- China

- /

- Consumer Durables

- /

- SZSE:300885

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by accelerating inflation and near-record highs in major U.S. stock indexes, small-cap stocks have lagged behind their larger counterparts, presenting unique opportunities for discerning investors. In this context, identifying promising small-cap companies—those with robust fundamentals and potential for growth despite broader market volatility—can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Shenzhen Farben Information TechnologyLtd | 7.69% | 21.56% | 3.60% | ★★★★★★ |

| 3B Blackbio Dx | 0.31% | -9.96% | -9.16% | ★★★★★★ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

| Sanstar | 9.90% | 23.18% | 36.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

China Catalyst Holding (SHSE:688267)

Simply Wall St Value Rating: ★★★★★★

Overview: China Catalyst Holding Co., Ltd. focuses on the research, development, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both in China and internationally with a market cap of approximately CN¥4.27 billion.

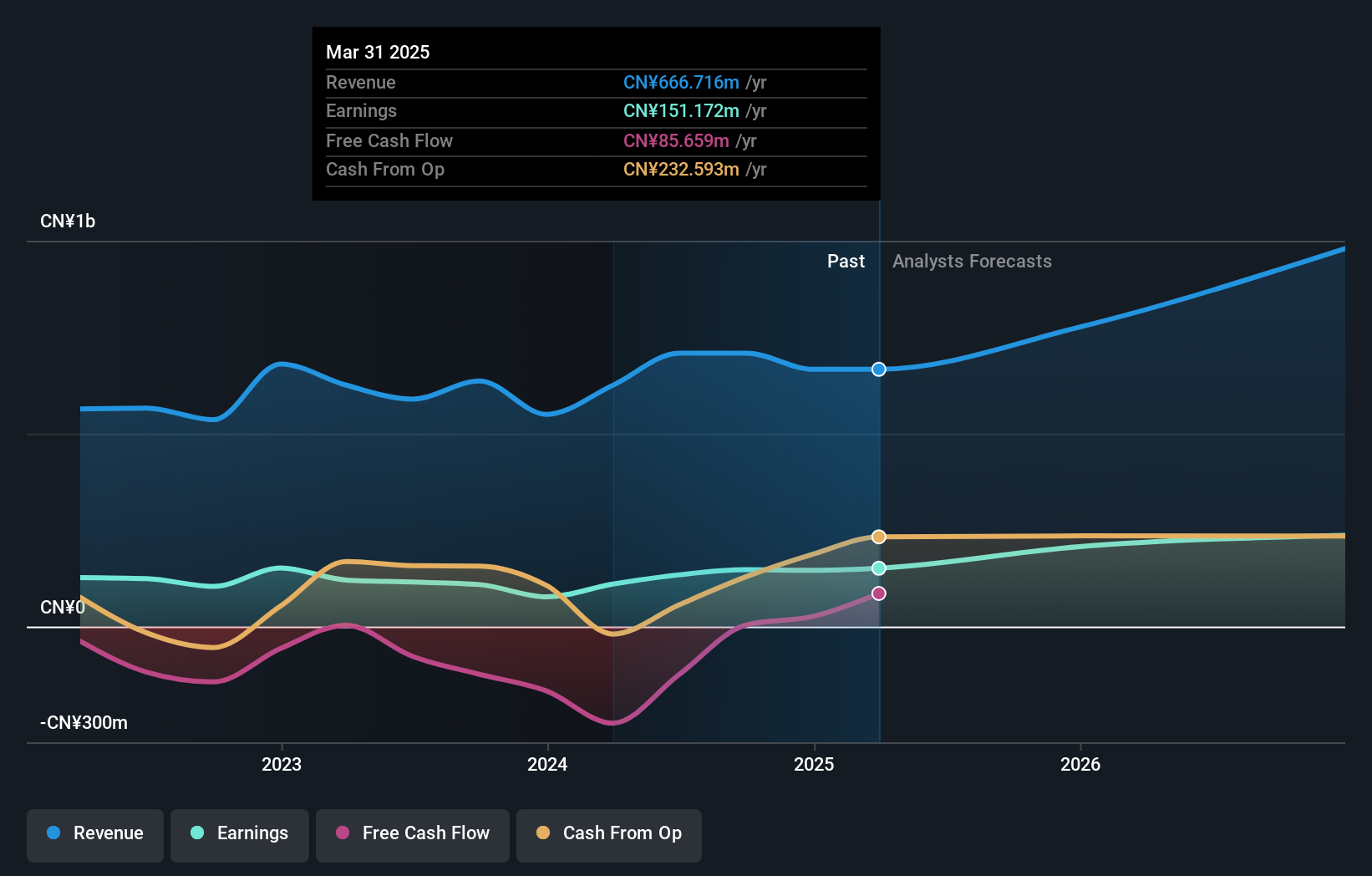

Operations: The primary revenue stream for China Catalyst Holding comes from its Chemical Reagent and Auxiliary Manufacturing segment, contributing CN¥708.63 million. The company's financial performance is highlighted by its gross profit margin, which reflects the efficiency in managing production costs relative to sales.

China Catalyst Holding, a compact player in the chemicals sector, showcases a promising profile with earnings growth of 35.5% over the past year, outpacing the industry average of -5.4%. Its debt-to-equity ratio impressively shrank from 24.9% to just 0.02% over five years, indicating strong financial management. With a price-to-earnings ratio at 29x below the CN market's 36.5x, it appears attractively valued for investors seeking opportunities in this space. The company is also forecasted to grow earnings by about 22.92% annually, suggesting potential for continued upward momentum in its financial performance.

- Click to explore a detailed breakdown of our findings in China Catalyst Holding's health report.

Assess China Catalyst Holding's past performance with our detailed historical performance reports.

Shenzhen Liande Automation Equipmentltd (SZSE:300545)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Liande Automation Equipment Co., Ltd. (SZSE:300545) specializes in the design and manufacturing of automation equipment, with a market cap of CN¥5.93 billion.

Operations: Liande Automation Equipment generates revenue primarily from the design and manufacturing of automation equipment. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of its operations in converting revenue into actual profit.

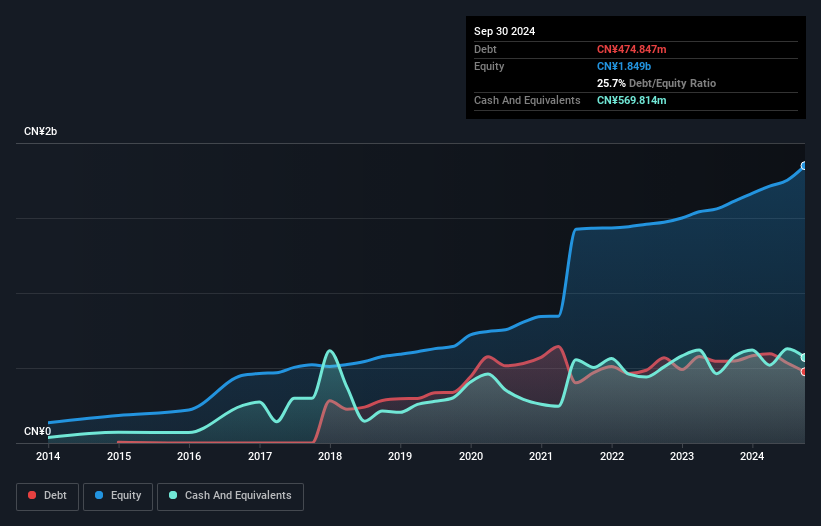

Shenzhen Liande Automation Equipment, a nimble player in the machinery sector, has shown impressive growth with earnings surging 56.6% over the past year, outpacing the industry average of -0.06%. Its price-to-earnings ratio stands at 24.3x, offering good value compared to the broader Chinese market's 36.5x. Financially robust, this company reduced its debt to equity from 52.5% to 25.6% over five years and holds more cash than total debt, ensuring interest payments are well-covered by EBIT at a healthy 37.5x multiple. Recent changes in business scope suggest potential strategic shifts on the horizon.

- Unlock comprehensive insights into our analysis of Shenzhen Liande Automation Equipmentltd stock in this health report.

Learn about Shenzhen Liande Automation Equipmentltd's historical performance.

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. focuses on the design, production, and marketing of powder metallurgy structural parts in China with a market cap of CN¥3.12 billion.

Operations: Yangzhou Seashine generates revenue primarily from the sale of powder metallurgy structural parts. The company reported a gross profit margin of 35.7%, indicating efficient cost management in production relative to its sales.

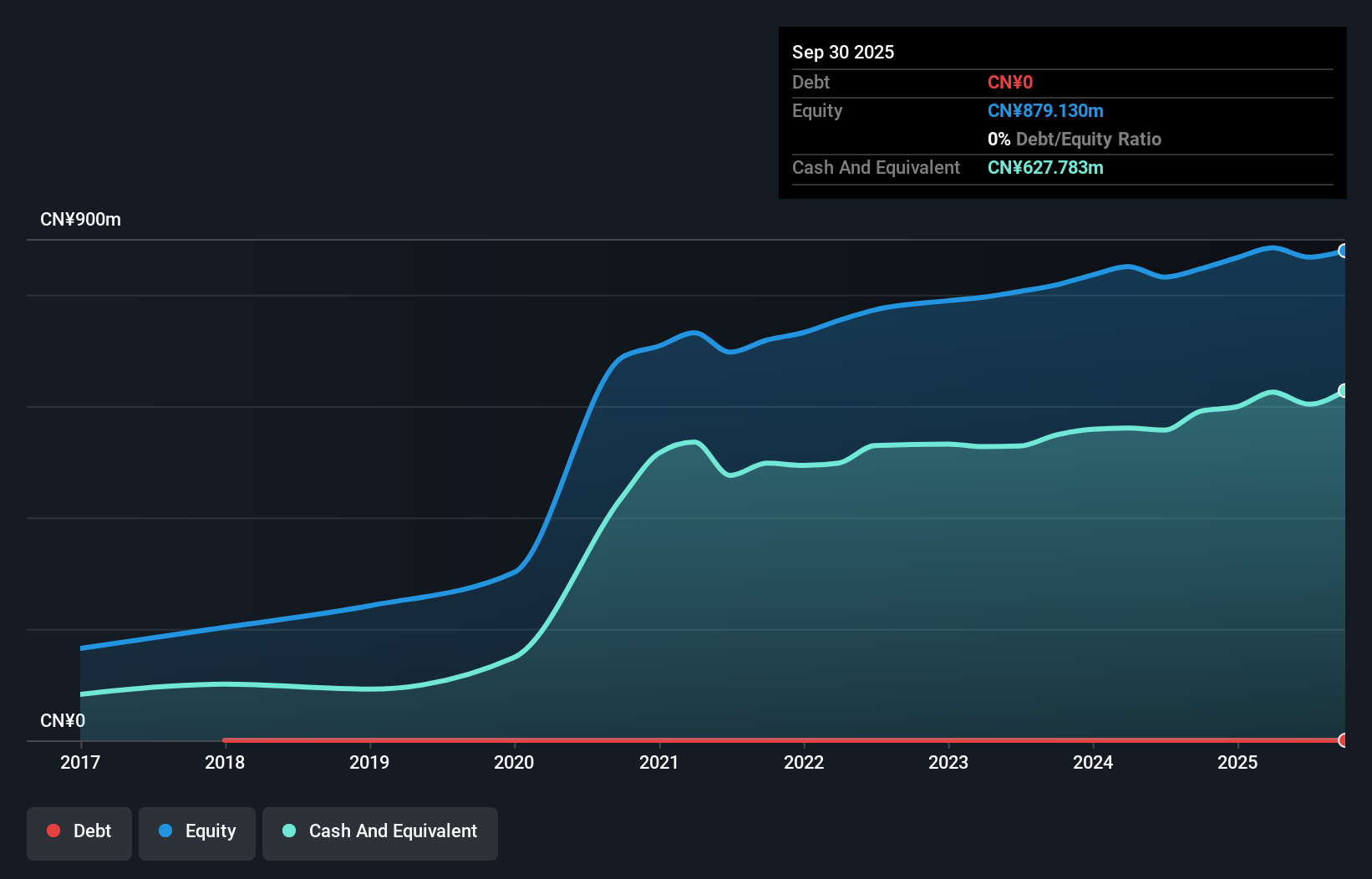

Yangzhou Seashine New Materials Ltd. showcases a robust financial profile with no debt over the past five years, which is quite impressive for a company in its sector. Earnings surged by 84% last year, outpacing the Consumer Durables industry, which saw a -1.9% change. The company has also repurchased 2,648,200 shares for CNY 20 million as part of its buyback initiative announced earlier in April 2024. Despite earnings declining by an average of 9% annually over five years, the recent growth and strategic share buybacks suggest potential for future value appreciation within this small-cap space.

Seize The Opportunity

- Access the full spectrum of 4745 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300885

Yangzhou Seashine New MaterialsLtd

Engages in the design, production, and marketing of various powder metallurgy structural parts in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives