- China

- /

- Metals and Mining

- /

- SHSE:600361

Concerns Surrounding Innovation New Material Technology's (SHSE:600361) Performance

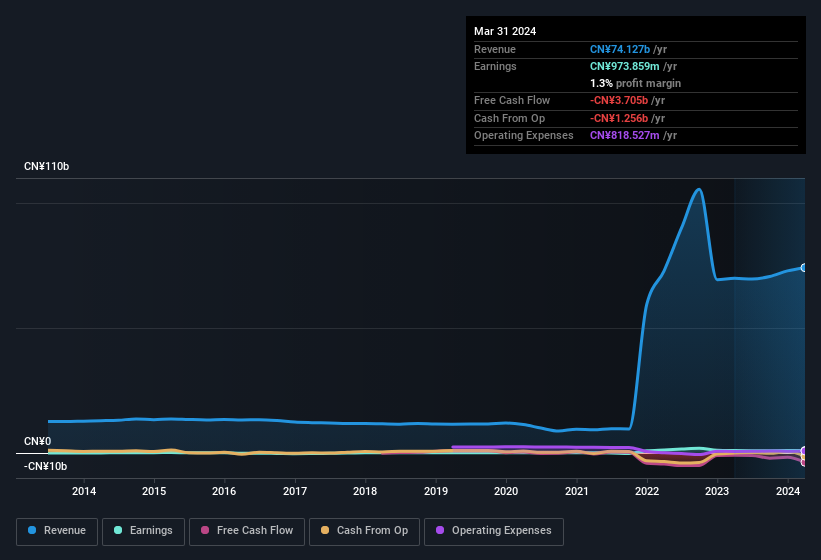

Innovation New Material Technology Co., Ltd. (SHSE:600361) just released a solid earnings report, and the stock displayed some strength. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

Check out our latest analysis for Innovation New Material Technology

Examining Cashflow Against Innovation New Material Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Innovation New Material Technology has an accrual ratio of 0.34 for the year to March 2024. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥3.7b despite its profit of CN¥973.9m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥3.7b, this year, indicates high risk. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Innovation New Material Technology increased the number of shares on issue by 8.3% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Innovation New Material Technology's historical EPS growth by clicking on this link.

How Is Dilution Impacting Innovation New Material Technology's Earnings Per Share (EPS)?

Innovation New Material Technology has improved its profit over the last three years, with an annualized gain of 1,243% in that time. But EPS was only up 124% per year, in the exact same period. However, net income was pretty flat over the last year with a miniscule increase. While EPS growth was also pretty flat, but no prizes for guessing that it looked worse than the net income. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Innovation New Material Technology shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Innovation New Material Technology's Profit Performance

As it turns out, Innovation New Material Technology couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. For the reasons mentioned above, we think that a perfunctory glance at Innovation New Material Technology's statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into Innovation New Material Technology, you'd also look into what risks it is currently facing. Our analysis shows 4 warning signs for Innovation New Material Technology (2 make us uncomfortable!) and we strongly recommend you look at them before investing.

Our examination of Innovation New Material Technology has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600361

Innovation New Material Technology

Innovation New Material Technology Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives