- China

- /

- Consumer Durables

- /

- SZSE:002779

Zhejiang Zhongjian TechnologyLtd (SZSE:002779) shareholder returns have been enviable, earning 362% in 3 years

For us, stock picking is in large part the hunt for the truly magnificent stocks. But when you hold the right stock for the right time period, the rewards can be truly huge. Take, for example, the Zhejiang Zhongjian Technology Co.,Ltd (SZSE:002779) share price, which skyrocketed 358% over three years. Also pleasing for shareholders was the 137% gain in the last three months.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Zhejiang Zhongjian TechnologyLtd

We don't think that Zhejiang Zhongjian TechnologyLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Zhejiang Zhongjian TechnologyLtd saw its revenue grow at 16% per year. That's pretty nice growth. Arguably the very strong share price gain of 66% a year is very generous when compared to the revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

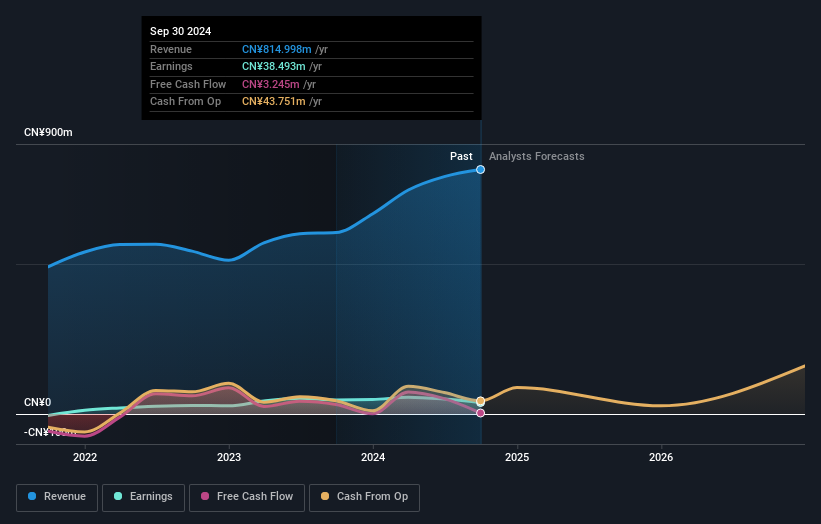

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Zhejiang Zhongjian TechnologyLtd has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Zhejiang Zhongjian TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Zhejiang Zhongjian TechnologyLtd's TSR for the last 3 years was 362%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Zhejiang Zhongjian TechnologyLtd has rewarded shareholders with a total shareholder return of 254% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 35% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Zhejiang Zhongjian TechnologyLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongjian TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002779

Zhejiang Zhongjian TechnologyLtd

Engages in the research and development, production, and sale of various garden machinery products in China and internationally.

Flawless balance sheet with questionable track record.