- China

- /

- Consumer Durables

- /

- SZSE:300249

The 16% return this week takes Yimikang Tech.Group's (SZSE:300249) shareholders one-year gains to 169%

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Yimikang Tech.Group Co., Ltd. (SZSE:300249) share price had more than doubled in just one year - up 169%. On top of that, the share price is up 43% in about a quarter. It is also impressive that the stock is up 61% over three years, adding to the sense that it is a real winner.

The past week has proven to be lucrative for Yimikang Tech.Group investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Yimikang Tech.Group

Yimikang Tech.Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Yimikang Tech.Group grew its revenue by 36% last year. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 169% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

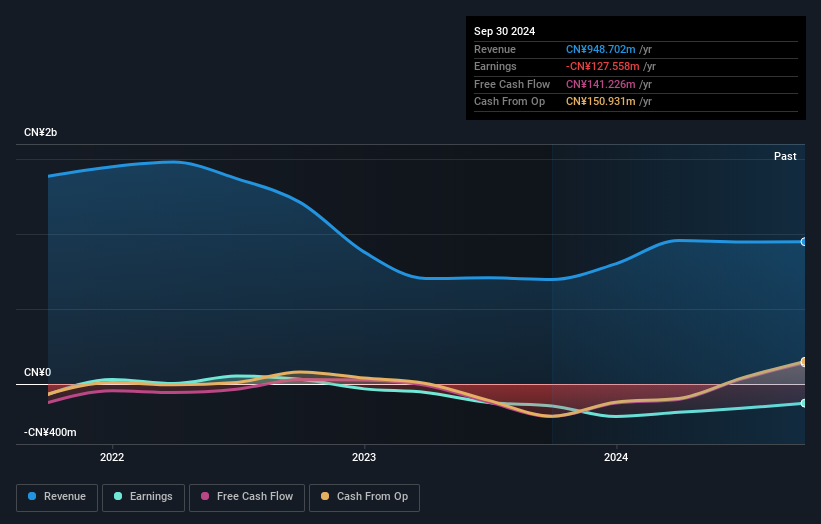

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Yimikang Tech.Group shareholders have received a total shareholder return of 169% over one year. That gain is better than the annual TSR over five years, which is 16%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Yimikang Tech.Group you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300249

Yimikang Tech.Group

Manufactures and sells precision air conditioning solutions in China.

Adequate balance sheet very low.

Market Insights

Community Narratives