- Hong Kong

- /

- Consumer Services

- /

- SEHK:2262

Top Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a tumultuous landscape marked by busy earnings reports and mixed economic signals, many investors are turning their attention to smaller-cap stocks. Penny stocks, though often seen as relics of past market eras, continue to offer intriguing opportunities due to their potential for growth at lower price points. By focusing on companies with strong financials and solid fundamentals, investors can uncover promising candidates in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$139.45M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.22 | THB1.8B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,772 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Steve Leung Design Group (SEHK:2262)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Steve Leung Design Group Limited offers interior design services in the People’s Republic of China, Hong Kong, and internationally with a market cap of HK$285.35 million.

Operations: The company generates revenue from various segments, including Product Design Services (HK$57.80 million), Interior Design Services (HK$197.35 million), and Interior Decorating and Furnishing Services (HK$104.94 million).

Market Cap: HK$285.35M

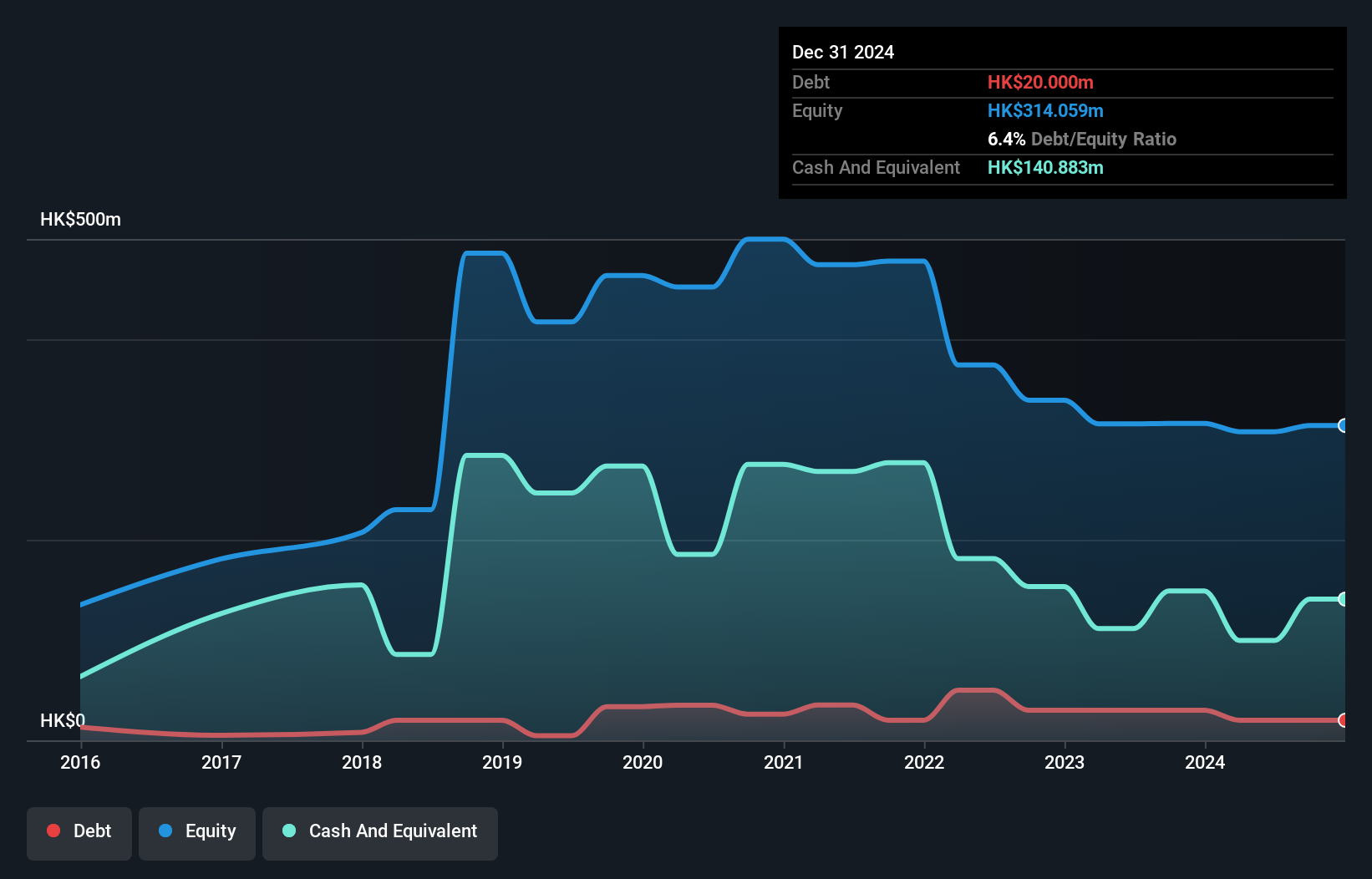

Steve Leung Design Group Limited, with a market cap of HK$285.35 million, has seen its debt to equity ratio rise from 1.1% to 6.5% over five years, yet its debt is well covered by operating cash flow (114.6%). Despite being unprofitable with a negative Return on Equity of -3.11%, the company’s short-term assets (HK$358.3M) comfortably cover both short-term and long-term liabilities (HK$136M and HK$23.3M respectively). Recent earnings show a reduced net loss compared to last year, but interest coverage remains weak at 0.1x EBIT, indicating financial challenges ahead for this penny stock contender.

- Navigate through the intricacies of Steve Leung Design Group with our comprehensive balance sheet health report here.

- Assess Steve Leung Design Group's previous results with our detailed historical performance reports.

Renrui Human Resources Technology Holdings (SEHK:6919)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Renrui Human Resources Technology Holdings Limited is an investment holding company that provides human resources services in China with a market cap of HK$676.17 million.

Operations: The company generates its revenue from two main segments: Comprehensive Flexible Staffing, which accounts for CN¥4.83 billion, and Professional Recruitment and Other HR Solutions, contributing CN¥53.5 million.

Market Cap: HK$676.17M

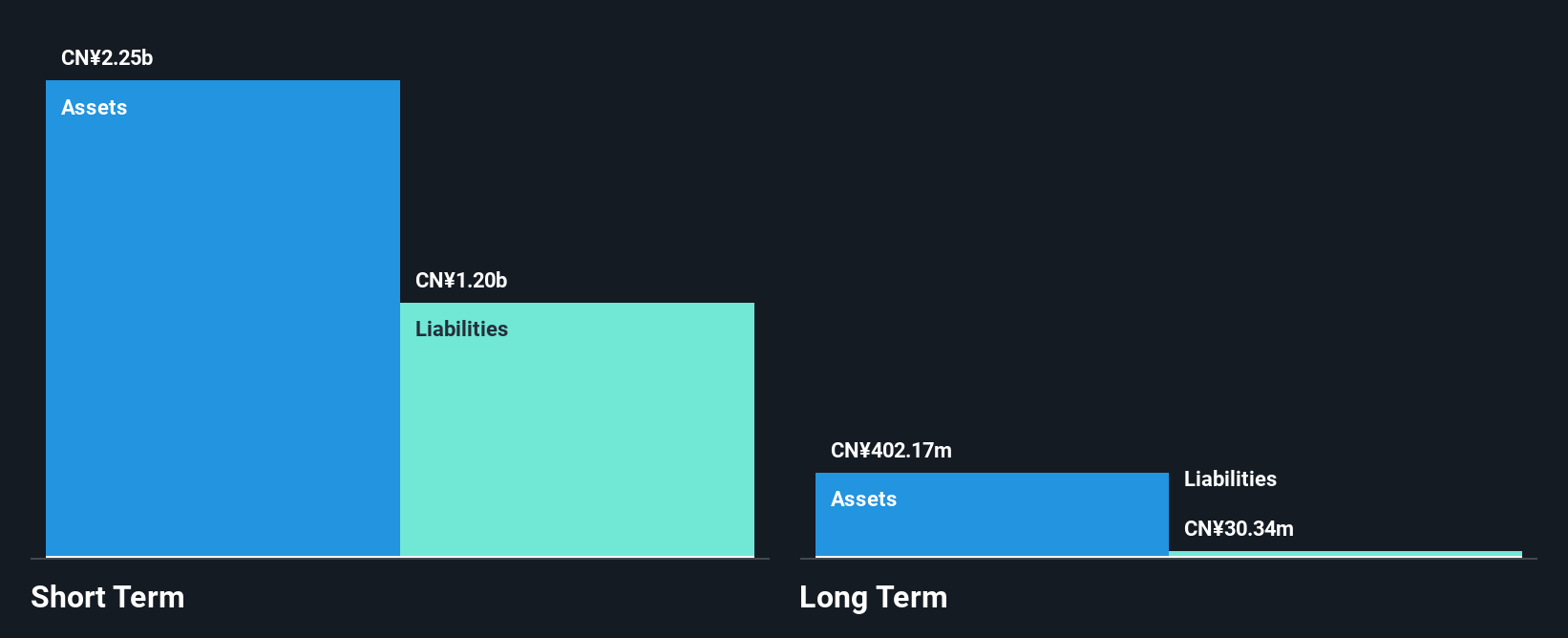

Renrui Human Resources Technology Holdings, with a market cap of HK$676.17 million, has demonstrated robust earnings growth, surpassing industry averages with an 87.5% increase over the past year. The company reported half-year sales of CN¥2.48 billion and net income of CN¥21.85 million, reflecting improved profit margins from last year. Its short-term assets (CN¥1.9 billion) comfortably exceed both short-term and long-term liabilities, indicating solid financial health despite negative operating cash flow that limits debt coverage capabilities. The management team and board are experienced, contributing to stable operations without shareholder dilution in the past year.

- Jump into the full analysis health report here for a deeper understanding of Renrui Human Resources Technology Holdings.

- Explore Renrui Human Resources Technology Holdings' analyst forecasts in our growth report.

Huasi Holding (SZSE:002494)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Huasi Holding Company Limited operates in the fur industry both in China and internationally, with a market cap of CN¥1.57 billion.

Operations: Huasi Holding Company Limited has not reported specific revenue segments.

Market Cap: CN¥1.57B

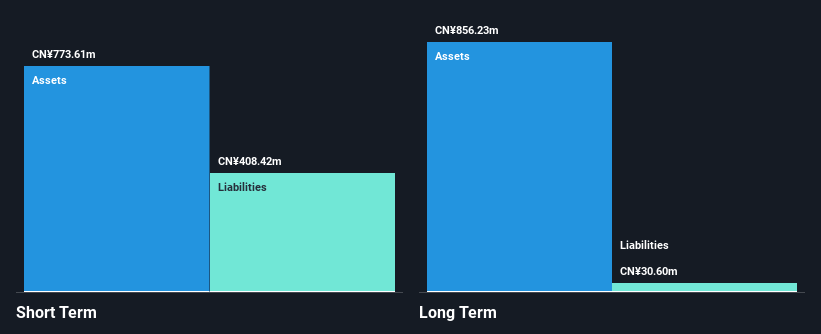

Huasi Holding Company Limited, with a market cap of CN¥1.57 billion, has shown recent improvements in financial performance despite past challenges. For the nine months ended September 2024, the company reported sales of CN¥344.2 million and net income of CN¥2.77 million, marking a turnaround from a net loss last year. The company maintains a satisfactory debt level with short-term assets exceeding liabilities and has not experienced shareholder dilution recently. However, it remains unprofitable overall with negative return on equity and increased debt-to-equity ratio over five years despite having an experienced management team and board.

- Get an in-depth perspective on Huasi Holding's performance by reading our balance sheet health report here.

- Gain insights into Huasi Holding's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Embark on your investment journey to our 5,772 Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Steve Leung Design Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2262

Steve Leung Design Group

Provides interior design services in the People’s Republic of China, Hong Kong, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives