Zhejiang Jiaxin Silk Corp.,Ltd. (SZSE:002404) Surges 25% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Zhejiang Jiaxin Silk Corp.,Ltd. (SZSE:002404) shares have been powering on, with a gain of 25% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 9.4% isn't as attractive.

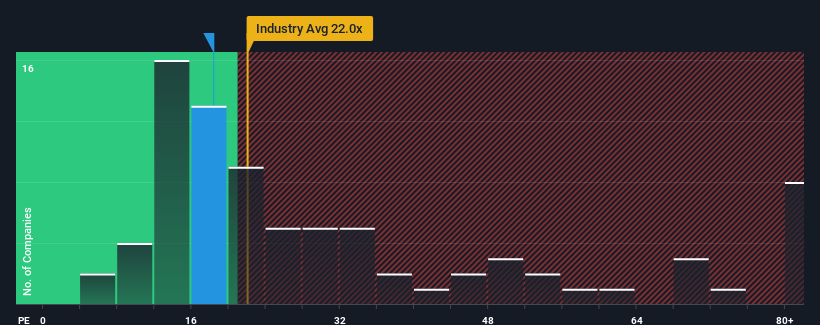

Even after such a large jump in price, Zhejiang Jiaxin SilkLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.4x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 61x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Zhejiang Jiaxin SilkLtd over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Zhejiang Jiaxin SilkLtd

How Is Zhejiang Jiaxin SilkLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Jiaxin SilkLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 30% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Zhejiang Jiaxin SilkLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Zhejiang Jiaxin SilkLtd's P/E

Despite Zhejiang Jiaxin SilkLtd's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Zhejiang Jiaxin SilkLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Zhejiang Jiaxin SilkLtd with six simple checks.

You might be able to find a better investment than Zhejiang Jiaxin SilkLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiaxin SilkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002404

Zhejiang Jiaxin SilkLtd

Research and development, production, and sales of silk products in China and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026