HangZhou Nbond Nonwovens Co., Ltd. (SHSE:603238) Shares Fly 30% But Investors Aren't Buying For Growth

Those holding HangZhou Nbond Nonwovens Co., Ltd. (SHSE:603238) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

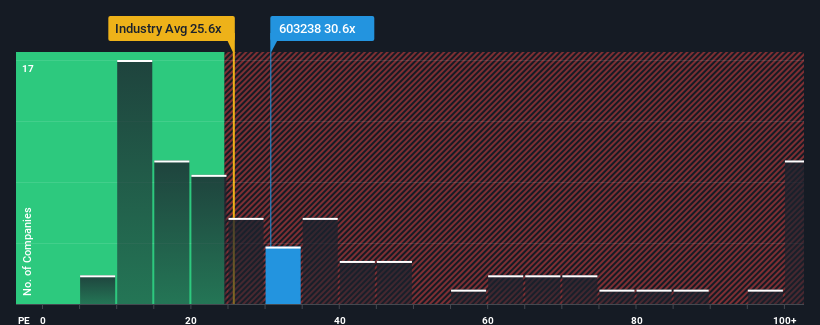

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 40x, you may still consider HangZhou Nbond Nonwovens as an attractive investment with its 30.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, HangZhou Nbond Nonwovens has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for HangZhou Nbond Nonwovens

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as HangZhou Nbond Nonwovens' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 54% last year. Still, incredibly EPS has fallen 35% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's an unpleasant look.

With this information, we are not surprised that HangZhou Nbond Nonwovens is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From HangZhou Nbond Nonwovens' P/E?

HangZhou Nbond Nonwovens' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that HangZhou Nbond Nonwovens maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HangZhou Nbond Nonwovens (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HangZhou Nbond Nonwovens might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603238

HangZhou Nbond Nonwovens

Engages in the research, develop, production, and sale of spunlace nonwovens materials in China and internationally.

Excellent balance sheet with proven track record.