- China

- /

- Consumer Durables

- /

- SZSE:002508

Hangzhou Robam Appliances (SZSE:002508) investors are sitting on a loss of 32% if they invested three years ago

Hangzhou Robam Appliances Co., Ltd. (SZSE:002508) shareholders should be happy to see the share price up 13% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 39% in the last three years, significantly under-performing the market.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Hangzhou Robam Appliances

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

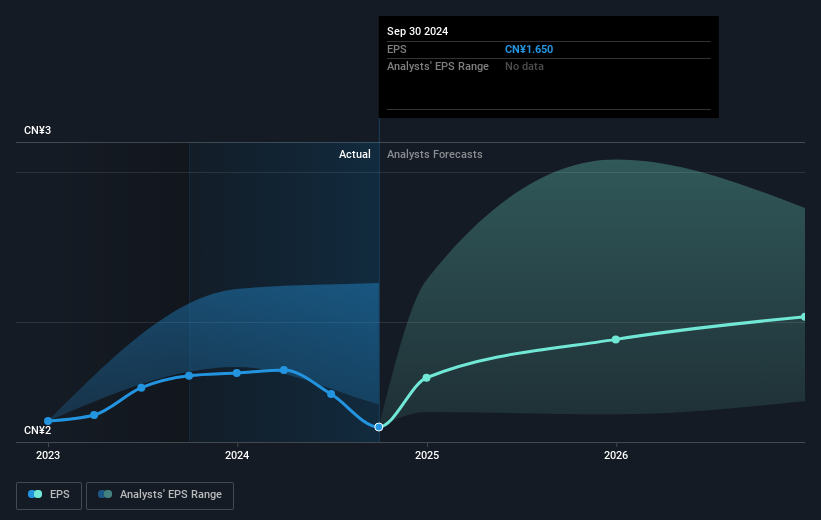

During the three years that the share price fell, Hangzhou Robam Appliances' earnings per share (EPS) dropped by 6.0% each year. This reduction in EPS is slower than the 15% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Hangzhou Robam Appliances' key metrics by checking this interactive graph of Hangzhou Robam Appliances's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Hangzhou Robam Appliances the TSR over the last 3 years was -32%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Hangzhou Robam Appliances provided a TSR of 11% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Hangzhou Robam Appliances is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Robam Appliances might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002508

Hangzhou Robam Appliances

Develops, manufactures, and sells kitchen appliances under the ROBAM brand in China and internationally.

Excellent balance sheet established dividend payer.