ZheJiang KangLongDa Special Protection Technology Co., Ltd's (SHSE:603665) Popularity With Investors Under Threat As Stock Sinks 29%

ZheJiang KangLongDa Special Protection Technology Co., Ltd (SHSE:603665) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

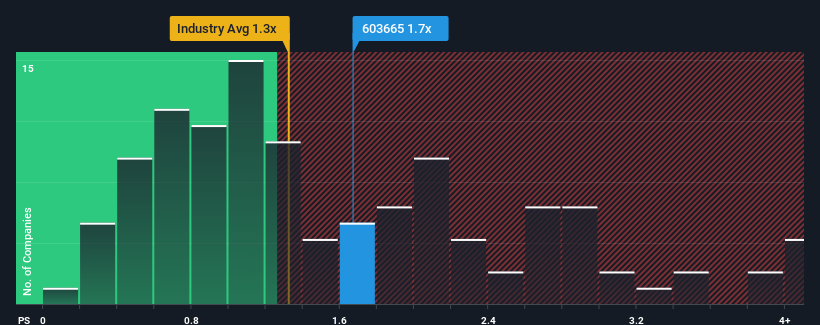

Even after such a large drop in price, you could still be forgiven for feeling indifferent about ZheJiang KangLongDa Special Protection Technology's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in China is also close to 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for ZheJiang KangLongDa Special Protection Technology

How Has ZheJiang KangLongDa Special Protection Technology Performed Recently?

We'd have to say that with no tangible growth over the last year, ZheJiang KangLongDa Special Protection Technology's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on ZheJiang KangLongDa Special Protection Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ZheJiang KangLongDa Special Protection Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like ZheJiang KangLongDa Special Protection Technology's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 32% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

With this in mind, we find it intriguing that ZheJiang KangLongDa Special Protection Technology's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for ZheJiang KangLongDa Special Protection Technology looks to be in line with the rest of the Luxury industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ZheJiang KangLongDa Special Protection Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ZheJiang KangLongDa Special Protection Technology that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZheJiang KangLongDa Special Protection Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603665

ZheJiang KangLongDa Special Protection Technology

ZheJiang KangLongDa Special Protection Technology Co., Ltd.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives