- Turkey

- /

- Diversified Financial

- /

- IBSE:BRYAT

Undiscovered Gems And 2 Other Promising Stocks with Solid Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, leading to a mixed performance across major indices, with large-cap stocks faring better than their small-cap counterparts. As investors navigate these challenging conditions and tepid economic growth signals from the Fed's Beige Book, identifying stocks with solid fundamentals and potential for growth becomes crucial. In this context, uncovering undiscovered gems can offer opportunities for diversification and resilience in an evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.07% | 32.89% | -17.68% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S. is an investment company involved in sectors such as steel, automotive, logistics, automotive supply, informatics and telecommunications, and e-commerce with a market capitalization of TRY55.21 billion.

Operations: The company's revenue streams are derived from its investments across diverse sectors, including steel, automotive, logistics, and e-commerce. The financial performance is influenced by the varying profitability of these sectors.

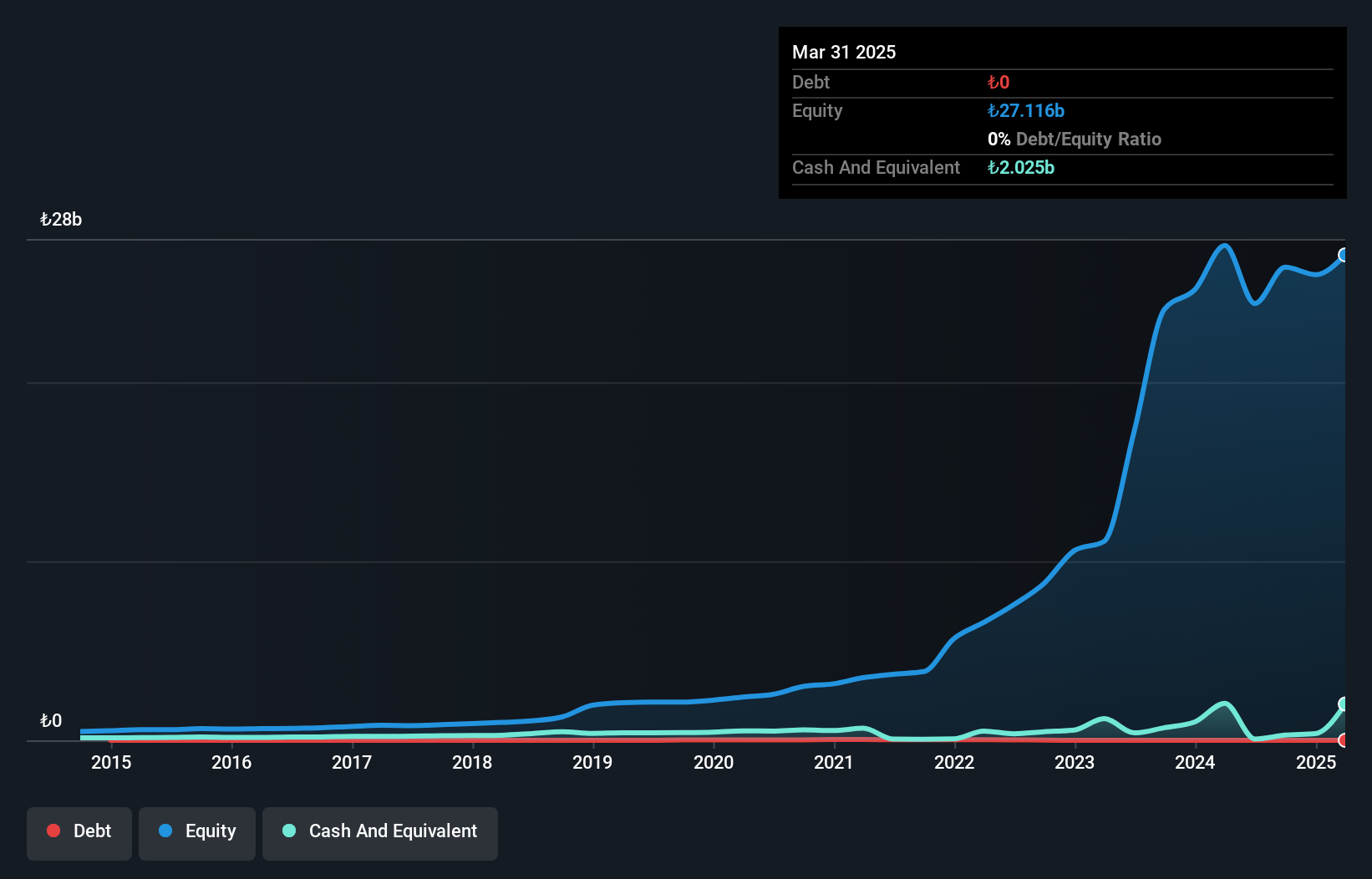

Borusan Yatirim ve Pazarlama, a company with no debt and high-quality earnings, has faced some challenges recently. Its net income for the second quarter was TRY 409.59 million, down from TRY 545.34 million the previous year, while basic earnings per share fell to TRY 14.56 from TRY 19.39. Over six months, sales dropped to TRY 79.45 million from TRY 138.61 million a year ago, and net income decreased to TRY 673.35 million compared to TRY 1,141.54 million previously reported figures show a volatile share price but positive free cash flow (TRY1 billion) suggests financial resilience despite industry pressures.

Guangxi Huaxi Nonferrous MetalLtd (SHSE:600301)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangxi Huaxi Nonferrous Metal Co., Ltd engages in trading steel and bulk commodities in China, with a market capitalization of CN¥11.18 billion.

Operations: The company generates revenue primarily from the chlorine alkali chemical industry, amounting to CN¥3.77 billion.

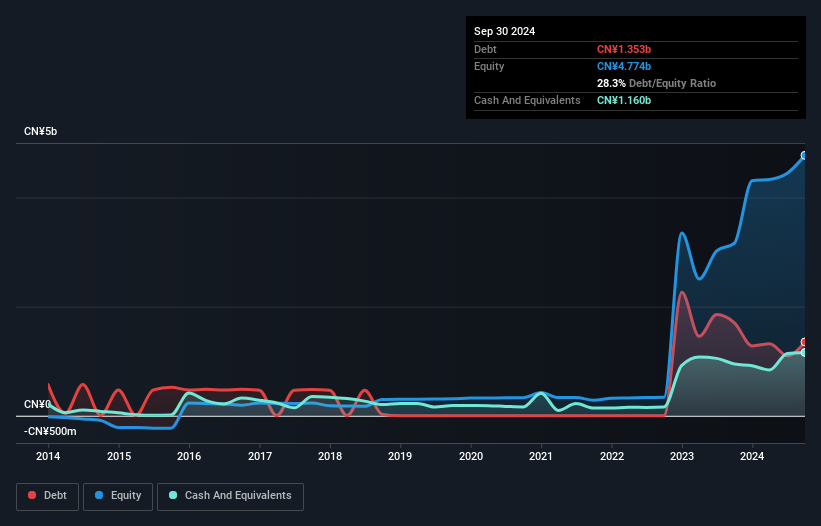

Guangxi Huaxi Nonferrous Metal Ltd, a noteworthy player in the metals industry, has shown impressive growth with earnings up by 98.9% over the past year, outpacing its industry peers. The company's debt to equity ratio rose to 24.8% from zero in five years, yet it holds more cash than total debt, indicating sound financial health. Recent reports highlight a significant boost in sales for the first nine months of 2024 at CNY 3.42 billion compared to CNY 2.19 billion last year, while net income surged to CNY 540 million from CNY 269 million previously—demonstrating strong operational performance and potential for future growth.

Whirlpool China (SHSE:600983)

Simply Wall St Value Rating: ★★★★★★

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both domestically and internationally with a market cap of CN¥6.67 billion.

Operations: Whirlpool China generates revenue primarily from the sale of kitchen appliances in domestic and international markets. The company's financial performance is characterized by a focus on managing costs effectively, impacting its net profit margin.

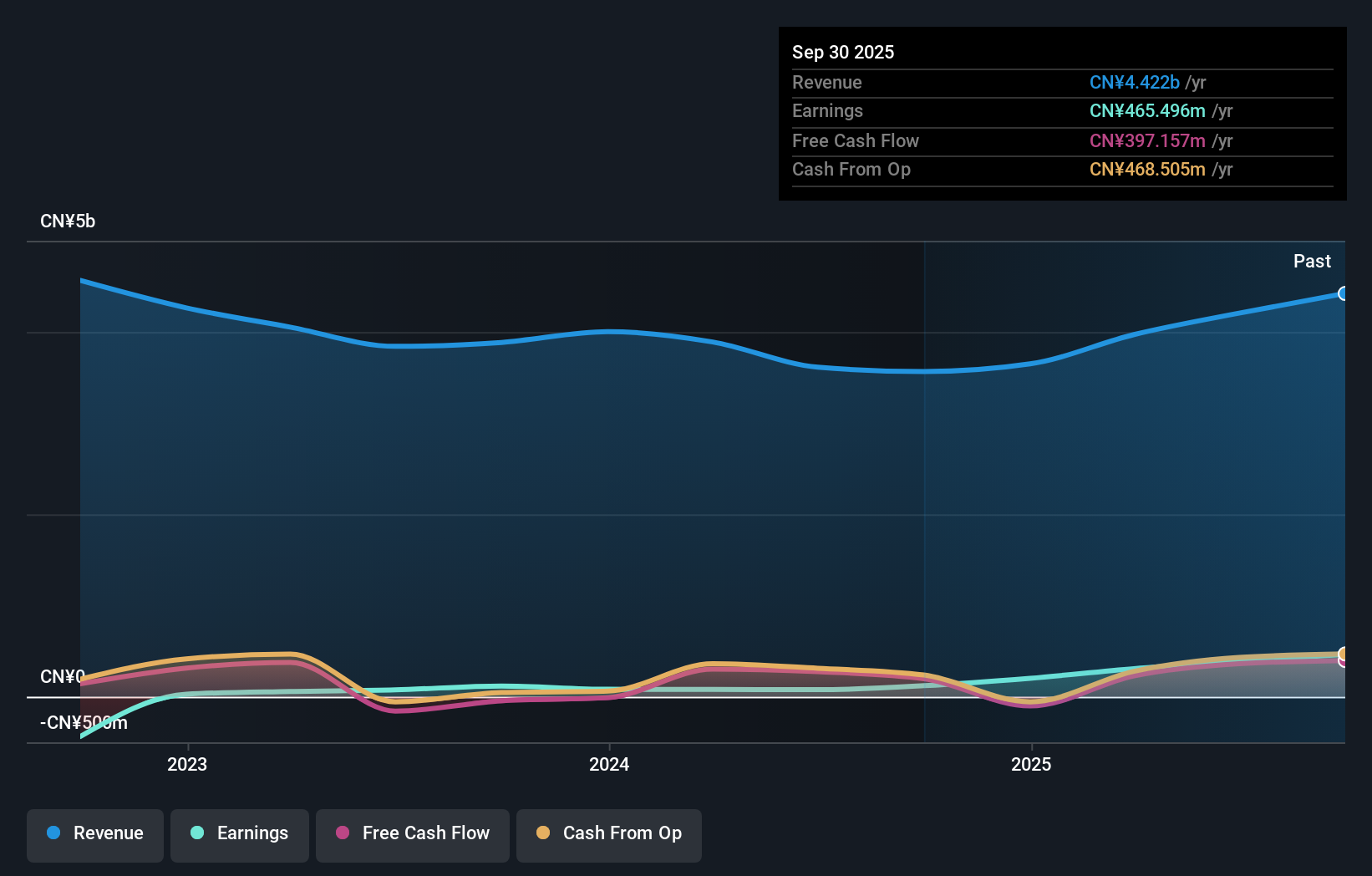

Whirlpool China has demonstrated resilience amidst challenges, with net income rising to CNY 53.07 million from CNY 14.15 million over the past year, despite a drop in sales from CNY 2,963.21 million to CNY 2,524.45 million for the nine months ending September 2024. The company boasts high-quality earnings and a reduced debt-to-equity ratio of 0.3 from 1.5 over five years, indicating improved financial health and stability in managing obligations efficiently while maintaining profitability above industry averages at an earnings growth rate of 2.3%. With more cash than total debt, it seems well-positioned financially for future endeavors in the consumer durables sector.

- Click to explore a detailed breakdown of our findings in Whirlpool China's health report.

Review our historical performance report to gain insights into Whirlpool China's's past performance.

Turning Ideas Into Actions

- Delve into our full catalog of 4743 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borusan Yatirim ve Pazarlama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BRYAT

Borusan Yatirim ve Pazarlama

Invests in companies in the industrial, commercial and service sectors.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives