In recent weeks, global markets have been influenced by cautious commentary from the Federal Reserve and political uncertainties, leading to broad-based declines in U.S. stocks, with smaller-cap indexes experiencing more pronounced losses. Amid this backdrop of fluctuating market sentiment and economic indicators, investors are increasingly on the lookout for lesser-known stocks that possess strong fundamentals and growth potential despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 20.75% | 18.12% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| C. Mer Industries | 131.82% | 12.24% | 75.61% | ★★★★★☆ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tycoon Group Holdings (SEHK:3390)

Simply Wall St Value Rating: ★★★★★☆

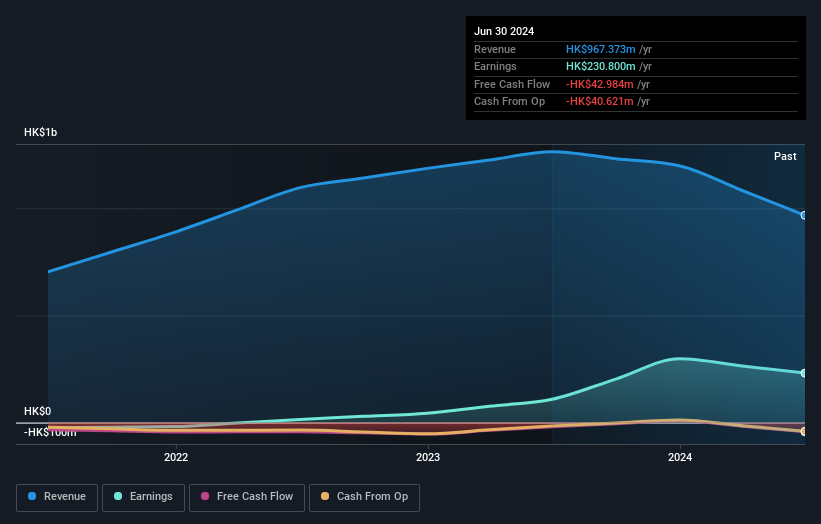

Overview: Tycoon Group Holdings Limited is an investment holding company that distributes and retails a variety of health and well-being products across Hong Kong, Mainland China, Macau, Singapore, and internationally, with a market cap of HK$2.85 billion.

Operations: The company's revenue primarily comes from its distribution segment, generating HK$651.61 million, and retail store operations contributing HK$202.28 million.

Tycoon Group Holdings, a small player in the healthcare sector, has shown impressive financial performance with earnings surging by 112% over the past year. Its debt to equity ratio has significantly improved from 140.5% to 46% over five years, indicating effective debt management. Despite not being free cash flow positive recently, the company seems financially stable with satisfactory net debt levels at 37.7%. Tycoon's earnings growth outpaced the broader healthcare industry decline of -16.9%, suggesting robust operational efficiency and potential for future expansion within its niche market segment.

- Get an in-depth perspective on Tycoon Group Holdings' performance by reading our health report here.

Zhong Wang FabricLtd (SHSE:605003)

Simply Wall St Value Rating: ★★★★★★

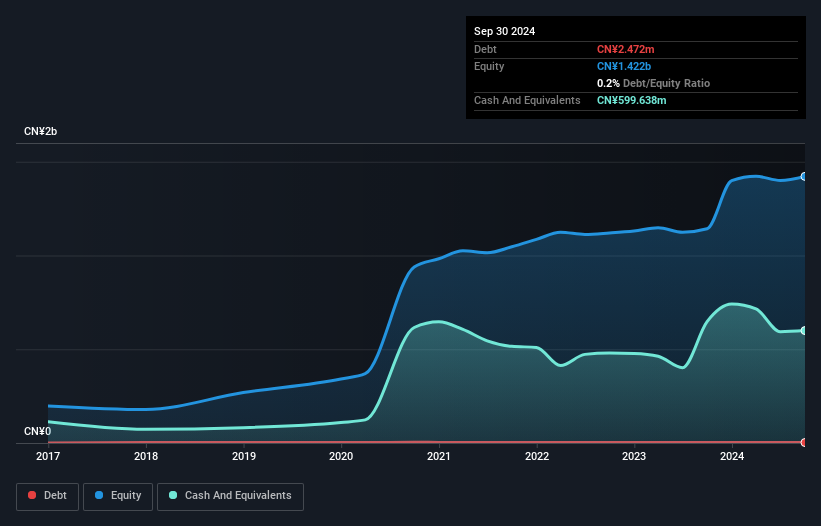

Overview: Zhong Wang Fabric Co., Ltd. specializes in the research, development, design, production, and sales of medium and high-end decorative fabrics and products in China, with a market capitalization of CN¥2.22 billion.

Operations: Zhong Wang Fabric Ltd generates revenue primarily from the sale of medium and high-end decorative fabrics. The company's net profit margin is 15%, reflecting its profitability in the competitive fabric industry.

Zhong Wang Fabric Ltd. has shown a notable performance with earnings surging 381% over the past year, outpacing the luxury industry's modest 3% growth. The company reported sales of CNY 385 million for the first nine months of 2024, up from CNY 335 million in the previous year, alongside a net income increase to CNY 68 million from CNY 57 million. Its debt-to-equity ratio improved significantly from 0.8 to just 0.2 over five years, suggesting effective financial management. Despite these gains, future earnings are projected to decline by about 32% annually over the next three years, presenting a mixed outlook for investors.

AB (WSE:ABE)

Simply Wall St Value Rating: ★★★★★★

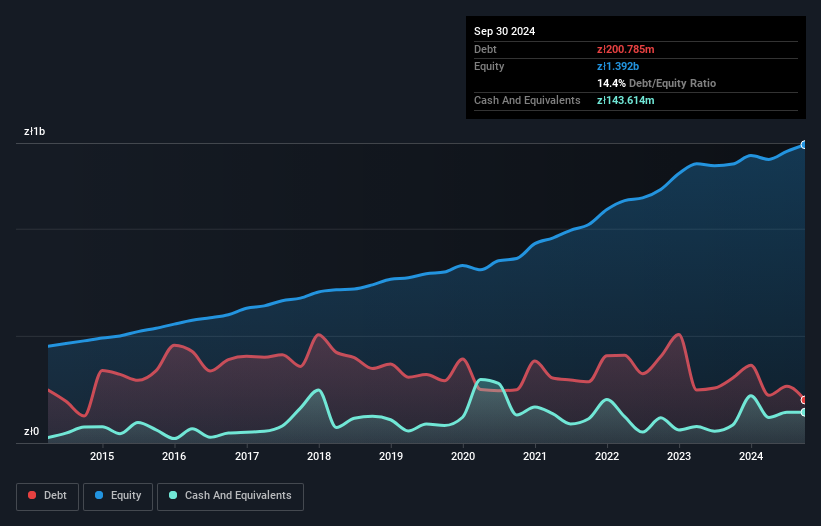

Overview: AB S.A., along with its subsidiaries, focuses on the distribution of IT products in Poland, the Czech Republic, and Slovakia with a market cap of PLN1.50 billion.

Operations: AB generates revenue primarily through wholesale trade, contributing PLN14.81 billion, followed by retail trade at PLN318.64 million and production at PLN53.42 million.

AB's financial health appears strong, with a debt to equity ratio improving from 40.4% to 19.4% over five years, suggesting effective debt management. The net debt to equity stands at a satisfactory 8.9%, and interest payments are comfortably covered by EBIT at four times the required amount, indicating robust earnings quality. With a price-to-earnings ratio of 8.6x compared to the Polish market's average of 10.7x, AB seems undervalued in its sector. Earnings grew by 10.9% last year, outpacing the electronic industry's growth rate of 5%, hinting at promising future prospects for this company in an evolving market landscape.

- Navigate through the intricacies of AB with our comprehensive health report here.

Assess AB's past performance with our detailed historical performance reports.

Next Steps

- Click this link to deep-dive into the 4607 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABE

AB

Distributes IT products primarily in Poland, the Czech Republic, and Slovakia.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives