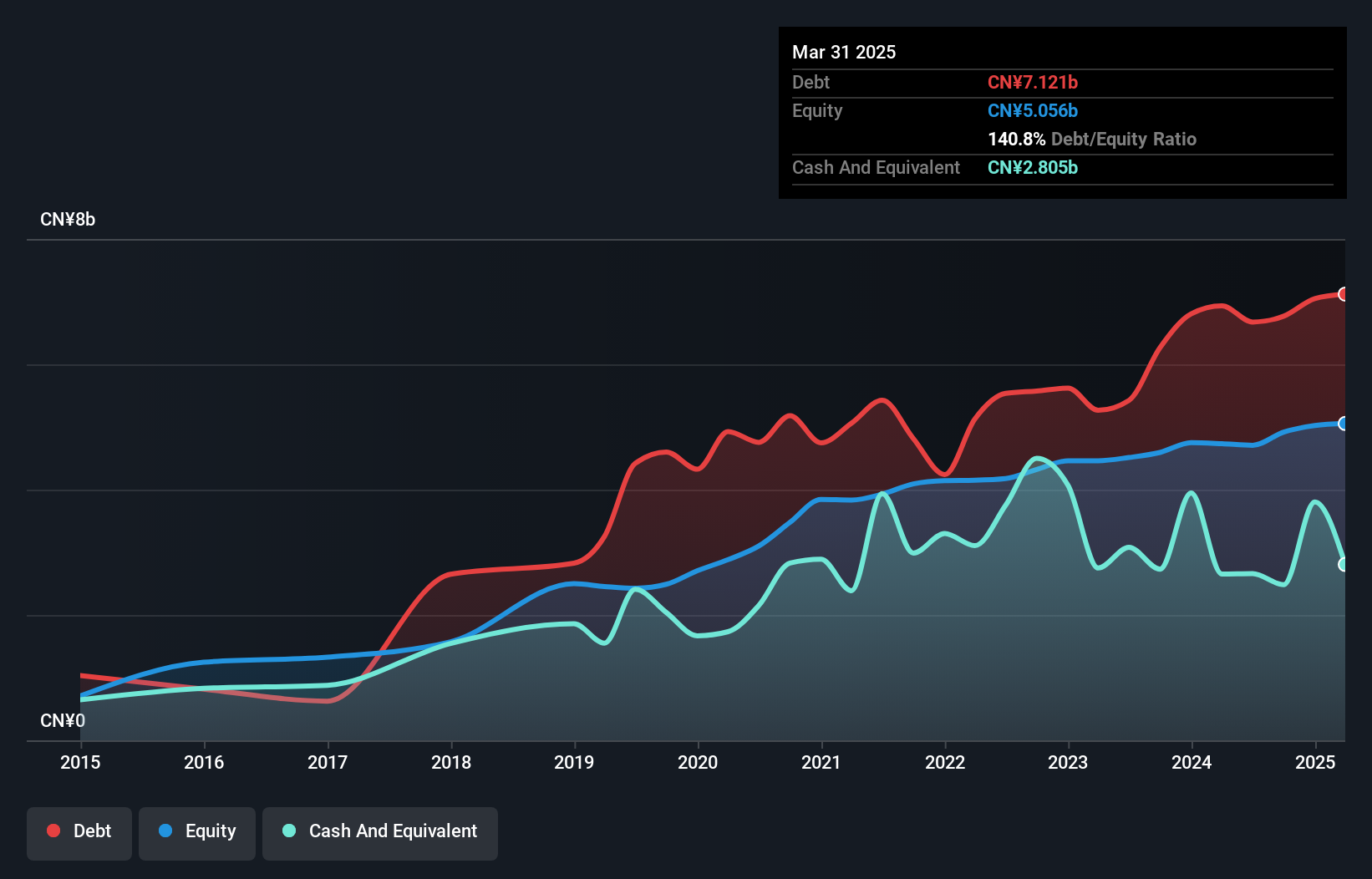

Xinjiang Communications Construction Group, an intriguing player in the construction sector, showcases a mixed financial landscape. The company’s net debt to equity ratio of 87.1% is notably high but has improved from 184.8% over five years, indicating some progress in managing leverage. Its price-to-earnings ratio of 25.5x suggests it might be undervalued compared to the broader CN market at 36.6x, offering potential value for investors seeking opportunities in smaller companies. Despite having high-quality past earnings and EBIT covering interest payments by 9.7 times, negative earnings growth of -12.8% against an industry average of -3.9% raises concerns about its current performance trajectory.

Itoki (TSE:7972)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Itoki Corporation is involved in the manufacturing and sale of office furniture both in Japan and internationally, with a market capitalization of approximately ¥86.55 billion.

Operations: Itoki generates revenue primarily through the manufacturing and sale of office furniture. The company has a market capitalization of approximately ¥86.55 billion.

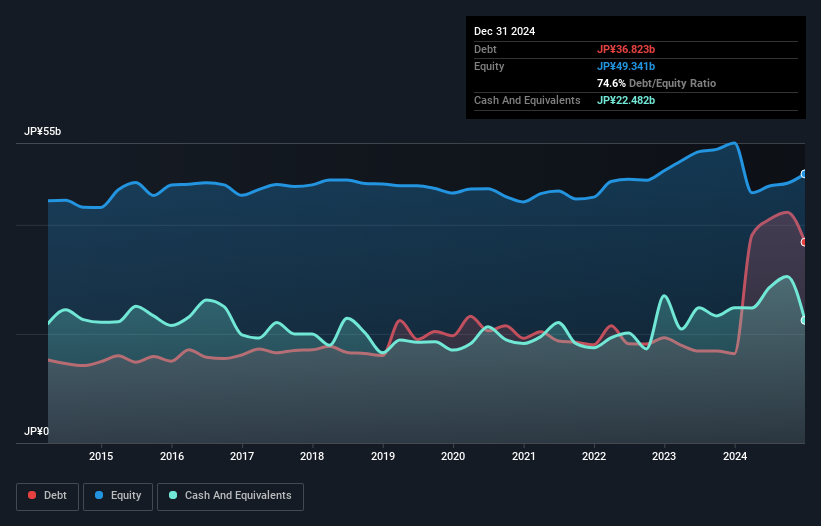

Itoki, a relatively small player in its industry, seems to be trading at an attractive 56.8% below its estimated fair value. Over the past year, earnings have grown by 21.6%, outpacing the broader Commercial Services sector's growth of 11.1%. Despite this positive momentum, Itoki's debt to equity ratio has risen from 42.9% to 74.6% over five years, which could signal some financial strain or strategic investments requiring leverage. However, with a net debt to equity ratio of 29.1%, it remains within satisfactory levels for investors concerned about debt management and interest coverage is robust at 60 times EBIT.

- Dive into the specifics of Itoki here with our thorough health report.

Explore historical data to track Itoki's performance over time in our Past section.

Next Steps

- Investigate our full lineup of 4714 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002941

Xinjiang Communications Construction Group

Xinjiang Communications Construction Group Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)