- Japan

- /

- Metals and Mining

- /

- TSE:5706

Sinotrans Leads 3 Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and fluctuating economic indicators, global markets have shown mixed performance, with U.S. stocks ending the week lower while European indices managed modest gains. In this environment, investors are increasingly turning to dividend stocks as a way to potentially enhance portfolio stability and generate income, making them an attractive option when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

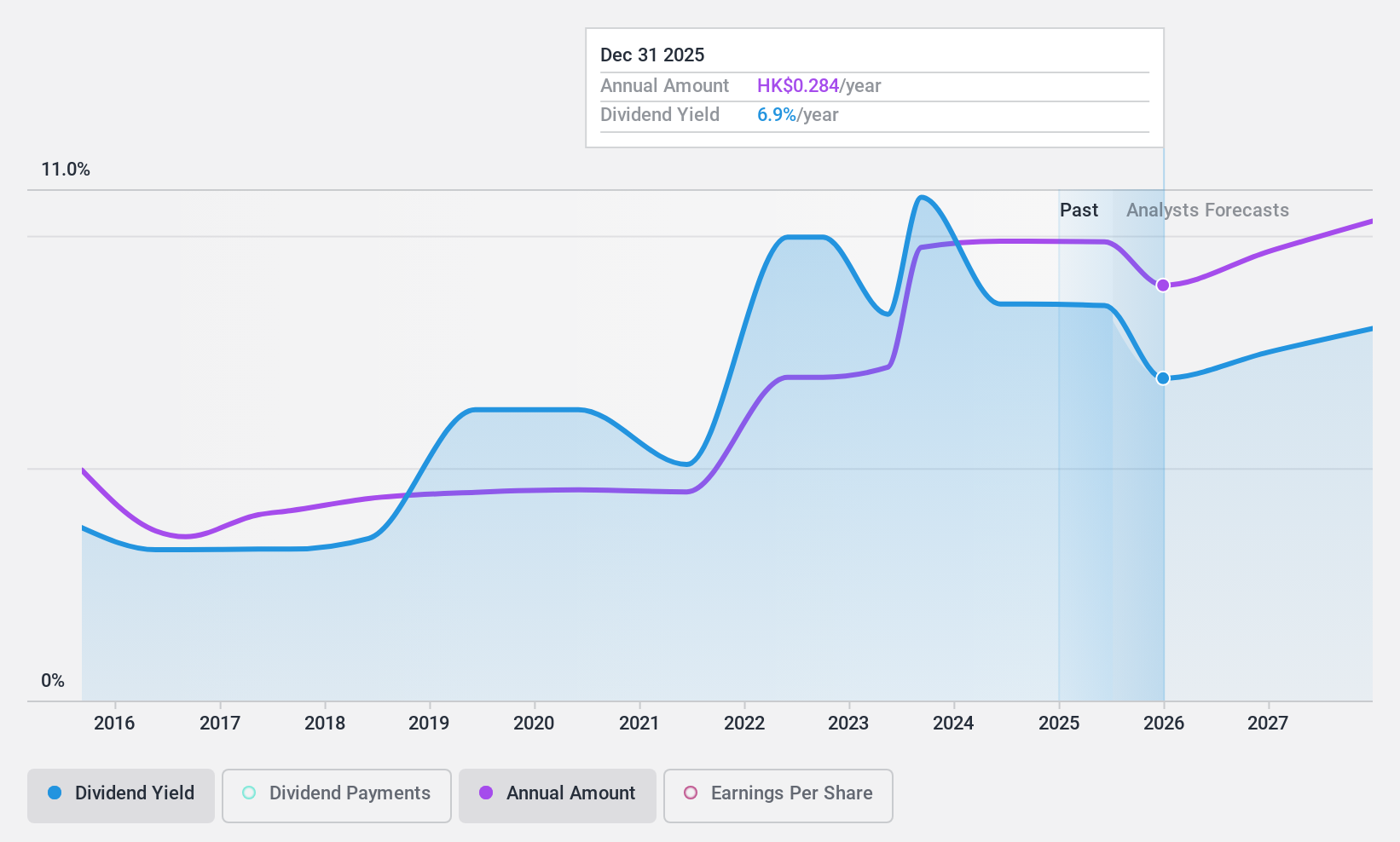

Sinotrans (SEHK:598)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotrans Limited offers integrated logistics services mainly in the People’s Republic of China, with a market capitalization of HK$36.25 billion.

Operations: Sinotrans Limited generates its revenue through various segments, including freight forwarding, logistics, and e-commerce logistics services in China.

Dividend Yield: 8.3%

Sinotrans offers a high dividend yield of 8.29%, ranking in the top 25% among Hong Kong dividend payers. However, its dividends are not well covered by free cash flows, with a cash payout ratio of 92.5%. Despite trading at a good value with a price-to-earnings ratio of 6.5x, below the market average, its dividends have been volatile and unreliable over the past decade. Recent share buybacks might indicate management's confidence in future prospects.

- Take a closer look at Sinotrans' potential here in our dividend report.

- According our valuation report, there's an indication that Sinotrans' share price might be on the cheaper side.

Whirlpool China (SHSE:600983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both domestically and internationally with a market cap of CN¥7.25 billion.

Operations: Whirlpool China Co., Ltd. generates its revenue primarily from the manufacture and sale of consumer electrical appliances, amounting to CN¥3.56 billion.

Dividend Yield: 8.3%

Whirlpool China offers a high dividend yield of 8.33%, placing it in the top 25% of CN market payers. However, its dividends have been volatile and unreliable over the past decade, with a cash payout ratio of 306.5%, indicating weak coverage by free cash flows. While earnings cover dividends with a payout ratio of 50.6%, share price volatility and inconsistent dividend growth raise concerns about sustainability despite recent profit growth.

- Navigate through the intricacies of Whirlpool China with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Whirlpool China is trading beyond its estimated value.

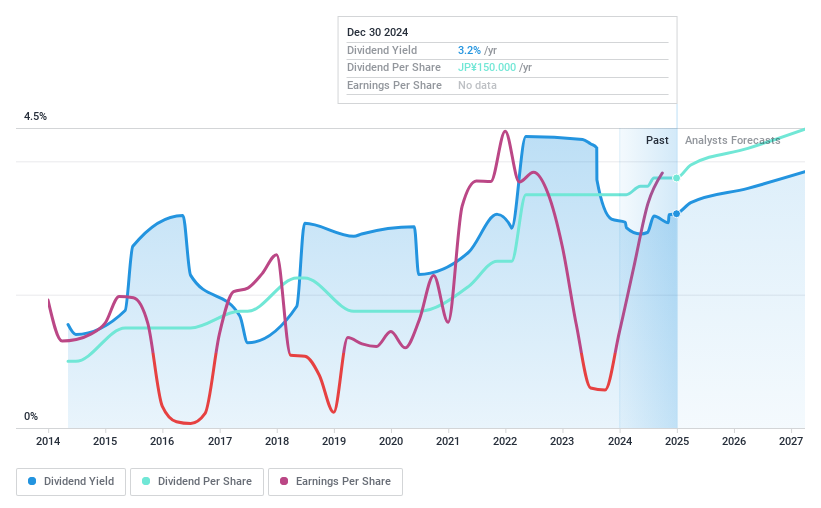

Mitsui Mining & Smelting (TSE:5706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui Mining & Smelting Co., Ltd. manufactures and sells nonferrous metal products both in Japan and internationally, with a market cap of ¥264.53 billion.

Operations: Mitsui Mining & Smelting Co., Ltd.'s revenue segments include Metals at ¥272.77 billion, Mobility at ¥207.19 billion, and Functional materials at ¥142.40 billion.

Dividend Yield: 3.2%

Mitsui Mining & Smelting's dividend payments are well covered by earnings and cash flows, with a payout ratio of 15.1% and a cash payout ratio of 20.2%. Despite trading at good value, the dividend yield is lower than top-tier payers in Japan. The company faces challenges with high debt levels and volatile dividends over the past decade. Recent fixed-income offerings totaling ¥10 billion may influence its financial strategy moving forward.

- Click here to discover the nuances of Mitsui Mining & Smelting with our detailed analytical dividend report.

- The analysis detailed in our Mitsui Mining & Smelting valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1958 more companies for you to explore.Click here to unveil our expertly curated list of 1961 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mitsui Mining & Smelting, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Mining & Smelting

Engages in the manufacture and sale of nonferrous metal products in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives