GuangZhou Wahlap Technology Corporation Limited (SZSE:301011) Stocks Shoot Up 34% But Its P/S Still Looks Reasonable

Those holding GuangZhou Wahlap Technology Corporation Limited (SZSE:301011) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

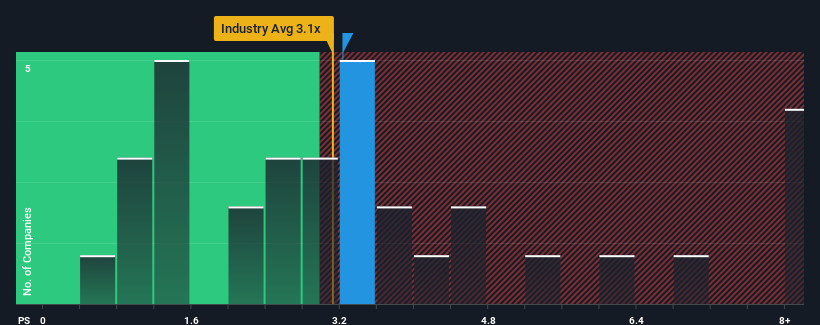

Although its price has surged higher, there still wouldn't be many who think GuangZhou Wahlap Technology's price-to-sales (or "P/S") ratio of 3.2x is worth a mention when the median P/S in China's Leisure industry is similar at about 3.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for GuangZhou Wahlap Technology

What Does GuangZhou Wahlap Technology's P/S Mean For Shareholders?

The recent revenue growth at GuangZhou Wahlap Technology would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on GuangZhou Wahlap Technology's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GuangZhou Wahlap Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.0%. This was backed up an excellent period prior to see revenue up by 73% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why GuangZhou Wahlap Technology's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

GuangZhou Wahlap Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that GuangZhou Wahlap Technology maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with GuangZhou Wahlap Technology (including 1 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301011

GuangZhou Wahlap Technology

Engages in the research and development, manufacture, sale, and distribution of amusement games in China.

Flawless balance sheet second-rate dividend payer.