- China

- /

- Consumer Durables

- /

- SHSE:688533

Is Suzhou SONAVOX ElectronicsLtd (SHSE:688533) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Suzhou SONAVOX Electronics Co.,Ltd. (SHSE:688533) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Suzhou SONAVOX ElectronicsLtd

What Is Suzhou SONAVOX ElectronicsLtd's Debt?

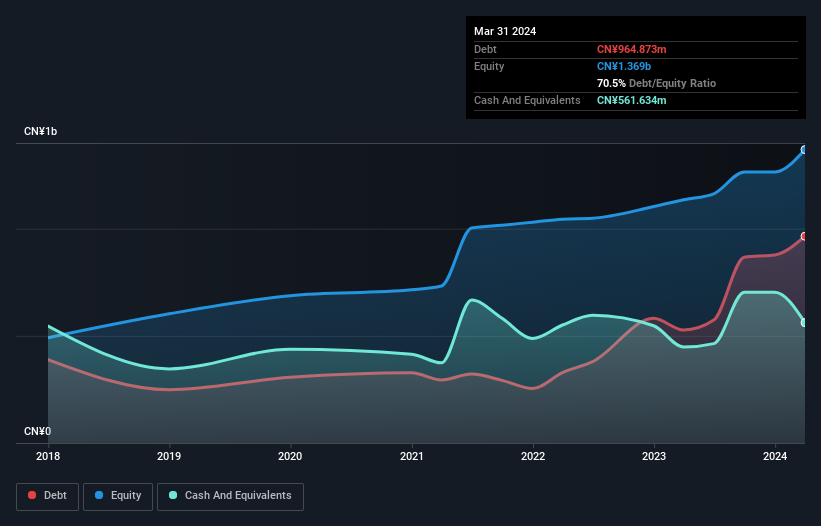

The image below, which you can click on for greater detail, shows that at March 2024 Suzhou SONAVOX ElectronicsLtd had debt of CN¥964.9m, up from CN¥527.2m in one year. However, because it has a cash reserve of CN¥561.6m, its net debt is less, at about CN¥403.2m.

How Healthy Is Suzhou SONAVOX ElectronicsLtd's Balance Sheet?

The latest balance sheet data shows that Suzhou SONAVOX ElectronicsLtd had liabilities of CN¥938.1m due within a year, and liabilities of CN¥601.1m falling due after that. Offsetting this, it had CN¥561.6m in cash and CN¥775.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥201.9m.

Since publicly traded Suzhou SONAVOX ElectronicsLtd shares are worth a total of CN¥4.67b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Suzhou SONAVOX ElectronicsLtd's net debt to EBITDA ratio of about 1.8 suggests only moderate use of debt. And its commanding EBIT of 2k times its interest expense, implies the debt load is as light as a peacock feather. Pleasingly, Suzhou SONAVOX ElectronicsLtd is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 211% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Suzhou SONAVOX ElectronicsLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Suzhou SONAVOX ElectronicsLtd burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Suzhou SONAVOX ElectronicsLtd's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Looking at all the aforementioned factors together, it strikes us that Suzhou SONAVOX ElectronicsLtd can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Suzhou SONAVOX ElectronicsLtd's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688533

Suzhou SONAVOX ElectronicsLtd

Engages in the design, manufacture, and sale of audio products and systems for the automotive industry.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives