Uncovering Opportunities: 3 Penny Stocks With Market Caps As Low As US$30M

Reviewed by Simply Wall St

Global markets have recently experienced volatility, with U.S. equities declining amid inflation concerns and political uncertainty, while small-cap stocks underperformed their larger counterparts. In such fluctuating conditions, investors often seek opportunities beyond the mainstream indices, where penny stocks—though considered a niche market—can offer intriguing prospects. These smaller or newer companies may present unique growth opportunities when supported by robust financials, making them appealing for those looking to uncover potential in less conventional investment areas.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £463.19M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.61 | £413.58M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.898 | £715.19M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.57 | HK$39.31B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Farmacosmo (BIT:COSMO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Farmacosmo S.p.A. operates as an online pharmacy and beauty store company in Italy with a market cap of €29.65 million.

Operations: Farmacosmo S.p.A. has not reported specific revenue segments.

Market Cap: €29.65M

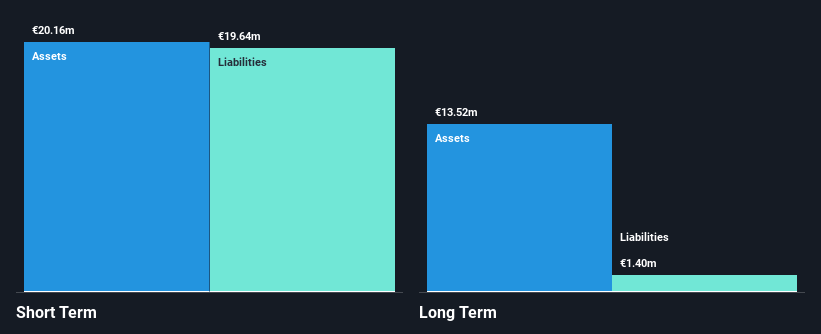

Farmacosmo S.p.A. is currently unprofitable, with a negative return on equity of -24.14%. Despite this, the company has a satisfactory net debt to equity ratio of 15.2% and sufficient cash runway for over three years if it maintains its current positive free cash flow level. The company's revenue is forecast to grow by 8.5% annually, yet its weekly volatility has increased significantly from 9% to 15% over the past year, indicating higher risk for investors. Farmacosmo's short-term assets exceed both its short and long-term liabilities, providing some financial stability amidst its challenges.

- Get an in-depth perspective on Farmacosmo's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Farmacosmo's future.

HL Corp (Shenzhen) (SZSE:002105)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HL Corp (Shenzhen) specializes in the R&D, manufacturing, and marketing of bicycle parts, sports and fitness equipment, and rehabilitation equipment in China with a market cap of CN¥1.76 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥1.76B

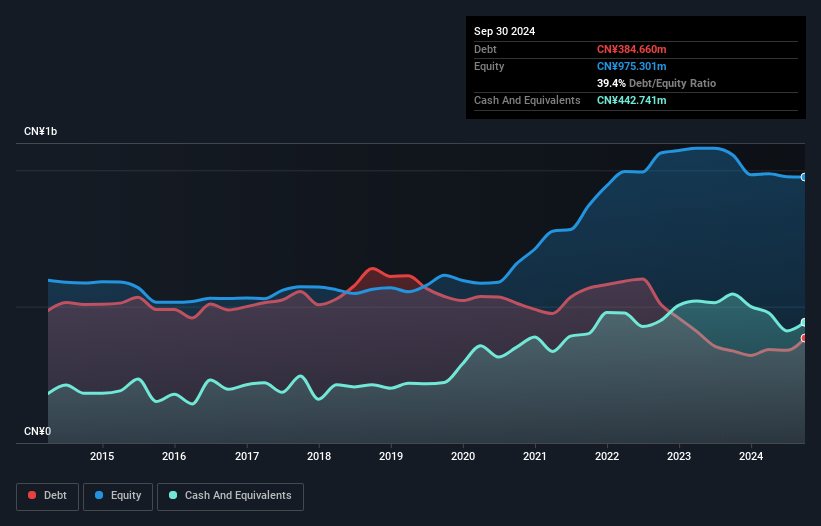

HL Corp (Shenzhen) has demonstrated stable asset management with short-term assets of CN¥1.0 billion exceeding both its short and long-term liabilities, indicating sound financial health. However, the company faces challenges with a low return on equity of -0.1% and declining profit margins, now at 0.04% compared to 2.1% last year. Despite a reduction in debt-to-equity ratio over five years, earnings have declined annually by 11.2%. The recent large one-off gain of CN¥22.3 million highlights volatility in earnings quality, while the dividend remains unsustainably covered by current profits or cash flows.

- Unlock comprehensive insights into our analysis of HL Corp (Shenzhen) stock in this financial health report.

- Learn about HL Corp (Shenzhen)'s historical performance here.

Zhenjiang Dongfang Electric Heating TechnologyLtd (SZSE:300217)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhenjiang Dongfang Electric Heating Technology Co., Ltd designs, manufactures, and sells various electric heaters in China with a market cap of CN¥6.30 billion.

Operations: Zhenjiang Dongfang Electric Heating Technology Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥6.3B

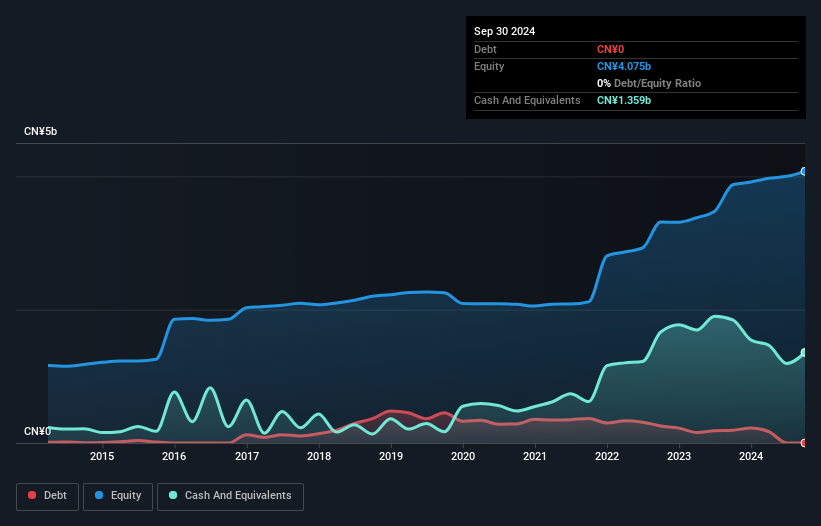

Zhenjiang Dongfang Electric Heating Technology Co., Ltd showcases financial resilience with short-term assets of CN¥5.2 billion comfortably covering both short and long-term liabilities, and the company operates without debt. Despite a competitive price-to-earnings ratio of 18.6x, recent performance has been mixed; earnings have decreased significantly over the past year with net income dropping to CN¥279.55 million from CN¥584.93 million previously, reflecting a challenging market environment for consumer durables. The management team is experienced, yet profit margins have contracted from 14.8% to 9.1%, posing potential concerns for future profitability growth amidst stable weekly volatility at 9%.

- Dive into the specifics of Zhenjiang Dongfang Electric Heating TechnologyLtd here with our thorough balance sheet health report.

- Explore Zhenjiang Dongfang Electric Heating TechnologyLtd's analyst forecasts in our growth report.

Seize The Opportunity

- Click here to access our complete index of 5,810 Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HL Corp (Shenzhen) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002105

HL Corp (Shenzhen)

HL CORP (Shenzhen) engages in the research and development, manufacture, and marketing of bicycle parts, sports and fitness equipment, and rehabilitation equipment in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives