- China

- /

- Consumer Durables

- /

- SHSE:603326

Little Excitement Around Nanjing OLO Home Furnishing Co.,Ltd's (SHSE:603326) Earnings As Shares Take 25% Pounding

Nanjing OLO Home Furnishing Co.,Ltd (SHSE:603326) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

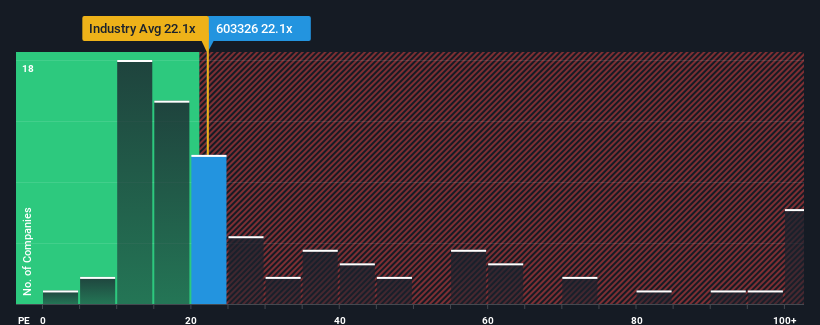

Since its price has dipped substantially, Nanjing OLO Home FurnishingLtd may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.1x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 63x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Nanjing OLO Home FurnishingLtd over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Nanjing OLO Home FurnishingLtd

How Is Nanjing OLO Home FurnishingLtd's Growth Trending?

In order to justify its P/E ratio, Nanjing OLO Home FurnishingLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. This means it has also seen a slide in earnings over the longer-term as EPS is down 58% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 38% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Nanjing OLO Home FurnishingLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Nanjing OLO Home FurnishingLtd's P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Nanjing OLO Home FurnishingLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Nanjing OLO Home FurnishingLtd (of which 1 is significant!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing OLO Home FurnishingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603326

Nanjing OLO Home FurnishingLtd

Engages in the design, research and development, production, sale, and service of furniture products in China.

Excellent balance sheet moderate.

Market Insights

Community Narratives