The Market Lifts Bafang Electric (Suzhou) Co.,Ltd. (SHSE:603489) Shares 26% But It Can Do More

Those holding Bafang Electric (Suzhou) Co.,Ltd. (SHSE:603489) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 54% share price decline over the last year.

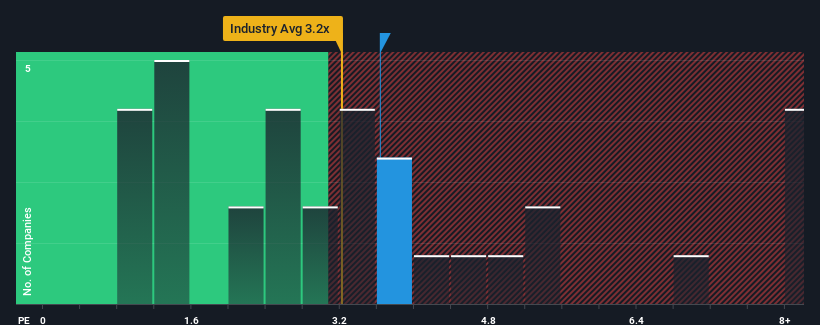

In spite of the firm bounce in price, there still wouldn't be many who think Bafang Electric (Suzhou)Ltd's price-to-sales (or "P/S") ratio of 3.6x is worth a mention when the median P/S in China's Leisure industry is similar at about 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Bafang Electric (Suzhou)Ltd

How Has Bafang Electric (Suzhou)Ltd Performed Recently?

Bafang Electric (Suzhou)Ltd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Bafang Electric (Suzhou)Ltd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Bafang Electric (Suzhou)Ltd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Bafang Electric (Suzhou)Ltd's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. Still, the latest three year period has seen an excellent 41% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we find it interesting that Bafang Electric (Suzhou)Ltd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Bafang Electric (Suzhou)Ltd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Bafang Electric (Suzhou)Ltd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Bafang Electric (Suzhou)Ltd is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bafang Electric (Suzhou)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603489

Bafang Electric (Suzhou)Ltd

Engages in the manufacture of e-mobility components and complete e-drive systems for e-bikes and electric scooters.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives