- China

- /

- Semiconductors

- /

- SHSE:605358

3 Growth Companies With Insider Ownership Ranging From 16% To 26%

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by tariff uncertainties and mixed economic signals, investors are keenly observing companies with robust earnings and insider confidence. In such a climate, growth companies with significant insider ownership can be particularly appealing, as this often indicates strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Fawaz Abdulaziz Al Hokair (SASE:4240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fawaz Abdulaziz Al Hokair & Company is a franchise retailer of fashion products operating in several countries including Saudi Arabia, Jordan, and the United States, with a market cap of SAR1.90 billion.

Operations: The company's revenue is primarily derived from Fashion Retail, generating SAR4.77 billion, followed by the F&B segment at SAR341.57 million and Indoor Entertainment contributing SAR68.91 million.

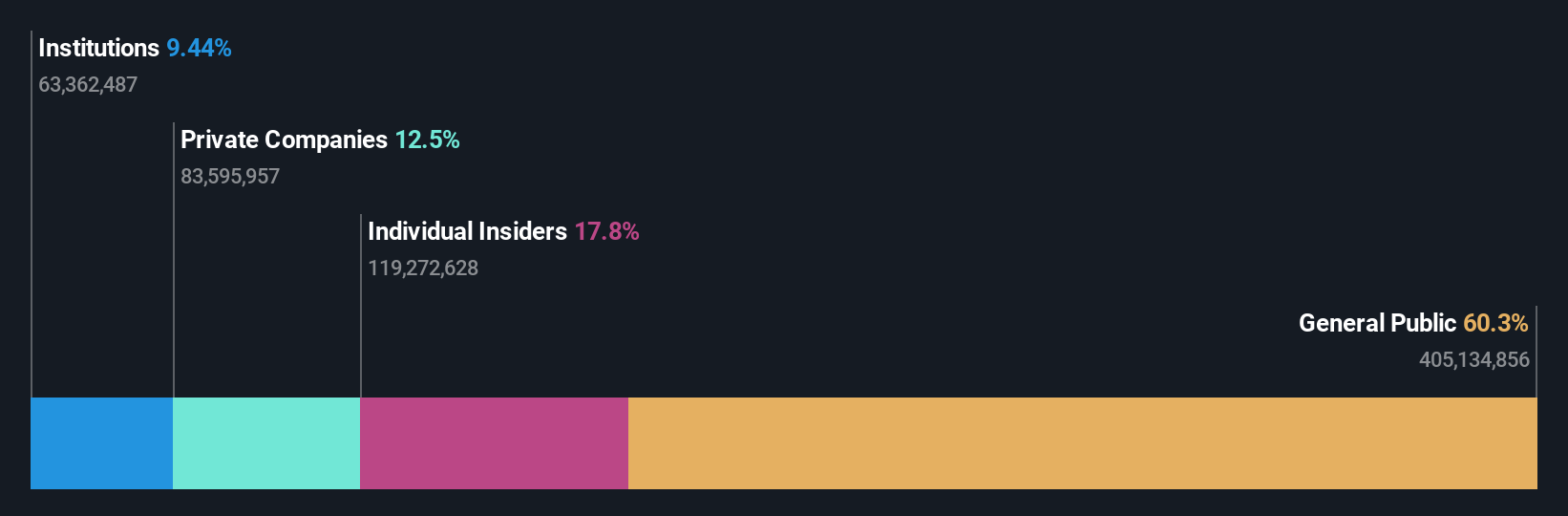

Insider Ownership: 16.1%

Fawaz Abdulaziz Al Hokair is forecast to achieve significant earnings growth of 115.98% annually, despite its high debt levels and volatile share price. While the company's revenue growth of 0.9% per year outpaces the broader Saudi Arabian market's decline, it remains below high-growth thresholds. The firm is expected to become profitable within three years, presenting a good relative value compared to peers, though insider trading activity has been minimal recently.

- Navigate through the intricacies of Fawaz Abdulaziz Al Hokair with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Fawaz Abdulaziz Al Hokair shares in the market.

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

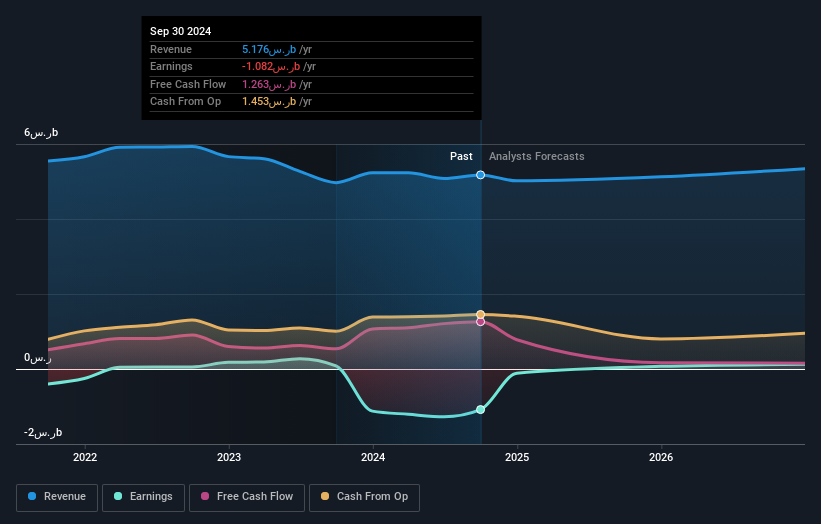

Overview: Hangzhou Lion Electronics Co., Ltd focuses on the R&D, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips in China with a market cap of CN¥16.99 billion.

Operations: The company generates revenue from semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips in China.

Insider Ownership: 17.8%

Hangzhou Lion Electronics Ltd. is projected to achieve substantial revenue growth of 23.7% annually, outpacing the Chinese market's average. Despite a low forecasted return on equity of 5.2% in three years and debt concerns not well covered by operating cash flow, the company is expected to become profitable within this period, indicating above-average market growth potential. Insider trading activity has been minimal recently, with no significant buying or selling reported over the past three months.

- Unlock comprehensive insights into our analysis of Hangzhou Lion ElectronicsLtd stock in this growth report.

- The valuation report we've compiled suggests that Hangzhou Lion ElectronicsLtd's current price could be inflated.

New Huadu Technology (SZSE:002264)

Simply Wall St Growth Rating: ★★★★★☆

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China and has a market capitalization of CN¥4.61 billion.

Operations: Unfortunately, the provided text does not include any specific revenue segment information for New Huadu Technology Co., Ltd.

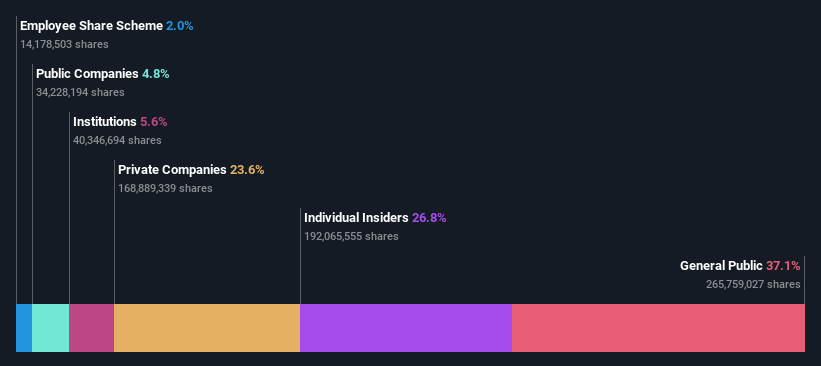

Insider Ownership: 26.8%

New Huadu Technology is projected to achieve significant earnings growth of 27.1% annually, outpacing the Chinese market average. The company trades at a favorable price-to-earnings ratio of 20.3x, below the market's 37.1x, indicating good relative value despite its low forecasted return on equity of 19.8%. Recent developments include a shareholders meeting to discuss reallocating surplus funds and supplementing working capital, with no substantial insider trading activity reported in the past three months.

- Dive into the specifics of New Huadu Technology here with our thorough growth forecast report.

- The valuation report we've compiled suggests that New Huadu Technology's current price could be quite moderate.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1448 more companies for you to explore.Click here to unveil our expertly curated list of 1451 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Lion ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605358

Hangzhou Lion ElectronicsLtd

Engages in the research and development, production, and sale of semiconductor silicon wafers and power devices, and compound semiconductor radio frequency chips in China.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives