- China

- /

- Consumer Durables

- /

- SZSE:301055

There's Reason For Concern Over Zhang Xiaoquan Inc.'s (SZSE:301055) Massive 30% Price Jump

Zhang Xiaoquan Inc. (SZSE:301055) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

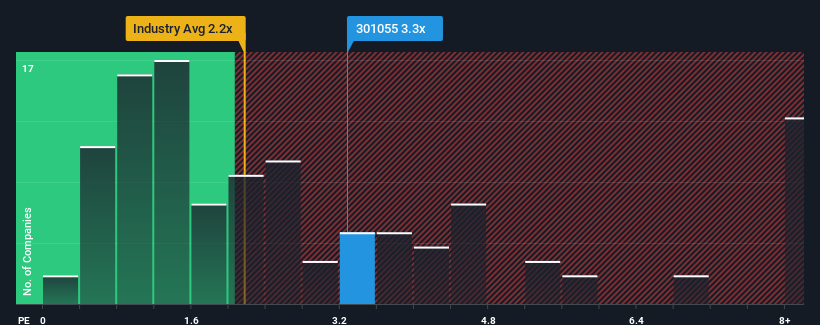

After such a large jump in price, you could be forgiven for thinking Zhang Xiaoquan is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in China's Consumer Durables industry have P/S ratios below 2.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Zhang Xiaoquan

What Does Zhang Xiaoquan's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Zhang Xiaoquan has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Zhang Xiaoquan's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Zhang Xiaoquan would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. As a result, it also grew revenue by 26% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is not materially different.

With this information, we find it interesting that Zhang Xiaoquan is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Zhang Xiaoquan's P/S?

Zhang Xiaoquan shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Zhang Xiaoquan's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It is also worth noting that we have found 2 warning signs for Zhang Xiaoquan that you need to take into consideration.

If you're unsure about the strength of Zhang Xiaoquan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhang Xiaoquan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301055

Zhang Xiaoquan

Engages in the design, research, development, production, sale, and servicing of household kitchen supplies, personal care supplies, garden and agricultural products, hotel kitchenware supplies, and other products to consumers in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026