- China

- /

- Consumer Durables

- /

- SHSE:600983

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks experiencing some profit-taking and economic indicators like the Chicago PMI pointing to contraction, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to balance risk and reward amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Whirlpool China (SHSE:600983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both in China and internationally with a market cap of CN¥7.20 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of consumer electrical appliances, amounting to CN¥3.56 billion.

Dividend Yield: 7.6%

Whirlpool China's dividend yield of 7.63% places it in the top 25% of dividend payers in China, but its sustainability is questionable due to a high cash payout ratio of 306.5%, indicating dividends are not well covered by cash flows. Despite earnings growth and increased dividends over the past decade, payments have been volatile and unreliable, with large one-off items impacting financial results. Recent earnings showed improved net income despite declining sales.

- Take a closer look at Whirlpool China's potential here in our dividend report.

- The analysis detailed in our Whirlpool China valuation report hints at an inflated share price compared to its estimated value.

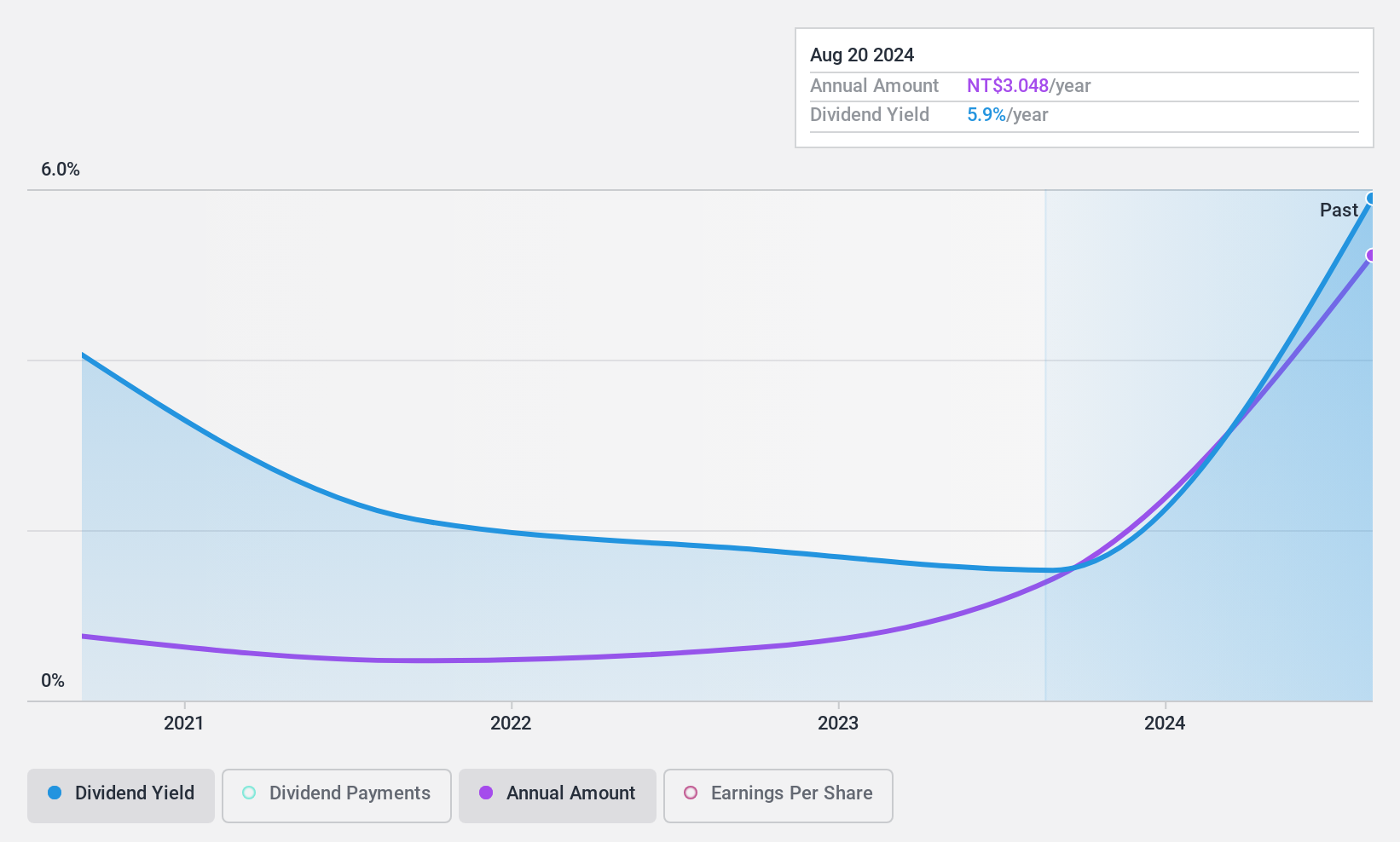

King Polytechnic Engineering (TPEX:6122)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: King Polytechnic Engineering Co., Ltd. is an integrated engineering and construction company operating in Taiwan and internationally, with a market cap of NT$3.97 billion.

Operations: King Polytechnic Engineering Co., Ltd. generates revenue from its First Business Unit with NT$2.63 billion and its Second Business Unit, including the Public Works Department, with NT$1.92 billion.

Dividend Yield: 5.9%

King Polytechnic Engineering's dividend yield of 5.87% ranks in the top 25% of Taiwan's market, supported by a sustainable payout ratio of 58.3% and cash payout ratio of 62.6%. However, its five-year dividend history is marked by volatility and unreliability, with payments dropping over 20% annually at times. Despite recent earnings growth, third-quarter sales declined year-over-year to TWD 1.05 billion from TWD 1.36 billion, impacting net income slightly but maintaining positive overall performance for the nine months ended September 2024.

- Unlock comprehensive insights into our analysis of King Polytechnic Engineering stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of King Polytechnic Engineering shares in the market.

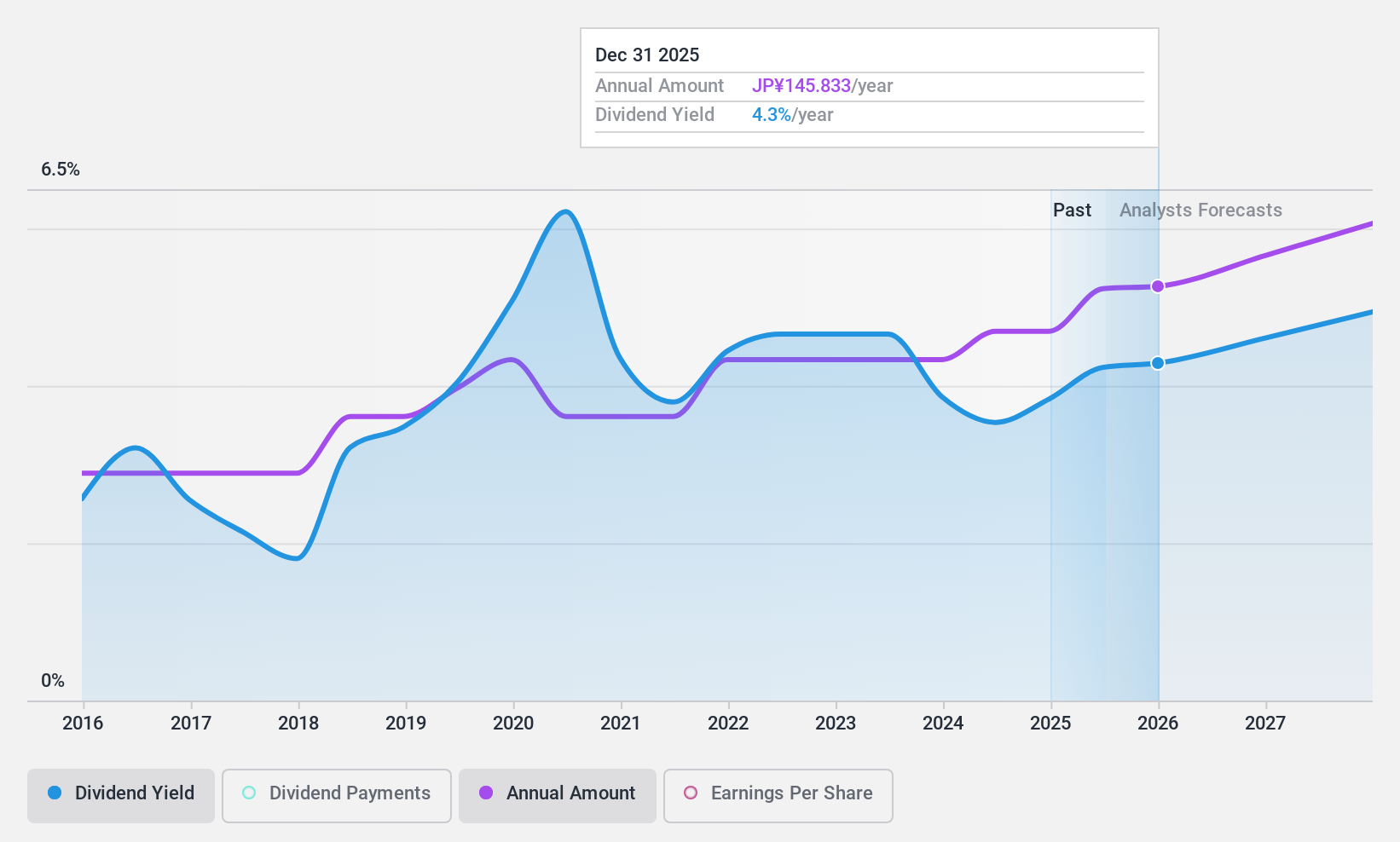

Nippon Electric Glass (TSE:5214)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Electric Glass Co., Ltd. manufactures and sells specialty glass products and glass making machinery both in Japan and internationally, with a market cap of approximately ¥272.17 billion.

Operations: Nippon Electric Glass Co., Ltd. generates revenue primarily from its Glass Business segment, which reported ¥298.14 billion in sales.

Dividend Yield: 3.7%

Nippon Electric Glass has a history of volatile and unreliable dividend payments over the past decade, though currently covered by earnings with a payout ratio of 52.5% and cash flows at 78.9%. Despite recent profitability, earnings are forecasted to decline, potentially impacting future dividends. The company completed a significant share buyback worth ¥19.99 billion in December 2024, which might influence shareholder value positively but doesn't guarantee stable dividends moving forward.

- Get an in-depth perspective on Nippon Electric Glass' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Nippon Electric Glass' share price might be too pessimistic.

Taking Advantage

- Gain an insight into the universe of 1983 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600983

Whirlpool China

Engages in the research, development, procurement, production, and sale of kitchen appliances in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives