Global Value Stocks That May Be Trading Below Estimates In April 2025

Reviewed by Simply Wall St

Amid heightened global trade tensions and significant stock market declines triggered by unexpected tariff announcements, investors are navigating an environment marked by uncertainty and volatility. As markets react to these developments, identifying undervalued stocks that may be trading below their intrinsic value can present opportunities for those looking to capitalize on potential mispricings in the current climate.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥150.00 | CN¥295.09 | 49.2% |

| Alexander Marine (TWSE:8478) | NT$140.00 | NT$276.52 | 49.4% |

| RACCOON HOLDINGS (TSE:3031) | ¥850.00 | ¥1696.44 | 49.9% |

| Mips (OM:MIPS) | SEK345.60 | SEK679.81 | 49.2% |

| People & Technology (KOSDAQ:A137400) | ₩38600.00 | ₩76669.43 | 49.7% |

| Gentili Mosconi (BIT:GM) | €2.53 | €5.01 | 49.5% |

| Etteplan Oyj (HLSE:ETTE) | €11.35 | €22.66 | 49.9% |

| BIKE O (TSE:3377) | ¥362.00 | ¥720.40 | 49.8% |

| Komplett (OB:KOMPL) | NOK11.45 | NOK22.45 | 49% |

| Bactiguard Holding (OM:BACTI B) | SEK34.00 | SEK67.43 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

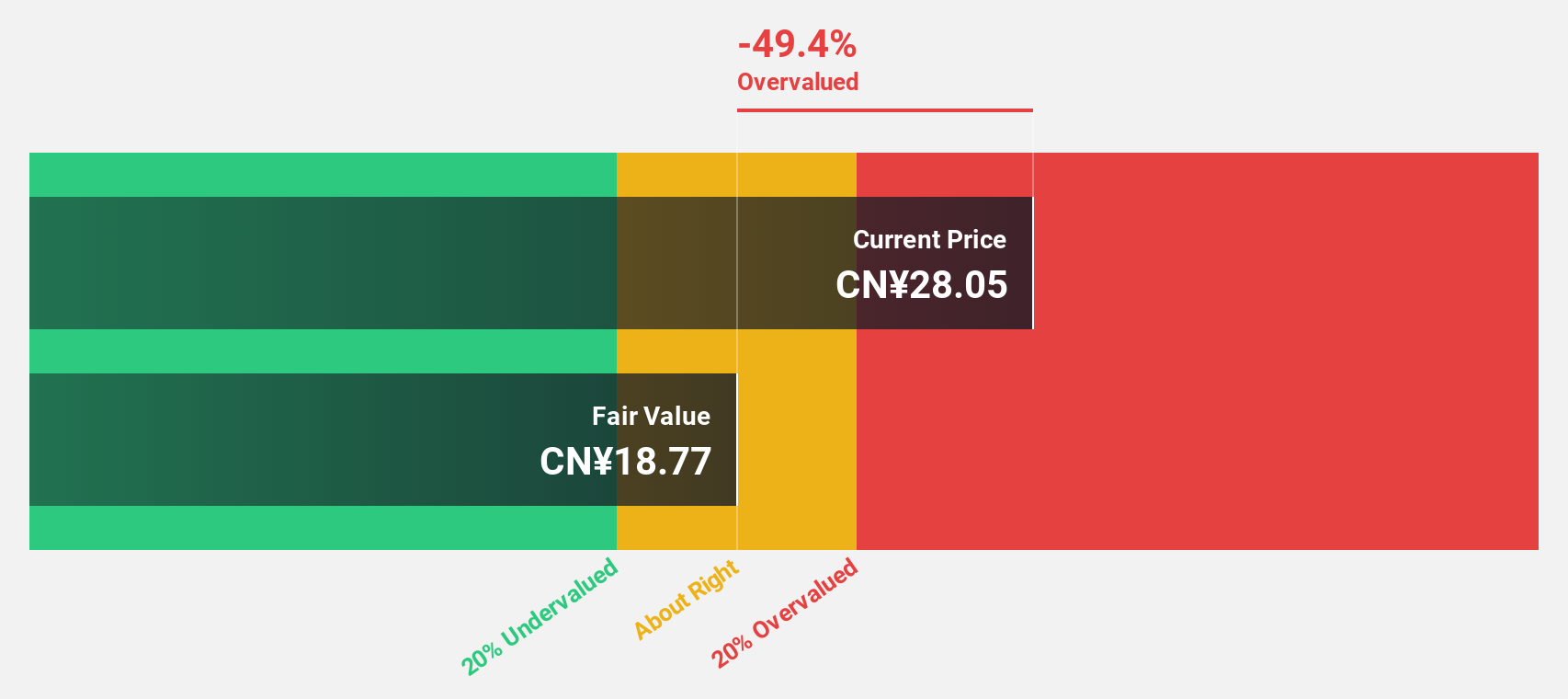

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical sector, with a market capitalization of CN¥6.06 billion.

Operations: I'm sorry, but there are no revenue segment details provided in the text you shared. If you have more information or specific figures for the revenue segments, please provide them so I can assist you further.

Estimated Discount To Fair Value: 26.7%

Suzhou Alton Electrical & Mechanical Industry is trading at CN¥33.53, below its fair value estimate of CN¥45.75, making it undervalued based on discounted cash flow analysis. Despite earnings growth of 54.9% last year and expected annual revenue growth of 25.4%, the dividend yield of 2.98% isn't well covered by earnings or free cash flows, and share price volatility remains high over recent months. Recent events include a special dividend announcement and shareholder meetings focused on capital allocation strategies.

- Insights from our recent growth report point to a promising forecast for Suzhou Alton Electrical & Mechanical Industry's business outlook.

- Take a closer look at Suzhou Alton Electrical & Mechanical Industry's balance sheet health here in our report.

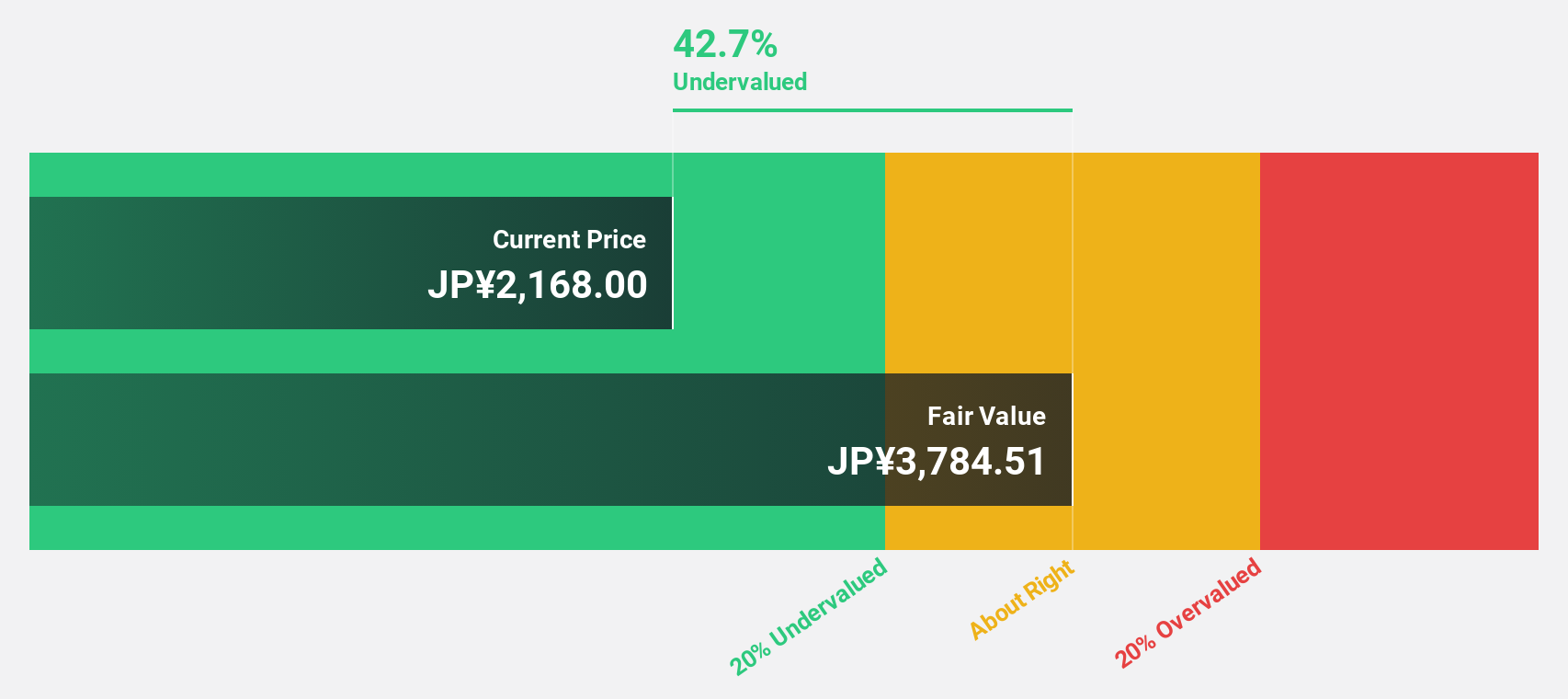

Plus Alpha ConsultingLtd (TSE:4071)

Overview: Plus Alpha Consulting Ltd (TSE:4071) is a company that offers marketing solutions and has a market capitalization of ¥56.26 billion.

Operations: The company generates revenue primarily from HR Solutions, which accounts for ¥10.92 billion, and Marketing Solutions, contributing ¥3.82 billion.

Estimated Discount To Fair Value: 18.4%

Plus Alpha Consulting Ltd. is trading at ¥1,380, below its fair value estimate of ¥1,691.8. This undervaluation is based on discounted cash flow analysis. The company has recently completed a share buyback program worth approximately ¥3 billion, enhancing shareholder value. Earnings have grown 22.6% annually over the past five years and are forecast to grow 18.1% per year, outpacing the Japanese market's average growth rate of 7.8%. However, its share price has been highly volatile recently.

- Upon reviewing our latest growth report, Plus Alpha ConsultingLtd's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Plus Alpha ConsultingLtd's balance sheet health report.

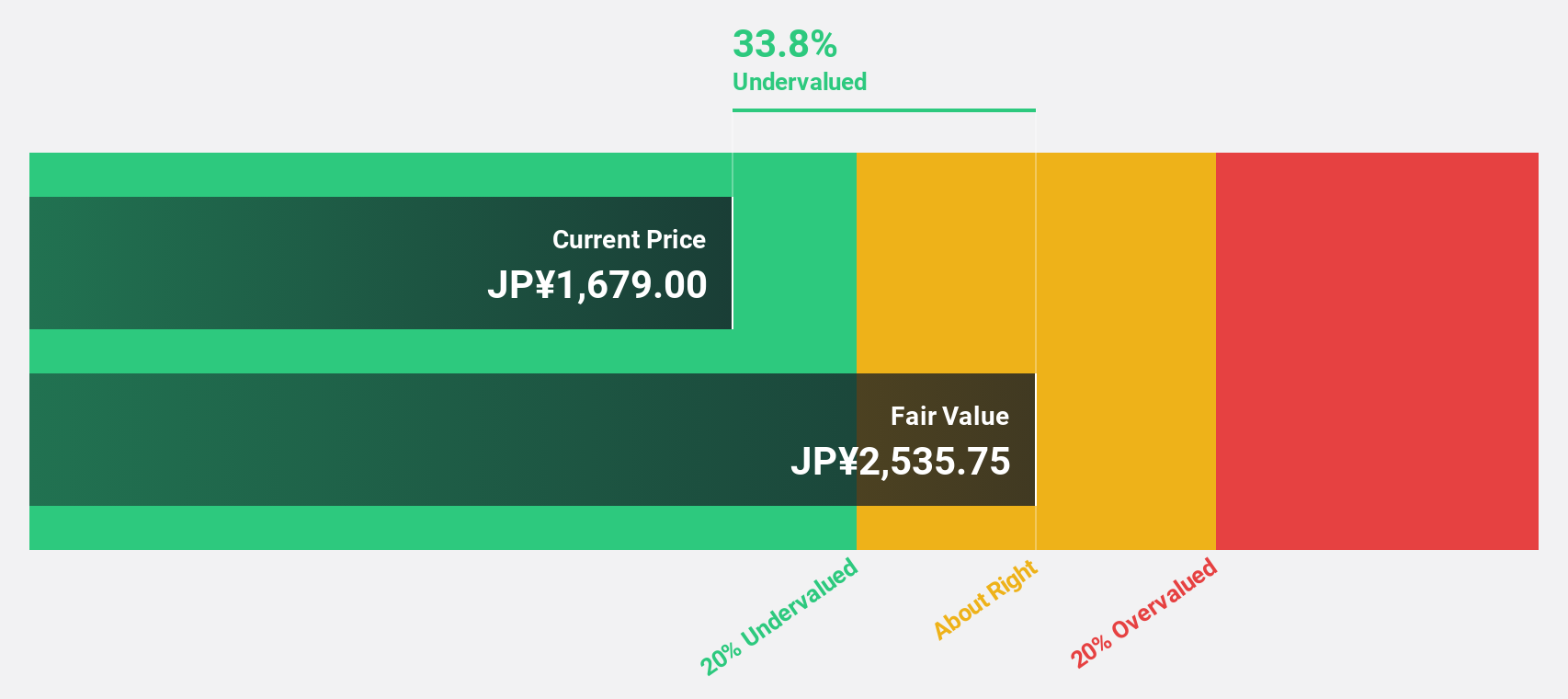

Relo Group (TSE:8876)

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥272.19 billion.

Operations: The company's revenue segments include the Relocation Business at ¥99.73 billion, Fringe Benefit Business at ¥27.13 billion, and Tourism Business at ¥15.66 billion.

Estimated Discount To Fair Value: 31.3%

Relo Group is trading at ¥1,818.5, significantly below its estimated fair value of ¥2,646.71 according to discounted cash flow analysis. Analysts agree the stock could rise by 25.7%. The company forecasts revenue of ¥140 billion and operating profit of ¥30 billion for fiscal year ending March 2024. Despite a dividend yield of 2.09% not well covered by earnings, Relo is expected to achieve profitability within three years with robust revenue growth surpassing the Japanese market average.

- In light of our recent growth report, it seems possible that Relo Group's financial performance will exceed current levels.

- Get an in-depth perspective on Relo Group's balance sheet by reading our health report here.

Where To Now?

- Explore the 479 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4071

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives