- China

- /

- Consumer Durables

- /

- SZSE:301260

Greenworks (Jiangsu) Co., Ltd.'s (SZSE:301260) Shares Leap 29% Yet They're Still Not Telling The Full Story

Greenworks (Jiangsu) Co., Ltd. (SZSE:301260) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 62% share price drop in the last twelve months.

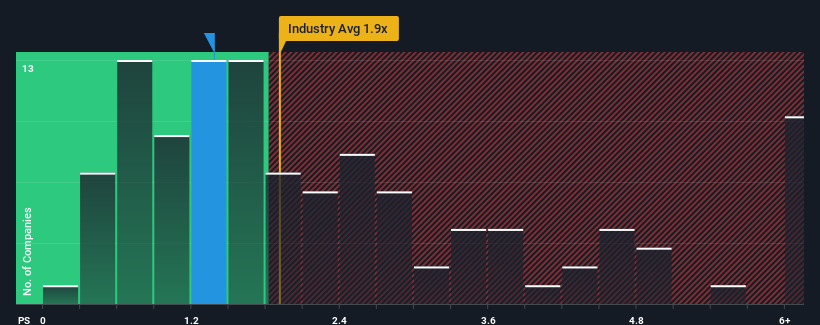

Although its price has surged higher, Greenworks (Jiangsu) may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Consumer Durables industry in China have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Greenworks (Jiangsu)

What Does Greenworks (Jiangsu)'s P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Greenworks (Jiangsu)'s revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Greenworks (Jiangsu) will help you uncover what's on the horizon.How Is Greenworks (Jiangsu)'s Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Greenworks (Jiangsu)'s to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Greenworks (Jiangsu)'s P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Greenworks (Jiangsu)'s P/S?

Greenworks (Jiangsu)'s stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Greenworks (Jiangsu)'s analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Greenworks (Jiangsu) with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301260

Greenworks (Jiangsu)

Engages in the research and development, design, production, and sale of garden machinery.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives